So, you're finding your feet in Malaysia, enjoying the delicious food, stunning landscapes, and vibrant culture. But amidst all the excitement, there's one crucial thing you can't escape – taxes. Yep, even in paradise, we've got to pay our dues. But don't worry, it's not as daunting as it sounds, especially when you know the ropes. That's where "cara daftar no cukai pendapatan" comes in – your key to understanding and registering for income tax in Malaysia.

Now, you might be thinking, "Hold on, 'cara daftar no cukai pendapatan' sounds a bit intimidating." And, sure, it might look like a mouthful at first, especially if you're new to the Malay language. But it simply translates to "how to register for an income tax number." See? Not so scary after all. This income tax number, also known as your tax identification number (TIN), is your unique identifier within the Malaysian tax system. It's like your tax passport, letting the authorities know you're playing by the rules.

Getting this number sorted is essential, whether you're a local starting your first job or an expat setting up shop. Think of it like this: no TIN, no way to file your taxes correctly, which could lead to some sticky situations. We're talking potential penalties, issues with visa renewals (for my fellow travelers out there), and even roadblocks when you're trying to open a bank account. Not exactly the souvenirs you want to take home, right?

The good news is that the Malaysian government has made the whole process pretty straightforward. They've embraced technology, so you can often say goodbye to tedious paperwork and long queues. Instead, you can register online, making life a whole lot easier. Plus, having your tax affairs in order unlocks a bunch of benefits, from claiming refunds (always a win!) to accessing government assistance programs if needed.

In this guide, we're going to break down everything you need to know about "cara daftar no cukai pendapatan." We'll cover who needs to register, the step-by-step registration process, the benefits involved, and even some handy tips to make your tax journey smoother. So, grab a cup of teh tarik, get comfortable, and let's dive into the world of Malaysian taxes together!

Advantages and Disadvantages of Cara Daftar No Cukai Pendapatan

| Advantages | Disadvantages |

|---|---|

| Easier to track income and expenses | Potential for paperwork and administrative burden |

| Can claim tax deductions and benefits | May need to pay taxes if income exceeds a certain threshold |

Best Practices for Implementing Cara Daftar No Cukai Pendapatan

While the process is generally smooth, here are some handy tips to make your "cara daftar no cukai pendapatan" journey even easier:

- Gather Your Documents: Before you start the registration process, make sure you have all the necessary documents handy. This usually includes your passport (for foreigners), employment contract, and proof of address.

- Double-Check Your Information: Accuracy is key! Before submitting your application, double-check all the information you've entered to avoid any delays or issues down the line.

- Keep Records of Everything: After you've registered, keep copies of your tax registration confirmation, tax returns, and any other related documents. These will come in handy for future reference.

- Meet Deadlines: Just like anywhere else, deadlines matter in Malaysia! Make sure you file your tax returns on time to avoid penalties.

- Don't Hesitate to Seek Help: If you're unsure about anything related to "cara daftar no cukai pendapatan," don't hesitate to seek help from the Lembaga Hasil Dalam Negeri (LHDN) or a qualified tax consultant.

Common Questions and Answers About Cara Daftar No Cukai Pendapatan

Here are some common questions and answers about "cara daftar no cukai pendapatan" to clear up any confusion:

Q: What is "cara daftar no cukai pendapatan"?

A: "Cara daftar no cukai pendapatan" simply means "how to register for an income tax number" in Malay. It's the process of getting a unique tax identification number (TIN) in Malaysia.

Q: Who needs to register for income tax in Malaysia?

A: If you're earning an income in Malaysia, whether you're a resident citizen, a non-resident, or even an expat working in the country temporarily, you'll likely need to register for income tax.

Q: How do I register for a tax identification number (TIN)?

A: You can register for your TIN online through the official LHDN website (https://www.hasil.gov.my/) or by visiting an LHDN branch in person.

Q: What are the benefits of registering for income tax?

A: Registering for income tax allows you to file your taxes correctly, claim tax refunds if eligible, and access various government assistance programs.

Q: What documents do I need to register?

A: Generally, you'll need your passport (for foreigners), a valid work visa, proof of employment (like an employment contract), and proof of your Malaysian address.

Q: What happens if I don't register for income tax?

A: Failing to register for income tax can lead to penalties, issues with visa renewals, and difficulties opening bank accounts or accessing other essential services in Malaysia.

Q: When is the deadline for filing income tax returns in Malaysia?

A: The deadline for filing your income tax returns varies depending on whether you're employed or self-employed. Typically, it falls between April and June for manual filing and slightly later for online submissions. The exact deadlines are available on the LHDN website.

Q: Can I get help with my taxes if needed?

A: Yes, the LHDN provides assistance to taxpayers. You can visit their branches, contact their customer service hotline, or access resources on their website. Additionally, you can consult with a qualified tax consultant for professional advice.

Conclusion: Embrace "Cara Daftar No Cukai Pendapatan"

Navigating the world of taxes in a new country might seem daunting at first. Still, understanding "cara daftar no cukai pendapatan" – or how to register for an income tax number – is a crucial step in your Malaysian journey. It's your gateway to fulfilling your tax obligations and unlocking a host of benefits. Remember, this process is more than just a bureaucratic hurdle; it's about actively participating in the Malaysian system and enjoying your time in the country with peace of mind.

Nfl week 4 confidence picks your guide to gridiron glory

Unlocking your potential with propel group pty l

Crack the cat conquer reading comprehension with practice questions

cara daftar no cukai pendapatan - Khao Tick On

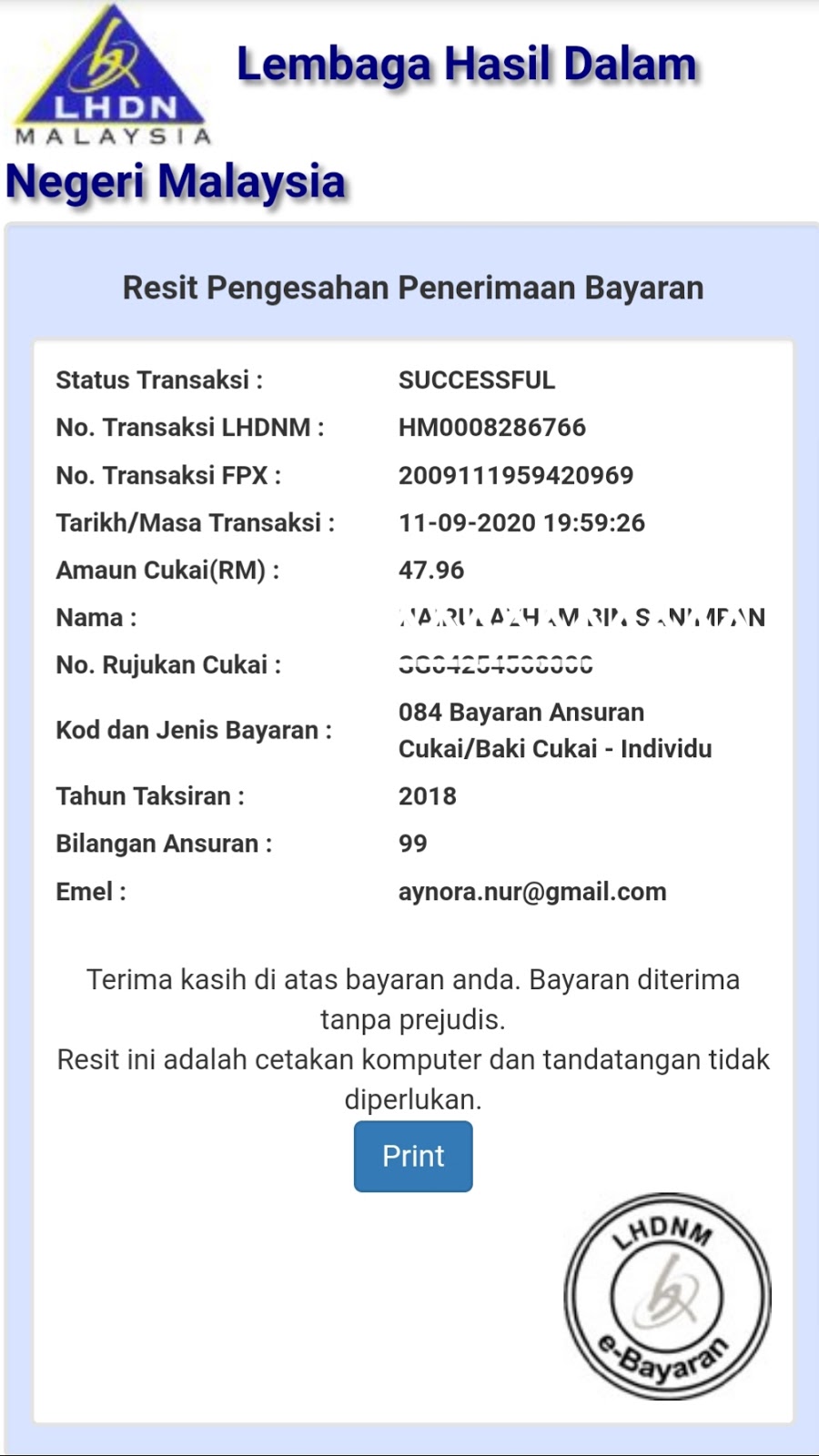

Cara Bayar Baki Cukai Pendapatan Secara Online Yang Mudah - Khao Tick On

Semakan No Cukai Pendapatan Individu (TIN Hasil) - Khao Tick On

Cara Daftar Cukai LHDN Pertama Kali Untuk e - Khao Tick On

10 Perkara Wajib Tahu Tentang Cukai Pendapatan INDIVIDU - Khao Tick On

Cara,Panduan Dan Langkah Isi Borang Cukai Pendapatan Online (E - Khao Tick On

SEMAK NO CUKAI PENDAPATAN : CARA DAPATKAN NOMBOR INCOME TAX INDIVIDU - Khao Tick On

cara daftar no cukai pendapatan - Khao Tick On

Cara Daftar LHDN Pertama Kali Untuk Declare Income Tax (e - Khao Tick On

Cara,Panduan Dan Langkah Isi Borang Cukai Pendapatan Online (E - Khao Tick On

Cara Daftar LHDN Pertama Kali Untuk Declare Income Tax (e - Khao Tick On

CARA MENDAPATKAN NO CUKAI PENDAPATAN INDIVIDU DAN SYARIKAT SERTA DAFTAR - Khao Tick On

Semakan No Cukai Pendapatan Syarikat - Khao Tick On

cara daftar no cukai pendapatan - Khao Tick On

cara daftar no cukai pendapatan - Khao Tick On