Navigating the world of international finance can often feel like traversing a labyrinth of unfamiliar rules and procedures. One common point of confusion arises when dealing with foreign checks. Perhaps you've received a payment from an overseas client, or maybe a loved one abroad sent you a gift. Whatever the source, you might find yourself wondering, "Can I even deposit this?"

For customers of Bank of America, one of the largest financial institutions in the United States, the question of handling foreign checks is particularly relevant. With its vast network and international presence, Bank of America seemingly presents itself as a convenient option for managing finances that cross borders. But does this convenience extend to accepting and processing checks drawn on foreign banks?

The answer, like many things in banking, is nuanced. While Bank of America does not directly accept foreign checks for deposit or cashing at its branches, there are avenues available to access funds from international sources. Understanding these options, as well as the intricacies of foreign transaction fees and processing times, is crucial for anyone dealing with checks from abroad.

Before diving into the specifics of Bank of America's policies and procedures, it's helpful to grasp the broader context. Why are foreign checks often treated differently than domestic ones? The answer lies in the complexities of international banking regulations, currency exchange rates, and the potential for fraud. Banks must navigate these challenges to ensure the security of their operations and protect their customers.

This cautious approach, while understandable, can create hurdles for individuals who need to access funds from foreign checks. This is where a clear understanding of available options becomes essential. Let's explore how you can manage funds received via foreign checks, even if you can't directly deposit them at your local Bank of America branch.

Advantages and Disadvantages of Bank of America's Policy on Foreign Checks

| Advantages | Disadvantages |

|---|---|

| Bank of America offers alternative solutions for handling international funds, such as wire transfers. | Direct deposit of foreign checks is not an option at Bank of America, which can be inconvenient. |

| Bank of America provides resources and customer support to guide customers through international banking processes. | Processing times for alternative solutions like wire transfers can be longer than traditional check deposits. |

While navigating the world of foreign checks might seem daunting, remember that banks like Bank of America offer alternative methods for receiving international funds. By understanding the options available, asking the right questions, and planning, you can manage your international finances effectively and efficiently.

Exploring europe with interactive maps

The tiny mark of a mighty bond exploring father daughter tattoos small

Indulge your senses exploring the world of backen mit christina torte

Paying Your RGE Bill by Credit Card: A Step - Khao Tick On

Does America Need a Foreign Policy? eBook by Henry Kissinger - Khao Tick On

does bank of america accept foreign checks - Khao Tick On

How Does Bank of America Accept Irrevocable Cash - Khao Tick On

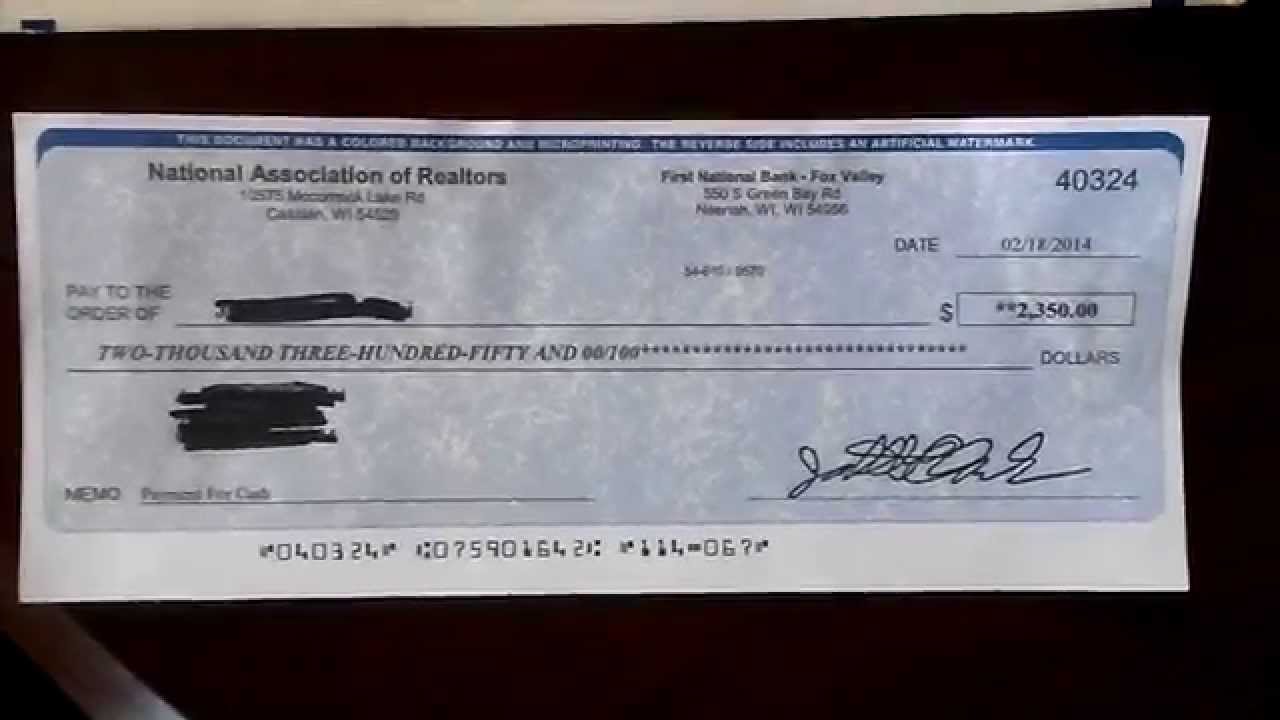

Fake Cashier's Check Scams: How to Spot and Beat Them - Khao Tick On

Does Target Accept Checks? - Khao Tick On

Buick Envision: Will America Accept a Chinese - Khao Tick On

Printable Fake Checks For Pranks - Khao Tick On

does bank of america accept foreign checks - Khao Tick On

Foreign Buyer's Guide by Mariana Oberschi - Khao Tick On

How to Accept Foreign Checks and Reduce Risks - Khao Tick On

Which banks in the US accept and cash foreign checks? - Khao Tick On

Bank of America Order Checks Online - Khao Tick On

Fake Downloadable Printable Fillable Blank Check Template - Khao Tick On

Necessary to know how to endorse a check for businessmen - Khao Tick On