Have you ever opened your credit card statement and felt a wave of confusion (or maybe dread) wash over you? Those interest charges can be tricky little beasts! But here's the good news: understanding how credit card interest works isn't rocket science. In fact, once you have the right knowledge, you can outsmart those charges and even make them work in your favor.

Before we dive into the how-to, let's talk about why understanding credit card interest is crucial. It's about more than just numbers on a page; it's about empowering yourself to make smart financial decisions. When you can calculate your own interest charges, you gain clarity on the true cost of borrowing. This knowledge helps you make informed choices about your spending, repayment strategies, and overall financial well-being.

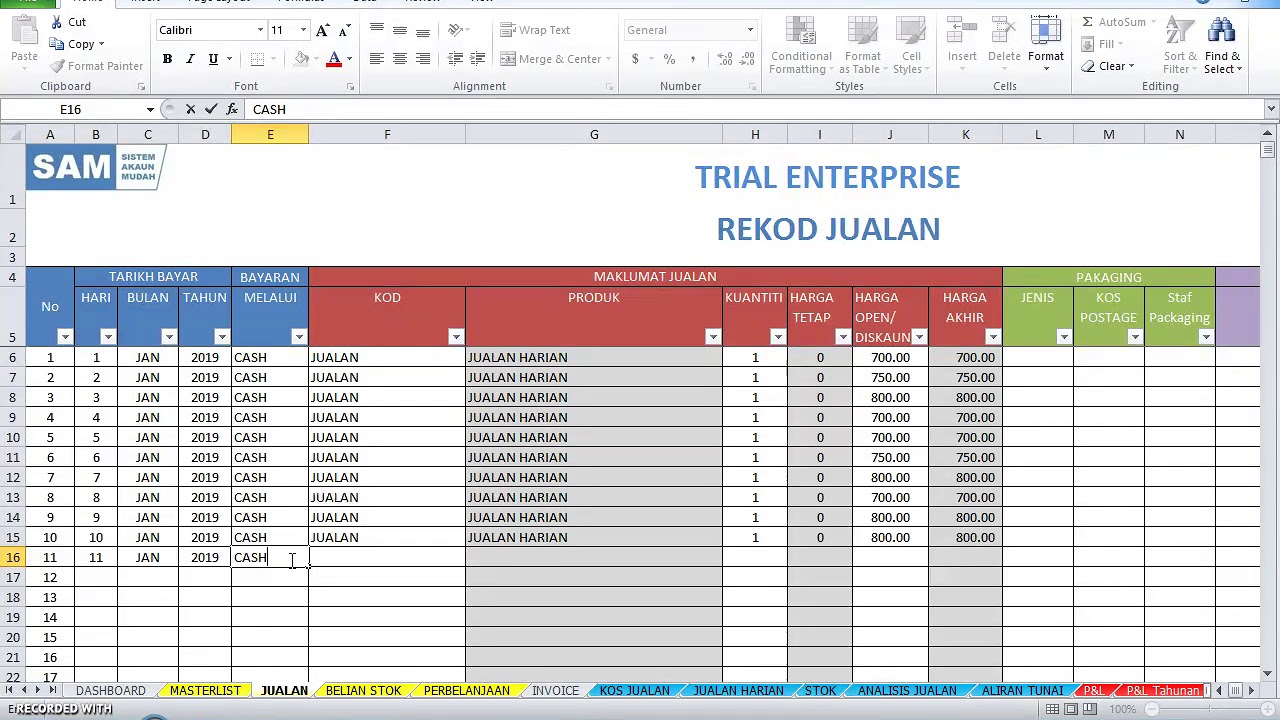

The concept of credit card interest has been around as long as credit cards themselves, emerging in the mid-20th century as a way for lenders to profit from extending credit. While the convenience of credit cards revolutionized consumer spending, it also introduced a system where failing to manage debt properly could lead to a cycle of escalating interest charges. This is where the importance of "cara kira interest kredit kad" or "how to calculate credit card interest" comes in.

The ability to calculate your own interest charges empowers you to:

- Anticipate Costs: By projecting potential interest charges, you can make informed decisions about whether to use your credit card for a purchase or explore alternative payment options.

- Budget Effectively: Knowing how much interest you'll accrue allows you to factor this expense into your monthly budget, reducing the risk of overspending and late payments.

- Strategize Repayment: Understanding how interest is calculated helps you develop an effective repayment plan, whether it's focusing on the highest-interest debt first or making more than the minimum payment.

Now, let's demystify the calculation process itself. To figure out your credit card interest, you need to gather a few key pieces of information:

Advantages and Disadvantages of Understanding Credit Card Interest

| Advantages | Disadvantages |

|---|---|

| Make informed financial decisions | Requires time and effort to understand |

| Avoid debt traps | May be complex for some credit card terms |

| Save money on interest charges | Does not guarantee debt elimination |

Best Practices for Managing Credit Card Interest

Here are some best practices to effectively manage your credit card interest and maintain a healthy financial profile:

- Pay your balance in full and on time: This is the golden rule. By doing so, you avoid interest charges altogether and build a strong credit history.

- Make more than the minimum payment: Even a small extra payment can make a significant difference in reducing the principal balance and overall interest paid over time.

- Consider a balance transfer to a lower-interest card: If you have a large balance, explore balance transfer options to potentially save on interest charges.

- Negotiate with your credit card issuer: Don't be afraid to contact your credit card company and negotiate a lower interest rate, especially if you have a good payment history.

- Create a realistic budget and stick to it: Track your spending, identify areas where you can cut back, and allocate funds toward credit card payments.

Frequently Asked Questions About Credit Card Interest

Here are some common questions people have about credit card interest:

- Q: How is credit card interest calculated? A: Credit card interest is typically calculated using either the average daily balance method or the daily balance method.

- Q: What is APR? A: APR stands for Annual Percentage Rate, and it represents the yearly cost of borrowing on your credit card.

- Q: What is a grace period? A: The grace period is the timeframe between the end of your billing cycle and when interest charges start accruing on new purchases.

- Q: What is a balance transfer fee? A: This is a fee charged by the credit card company for transferring a balance from another card.

- Q: How can I avoid paying credit card interest? A: The best way to avoid paying credit card interest is to pay your balance in full and on time each month.

- Q: Can I negotiate a lower interest rate with my credit card company? A: Yes, it's often possible to negotiate a lower interest rate, especially if you have a good credit history and a long-standing relationship with the issuer.

- Q: What should I do if I'm struggling to make my credit card payments? A: Contact your credit card company as soon as possible to discuss potential options, such as a hardship plan or debt consolidation.

- Q: Where can I find resources to help me manage my credit card debt? A: There are numerous reputable organizations that offer credit counseling and debt management assistance, such as the National Foundation for Credit Counseling (NFCC) and GreenPath Financial Wellness.

Conclusion:

Taking control of your credit card interest is an essential aspect of responsible financial management. By understanding how interest is calculated, you gain the power to make informed decisions about your spending, repayment strategies, and overall financial well-being. Remember, while credit cards offer convenience and flexibility, it's crucial to use them strategically and avoid falling into a cycle of debt. By implementing the tips and strategies outlined in this article, you can confidently navigate the world of credit card interest and achieve your financial goals.

Unlocking the magic your guide to adorable owl plushies

Dibujos de carnes rojas para colorear fun and educational activities for kids

Unlocking opportunities the power of a stellar surat iringan minta kerja

cara kira interest kredit kad - Khao Tick On

cara kira interest kredit kad - Khao Tick On

cara kira interest kredit kad - Khao Tick On

cara kira interest kredit kad - Khao Tick On

cara kira interest kredit kad - Khao Tick On

Free Retaining Wall Revit Download - Khao Tick On

cara kira interest kredit kad - Khao Tick On

cara kira interest kredit kad - Khao Tick On

cara kira interest kredit kad - Khao Tick On

Pin by Thiccmic on Favorite Characters in 2022 - Khao Tick On

HSBC Amanah Premier World MasterCard - Khao Tick On

cara kira interest kredit kad - Khao Tick On

cara kira interest kredit kad - Khao Tick On

cara kira interest kredit kad - Khao Tick On

cara kira interest kredit kad - Khao Tick On