Imagine this: you're all set to file your taxes, but a wave of confusion hits you. What's your 'no cukai pendapatan'? Why is it so important? Don't worry, we've all been there. Navigating the world of taxes can feel like deciphering a secret code, but it doesn't have to be that way. This guide will walk you through the process of checking your 'no cukai pendapatan' (income tax number in Malaysia), arming you with the knowledge to conquer your tax obligations.

In Malaysia, your 'no cukai pendapatan' is your unique identifier in the eyes of the Lembaga Hasil Dalam Negeri (LHDN), the Malaysian tax authority. Think of it as your tax ID – a crucial piece of information required for various financial transactions, from filing your tax returns to claiming refunds and even opening a bank account. Without it, you're essentially invisible in the Malaysian tax system.

The concept of income tax and the 'no cukai pendapatan' has been around for decades, evolving alongside Malaysia's economic landscape. Introduced as a means to fund public services and infrastructure, the system relies on individuals and businesses contributing their fair share based on their income. Over time, the process of obtaining and managing your 'no cukai pendapatan' has been streamlined, with online platforms now playing a pivotal role in simplifying the process.

However, despite these advancements, many people still face challenges. One of the biggest hurdles is simply understanding the importance of the 'no cukai pendapatan' and how it impacts their financial well-being. From failing to register for a tax file to misplacing their tax information, these issues can lead to complications, penalties, and missed opportunities for tax savings.

Understanding your 'no cukai pendapatan' isn't just about avoiding penalties; it's about empowering yourself. Knowing your tax status allows you to plan your finances more effectively, ensure you're paying the correct amount of tax, and take advantage of any tax reliefs or deductions you may be eligible for.

Advantages and Disadvantages of Checking Your 'No Cukai Pendapatan'

| Advantages | Disadvantages |

|---|---|

| Ensure accurate tax filing | Potential for encountering technical issues on online platforms |

| Claim tax refunds efficiently | Time commitment required to gather necessary information |

| Avoid penalties for non-compliance |

While the concept of checking your 'no cukai pendapatan' might seem straightforward, a few practical tips can make the process smoother:

Tip 1: Keep Your Information Organized: Maintain a dedicated folder for all your tax-related documents, including your 'no cukai pendapatan' notification letter, tax returns, and any supporting documents.

Tip 2: Embrace Online Platforms: Familiarize yourself with the LHDN's online portal, where you can access a wealth of information and manage your tax affairs digitally.

In conclusion, understanding and checking your 'no cukai pendapatan' is a fundamental aspect of financial responsibility in Malaysia. It's not just a number; it's your key to navigating the tax system effectively and ensuring you're on the right track financially. By embracing technology, staying organized, and seeking assistance when needed, you can demystify the process and approach your tax obligations with confidence. Remember, being informed is the first step towards taking control of your financial well-being.

Scoring free treasures in orange county craigslist goldmine

Unveiling the secrets conquering merge dragons levels with undead trees

The humble power of the pilot b2p a journey through sustainable writing

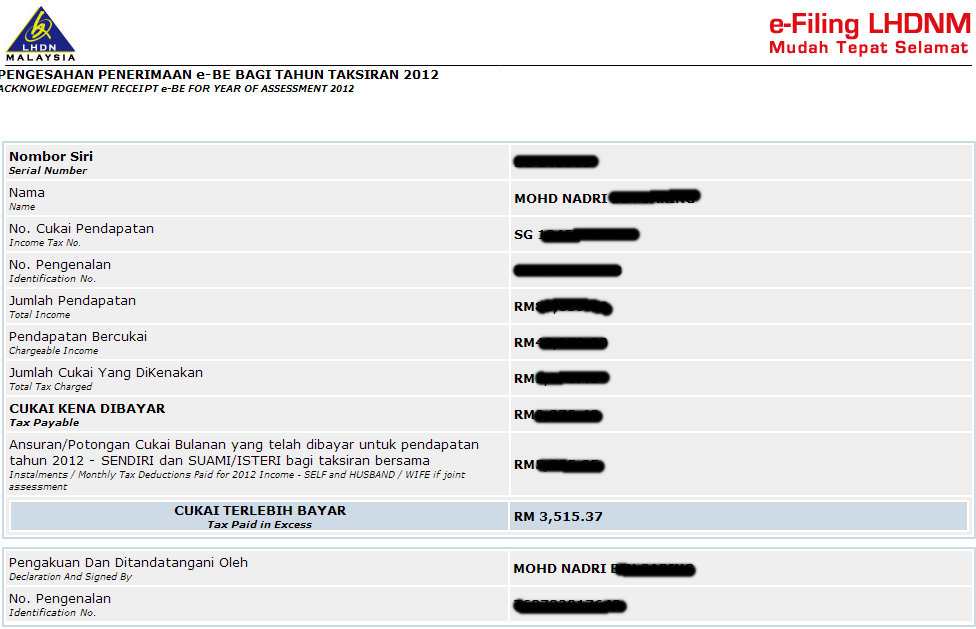

Efiling Cukai Pendapatan 2012 Ez Makan2 Jalan2 - Khao Tick On

Semakan No Cukai Pendapatan Syarikat - Khao Tick On

Borang E Filing Cukai Pendapatan - Khao Tick On

CHECK NO CUKAI PENDAPATAN/SYARIKAT MALAYSIA - Khao Tick On

Cukai Pendapatan Individu & Cara Bayar Online - Khao Tick On

how to check no cukai pendapatan - Khao Tick On

Nombor Pengenalan Cukai / Tax Identification Number (TIN) - Khao Tick On

Cukai Pintu, Cukai Tanah dan Cukai Petak? - Khao Tick On

Jangan Sampai Kena Denda 300% Dengan LHDN! INI Cara Nak Elakkan - Khao Tick On

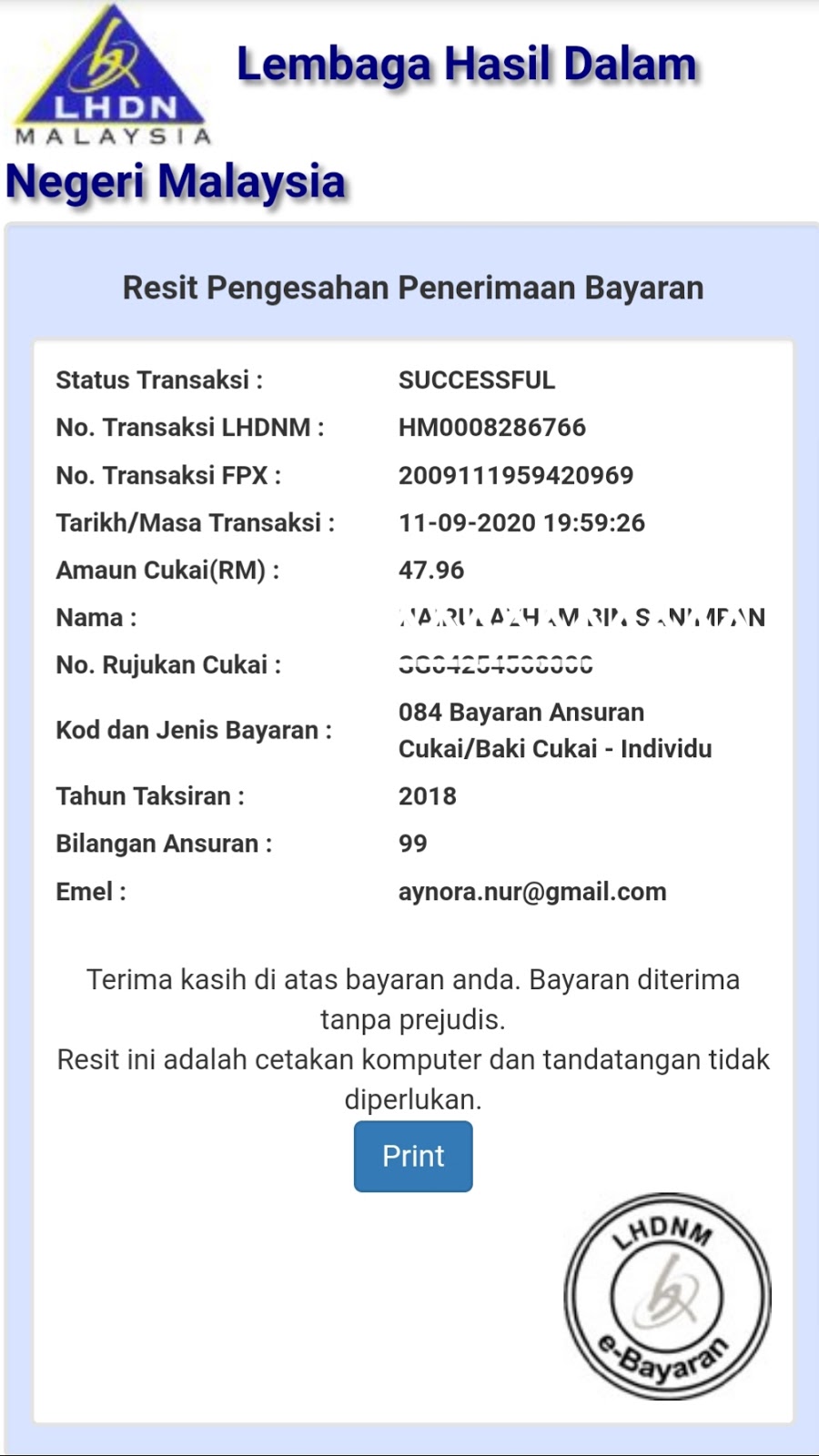

Cara Bayar Baki Cukai Pendapatan Secara Online Yang Mudah - Khao Tick On

Semakan No Cukai Pendapatan Syarikat - Khao Tick On

how to check no cukai pendapatan - Khao Tick On

Cara Declare Cukai Pendapatan Di LHDN - Khao Tick On

Semakan No Cukai Pendapatan Individu (TIN Hasil) - Khao Tick On

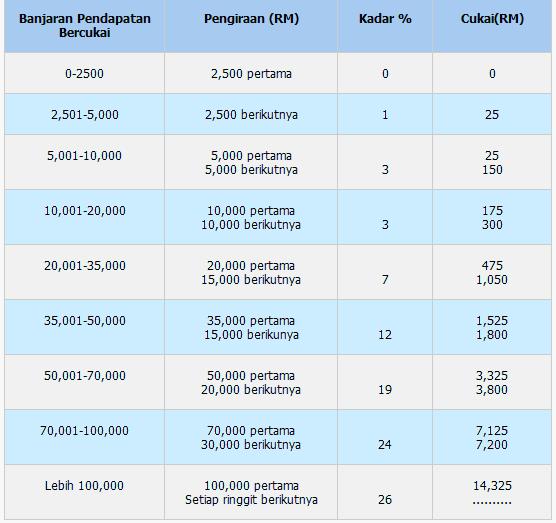

Cara Mudah Pengiraan Cukai Pendapatan Tips Bijak Menguruskan Wang Sah - Khao Tick On