So, you're finally launching that travel blog you've been dreaming of? Or maybe you're taking the plunge and turning your side hustle into a full-time tour company. Whatever exciting adventure awaits in the world of entrepreneurship, one thing's for sure: you need a solid financial foundation. That's where a business checking account comes in, and Chase is a name that consistently pops up.

But hold on a minute before you jump on the first bandwagon! Choosing the right business checking account is like picking the right backpack for a backpacking trip – it needs to fit your specific needs and carry the load. This means understanding the ins and outs of what a Chase business checking account offers and if it truly aligns with your business goals.

This isn't about blindly chasing brand names. It's about making informed decisions for your business's financial well-being. In this article, we'll dive deep into the world of Chase business checking accounts. We'll uncover the pros and cons, weigh the benefits against the drawbacks, and help you determine if it's the right fit for your unique entrepreneurial journey.

Let's face it, navigating the world of business banking can feel like traversing a foreign city without a map. We'll be your guide through the Chase business checking maze, arming you with the knowledge to make a decision that supports your entrepreneurial dreams, not hinders them.

Ready to explore? Let's unpack the details and see if a Chase business checking account is the right travel companion for your entrepreneurial adventure.

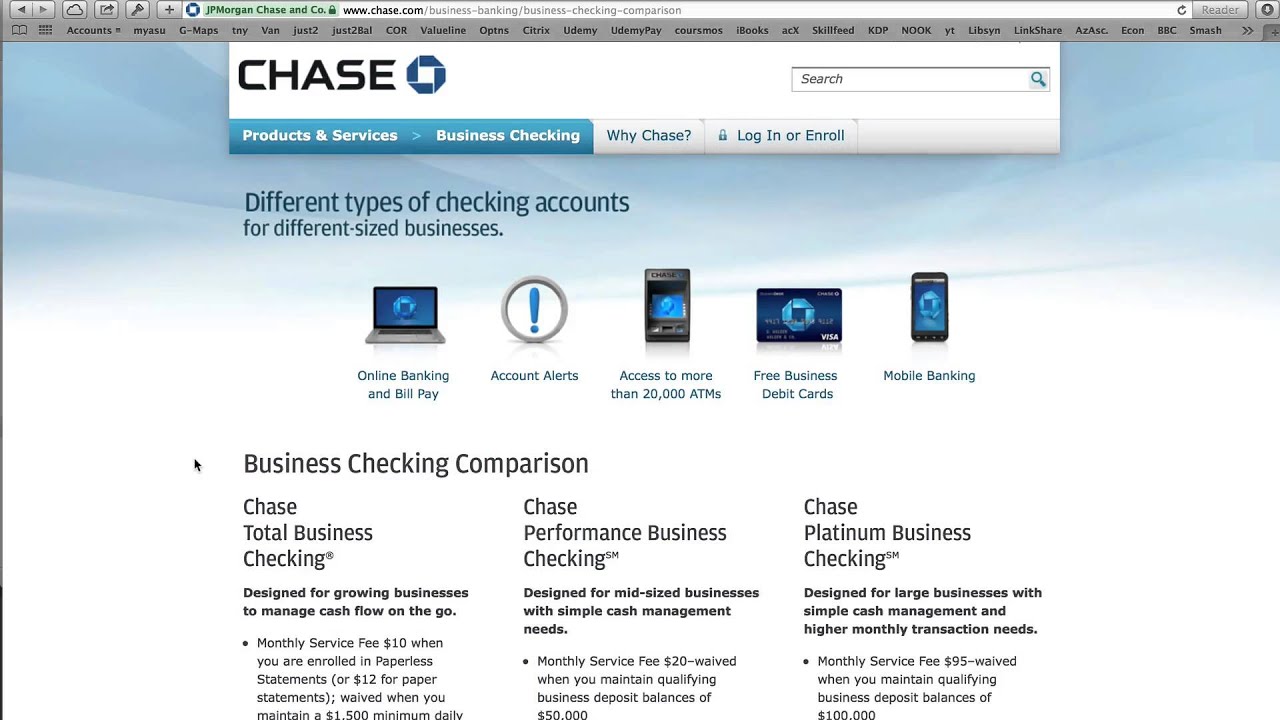

Advantages and Disadvantages of a Chase Business Checking Account

| Advantages | Disadvantages |

|---|---|

| Large network of branches and ATMs | Monthly fees (that can sometimes be waived) |

| Variety of account options to choose from | Transaction limits on some accounts |

| 24/7 customer service | Potentially higher fees compared to online banks |

| Online and mobile banking tools | Minimum balance requirements |

| Integration with other Chase products and services |

Best Practices for Using a Chase Business Checking Account

Opening an account is just the first step. Here are some best practices to make the most of your Chase business checking:

- Track Your Expenses Diligently: Just like you would meticulously plan your travel budget, keep a close eye on your business spending. Utilize Chase's online banking tools to categorize transactions and generate expense reports. This allows for better financial analysis and helps identify areas for potential savings.

- Leverage Mobile Banking: Running a business, especially a travel-related one, often means being on the go. Download the Chase mobile app to conveniently manage your account from anywhere. Deposit checks, pay bills, and transfer funds with ease, even when you're on the road.

- Explore Chase's Small Business Resources: Chase offers a suite of resources specifically designed to support small businesses. From educational webinars to networking events, take advantage of these opportunities to gain valuable insights and connect with fellow entrepreneurs.

- Set Up Payment Processing: If your business involves accepting payments from customers, consider integrating a payment processing solution with your Chase account. This streamlines transactions, improves cash flow, and provides a secure platform for handling payments.

- Communicate with Your Banker: Don't hesitate to reach out to your Chase business banker for personalized guidance and support. They can provide tailored advice, answer any questions you may have, and help you make informed financial decisions for your business.

Common Questions About Chase Business Checking Accounts

Let’s address some frequently asked questions to give you a clearer understanding:

- Q: What are the requirements for opening a Chase business checking account? A: Generally, you’ll need a registered business name, Employer Identification Number (EIN) or Social Security number, and business documentation.

- Q: How much does it cost to open a Chase business checking account? A: Chase offers different account options, each with its own fee structure. Some accounts might have a monthly fee that can be waived by meeting certain criteria, while others may have a minimum opening deposit requirement.

- Q: Can I open a Chase business checking account online? A: Yes, you can conveniently open an account online through Chase’s website.

- Q: Does Chase offer business savings accounts? A: Yes, Chase provides business savings accounts that you can link to your checking account to help separate funds and potentially earn interest.

- Q: What is Chase's customer service like? A: You can reach Chase customer service 24/7 by phone or secure messaging through their online banking platform.

- Q: Does Chase offer any rewards programs for business checking accounts? A: While specific offerings might vary, Chase often has programs where you can earn rewards or bonuses based on your account activity.

- Q: Can I use my personal credit card for business expenses with a Chase business checking account? A: While you can technically use a personal credit card, it’s highly recommended to have a separate business credit card to better track expenses, build business credit, and maintain financial clarity.

- Q: How secure are Chase business checking accounts? A: Chase employs robust security measures such as encryption technology and fraud monitoring to protect your account information.

Choosing the right business checking account is an important decision for any entrepreneur, especially those in the dynamic world of travel. A Chase business checking account comes with its own set of advantages and disadvantages.

Ultimately, the best account for you depends on your specific business needs and financial situation. By carefully weighing the pros and cons and arming yourself with the information we've provided, you can confidently make a decision that sets your travel business up for financial success.

Refresh your tech the ultimate guide to spring background wallpapers hd

Finding simplicity in the story die geschichte von weihnachten

Chevy silverado 1500 30 duramax mpg fuel efficiency redefined

How Long Does It Take A Large Check To Clear At Chase at William Wilson - Khao Tick On

Mailing A Check To Bank at Floyd Gartner blog - Khao Tick On

Chase Total Business Checking, $500 Bonus with No Direct Deposit Req - Khao Tick On

chase business checking account - Khao Tick On

Chase Bank Statement Template Best Of 003 Template Ideas Fake Chase - Khao Tick On

[Dead] Chase Business Performance Checking $500 In Branch Bonus - Khao Tick On

Chase Total Business Checking Accounts [2020 Update] - Khao Tick On

[Targeted] Chase Business Total Checking $750 Bonus - Khao Tick On

Chase business bank statement pdf: Fill out & sign online - Khao Tick On

Get $500 When You Open a Chase Business Checking Account - Khao Tick On

Chase Bank Repossession Department - Khao Tick On

How to funds a house expansion? - Khao Tick On

New 2023 Chase Bank Statement Template - Khao Tick On

New 2023 Chase Bank Statement Template - Khao Tick On

Chase Business Account Wire Fee - Khao Tick On

![[Dead] Chase Business Performance Checking $500 In Branch Bonus](https://i2.wp.com/www.doctorofcredit.com/wp-content/uploads/2018/05/chase-business-checking.png)

![Chase Total Business Checking Accounts [2020 Update]](https://i2.wp.com/upgradedpoints.com/wp-content/uploads/2019/01/Chase-Business-Checking-Accounts.png)

![[Targeted] Chase Business Total Checking $750 Bonus](https://i2.wp.com/www.doctorofcredit.com/wp-content/uploads/2021/05/Screen-Shot-2021-05-03-at-4.03.25-PM.png)