In the intricate dance of modern commerce, a subtle yet crucial element often goes unnoticed: proof of billing. Think of it as the silent handshake confirming a transaction, the tangible evidence that funds have changed hands. This seemingly mundane document holds significant power, offering both protection and clarity in the financial world.

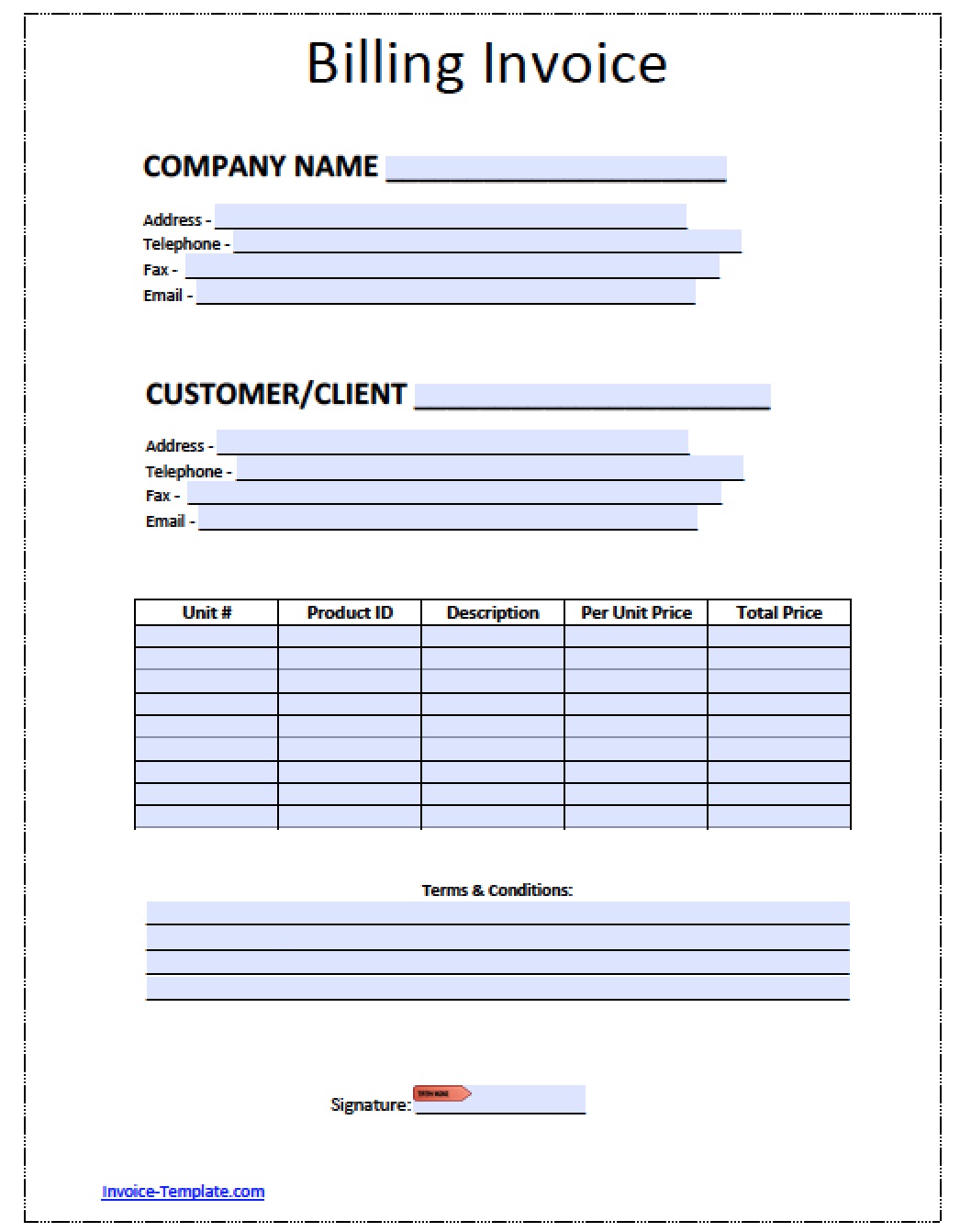

What exactly constitutes a billing verification document? It's essentially any record that substantiates a purchase or payment. This could be a traditional paper receipt, a credit card statement, an electronic invoice, or even a screenshot of an online transaction. The specifics may vary, but the core function remains the same: to validate the exchange of value.

The history of billing verification is intertwined with the evolution of commerce itself. From ancient clay tablets recording bartered goods to the digital receipts of today, the need to document transactions has been a constant. As commerce grew more complex, so too did the methods of verification, reflecting the changing landscape of financial interactions.

The significance of maintaining proper billing documentation cannot be overstated. It serves as a crucial piece of evidence in case of disputes, discrepancies, or even fraud. Imagine a contested charge on your credit card; without a valid proof of payment, reclaiming your funds can become an uphill battle. Similarly, for businesses, meticulous billing records are essential for accurate accounting, tax compliance, and smooth financial operations.

One of the main issues surrounding billing documentation is the transition to digital formats. While electronic records offer convenience and accessibility, they also pose challenges in terms of storage, organization, and long-term retrieval. Ensuring the security and integrity of digital billing information is paramount in today's interconnected world.

A simple example of a billing proof is a utility bill. It clearly outlines the services provided, the amount due, the payment date, and the payment method. This document serves as verification that you have fulfilled your financial obligation to the utility company. Another example is a bank transfer confirmation, which provides electronic proof of funds transferred between accounts.

One key benefit of maintaining organized billing records is improved financial management. By tracking your expenses and payments, you can gain a clearer picture of your spending habits, identify areas for potential savings, and make informed financial decisions.

Another advantage is enhanced fraud protection. Having readily accessible proof of payment allows you to quickly identify and dispute unauthorized transactions, minimizing potential financial losses. Furthermore, meticulous billing documentation simplifies tax preparation, providing the necessary documentation to support deductions and avoid penalties.

To effectively manage your billing documentation, consider implementing a digital filing system. Scan paper receipts and store electronic records in a secure, cloud-based platform. Categorize your files by type and date for easy retrieval. Regularly review your billing statements to identify any discrepancies or potential issues.

Advantages and Disadvantages of Detailed Billing Records

| Advantages | Disadvantages |

|---|---|

| Better Financial Management | Time and Effort for Organization |

| Improved Fraud Protection | Potential Data Security Risks (if not stored securely) |

| Simplified Tax Preparation | Storage Space Requirements (for physical documents) |

Best practices include regularly reviewing your statements, keeping digital backups, and shredding unnecessary physical documents. Five real-world examples of billing proof include credit card statements, utility bills, invoices, online transaction confirmations, and payment receipts. Challenges related to digital storage can be addressed by using secure cloud services. Disputes over billing can be resolved by providing clear documentation.

Frequently asked questions revolve around acceptable forms of proof, digital storage methods, and dispute resolution procedures. Tips and tricks for managing billing information include setting up automatic payment reminders and utilizing budgeting apps.

In conclusion, the seemingly simple act of retaining proof of billing is a cornerstone of sound financial practice. From protecting against fraud to simplifying tax season, the benefits are far-reaching. Embrace the power of proper billing documentation and take control of your financial well-being. In an increasingly digital world, adopting secure and organized methods for storing and managing billing verification is not just a good practice—it's a necessity. By understanding the importance of these records and implementing the strategies outlined above, you can navigate the complexities of modern finance with confidence and peace of mind. Start organizing your billing documents today and experience the tangible benefits of financial clarity and control. It's an investment in your financial future that will pay dividends for years to come.

Unveiling the deception understanding i now see it was all a lie

Demon slayer 4k wallpapers level up your desktop

Mastering gmc acadia lug nut torque your guide to wheel safety

example of proof of billing - Khao Tick On

Printable Invoice Template Excel - Khao Tick On

Invoice Form For Ces Rendered Sample Letter Download Template - Khao Tick On

example of proof of billing - Khao Tick On

Did this gene give modern human brains their edge? - Khao Tick On

Actor Wendell Pierce took to X, formerly Twitter, to call out a white - Khao Tick On

Thanks Paul! What's fascinating is reading the myriad of opinions and - Khao Tick On

example of proof of billing - Khao Tick On

Full Injectables and Treatment Menu - Khao Tick On

example of proof of billing - Khao Tick On

example of proof of billing - Khao Tick On

example of proof of billing - Khao Tick On

example of proof of billing - Khao Tick On

example of proof of billing - Khao Tick On

example of proof of billing - Khao Tick On

.jpg)