Sending or receiving money can feel like navigating a maze, especially when it involves wire transfers. With JPMorgan Chase being a major player in the financial world, understanding their specific wire transfer procedures is crucial. This guide will break down the essentials of JPMorgan Chase wire instructions, addresses, and everything in between, ensuring your transfers are smooth and hassle-free.

Whether you're a seasoned business owner or an individual sending money abroad, knowing the correct details for a JPMorgan Chase wire transfer is paramount. Incorrect information can lead to delays, returned funds, or even lost money. We'll demystify the process, providing clear explanations and practical examples to empower you with the knowledge you need.

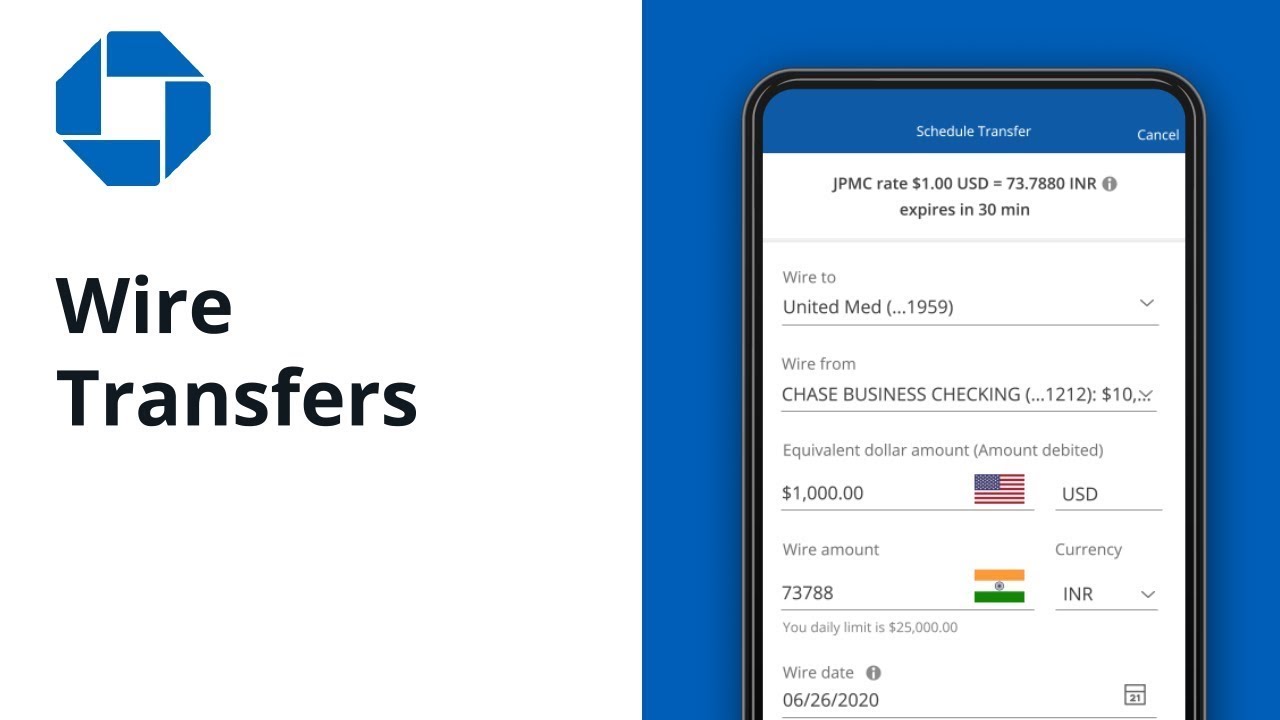

Navigating the world of wire transfers can be daunting, but with the right information, it doesn't have to be. This guide will equip you with the tools to confidently initiate and receive wire transfers through JPMorgan Chase. We'll cover domestic and international transfers, addressing key details like SWIFT codes, routing numbers, and the importance of accurate beneficiary information.

One of the most common questions people have is, "Where do I find the right JPMorgan Chase wire instructions and address?" We'll address this directly, providing clear guidance on locating the necessary information for various transfer types. This includes understanding the difference between domestic and international wire transfer requirements, ensuring your transfer reaches its destination accurately and efficiently.

Beyond simply finding the correct address for JPMorgan Chase wire instructions, understanding the process itself is vital. We'll delve into the steps involved in initiating a wire transfer, highlighting best practices for security and accuracy. This will include tips on verifying information, avoiding common errors, and ensuring your funds are transferred securely.

Historically, wire transfers have been a preferred method for large sums of money, offering a relatively quick and secure way to move funds across borders. JPMorgan Chase, with its extensive global network, has played a significant role in facilitating these transactions.

The importance of accurate JPMorgan Chase wire instructions and addresses cannot be overstated. Inaccurate information can lead to significant delays, requiring time and effort to rectify the issue. In some cases, funds might be returned, incurring additional fees. Understanding the specific requirements for different types of transfers, such as domestic versus international, is essential.

A domestic wire transfer within the United States typically requires the recipient's bank name, account number, and the JPMorgan Chase routing number for the recipient's location. For international wire transfers, you'll need the recipient's bank's SWIFT code, their IBAN (International Bank Account Number), and potentially additional details depending on the country. Always double-check the specific requirements with JPMorgan Chase to avoid errors.

One benefit of using wire transfers is speed. They are generally faster than other forms of international money transfer. Another advantage is security. Wire transfers are typically considered secure due to the verification processes involved. Finally, they are reliable, offering a consistent and predictable way to send and receive large sums of money.

Advantages and Disadvantages of Wire Transfers

| Advantages | Disadvantages |

|---|---|

| Speed | Cost |

| Security | Irreversibility |

| Reliability | Potential for Fraud if Precautions Aren't Taken |

Best Practices:

1. Always double-check recipient details.

2. Verify the JPMorgan Chase wire instructions with a bank representative.

3. Use strong passwords and two-factor authentication for online banking.

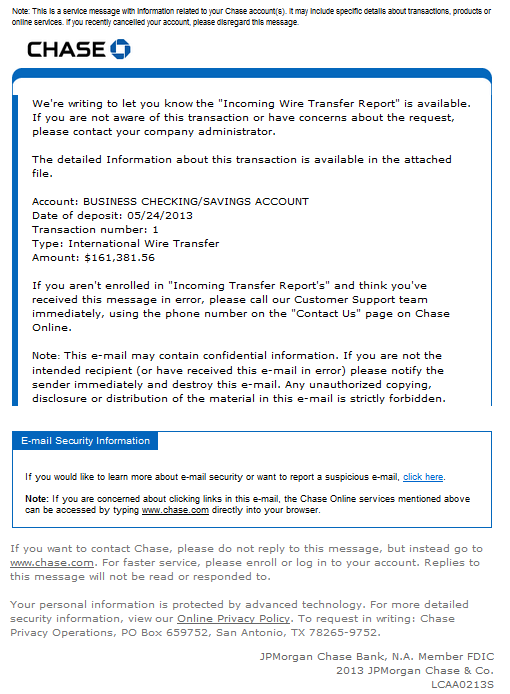

4. Be wary of phishing scams requesting wire transfer information.

5. Keep records of all your wire transfer details.

Frequently Asked Questions:

1. How long does a wire transfer take? - Typically 1-3 business days.

2. What are the fees associated with wire transfers? - Varies depending on the type and amount.

3. How do I track my wire transfer? - Through your JPMorgan Chase online banking portal.

4. What should I do if my wire transfer is delayed? - Contact JPMorgan Chase customer service.

5. Can I cancel a wire transfer? - Possibly, if it hasn't been processed yet.

6. Where can I find the correct JPMorgan Chase routing number? - On the JPMorgan Chase website or your bank statement.

7. What is a SWIFT code? - A code used to identify banks and financial institutions globally.

8. What information do I need to receive a wire transfer? - Your bank name, account number, and potentially a SWIFT code for international transfers.

Tips and Tricks: Initiate transfers early in the day to allow for processing time. Keep a record of all transaction details for future reference. Use a secure internet connection when conducting online banking transactions.

In conclusion, understanding the intricacies of JPMorgan Chase wire instructions and addresses is crucial for seamless and secure transactions. Whether you're sending money domestically or internationally, ensuring accurate information is paramount. By following the best practices outlined in this guide, you can confidently navigate the world of wire transfers, minimizing delays and potential issues. Remember to double-check all recipient details, verify information with the bank, and prioritize security measures. Utilizing the resources available, such as the JPMorgan Chase website and customer service, can provide valuable support throughout the process. With the right knowledge and preparation, wire transfers can be a reliable and efficient way to manage your finances. Take the time to familiarize yourself with the procedures and safeguard your transactions for a smooth and successful experience. Don't hesitate to contact JPMorgan Chase directly for specific questions or concerns regarding your individual needs.

Unlocking your honda pioneer 500s potential a guide to lug pattern and wheel upgrades

Unlocking the secrets of the chevy 37l 5 cylinder engine

Banish water spots the ultimate guide to sparkling clean

How Much Is The International Wire Transfer Fee At Bank Of America at - Khao Tick On

Wiring Instructions For Chase - Khao Tick On

Fillable Online Incoming Wiring Instructions Chase Bank Fax Email Print - Khao Tick On

Truist Bank Domestic Wiring Instructions - Khao Tick On

Chase Wire Transfer Form PDF Complete with ease - Khao Tick On

Chase Wiring Instructions Receive - Khao Tick On

Scanned documents related to the complaint against JPMorgan Chase Bank - Khao Tick On

Wiring Instructions For Bank Of America - Khao Tick On

Wiring Instructions Template Complete with ease - Khao Tick On

Pnc Bank Wire Transfer Instructions - Khao Tick On

Chase Bank Wire Transfer Fees and Instructions - Khao Tick On

how do i do a wire transfer with chase - Khao Tick On

Employee Direct Deposit Form - Khao Tick On

How To Wire From Capital One - Khao Tick On

Grounded off in arrange toward seize this benami objekt this Account - Khao Tick On