Are you nearing Medicare eligibility and feeling overwhelmed by the alphabet soup of supplemental plans? You're not alone. Many soon-to-be beneficiaries grapple with understanding the various options, particularly the costs associated with each. One popular choice, Medicare Supplement Plan B, offers valuable coverage, but understanding its typical price tag is crucial for effective budgeting.

Medicare Supplement Plan B helps bridge the gaps left by Original Medicare, covering part of the costs for services like doctor visits, outpatient care, and medical equipment. But what does this coverage typically cost? The price of Plan B, like other Medigap policies, varies based on several factors. Let's unpack the elements that influence the average cost of Medicare Supplement Plan B.

Several factors play a role in determining your Plan B premium. Location, insurance company, age, and even gender can influence the price you'll pay. Comparing quotes from different insurers in your area is essential to finding the most affordable Plan B option. Don't assume all Plan B policies are created equal; premiums can differ significantly.

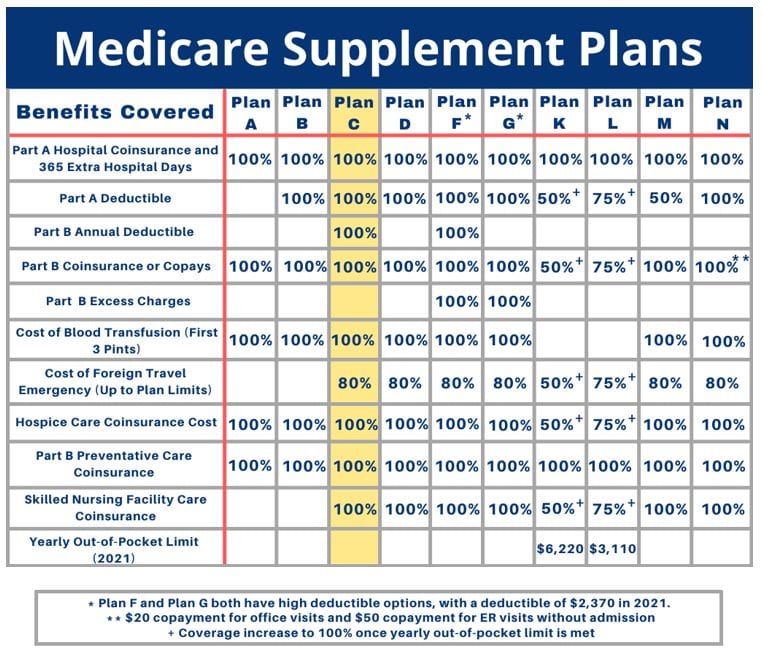

Understanding the historical context of Medicare Supplement plans is helpful. These plans, also known as Medigap, were designed to supplement Original Medicare coverage, helping beneficiaries manage out-of-pocket expenses. Over time, standardized plans, labeled with letters (like Plan B), emerged, ensuring consistent benefits across different insurers. This standardization helps consumers compare apples to apples when choosing a plan.

The importance of understanding Medicare Supplement Plan B costs cannot be overstated. Healthcare expenses can be unpredictable, and knowing your expected monthly premium empowers you to budget effectively and avoid financial surprises. Knowing the typical Plan B cost in your region provides a baseline for comparison shopping and helps you evaluate the value offered by different insurers.

Medicare Supplement Plan B helps cover the Medicare Part A deductible, Part B coinsurance, and the first three pints of blood. It does not cover the Part B deductible. A simple example: If you incur a hospital stay, Plan B would help cover the Part A deductible, reducing your out-of-pocket expense.

One benefit of knowing the average cost of Plan B is the ability to budget effectively for healthcare expenses. Another is the power to compare plans effectively, ensuring you get the best value for your money. Finally, understanding the cost structure empowers you to make informed decisions about your Medicare coverage.

Creating an action plan for finding the best Plan B involves several steps: First, research different insurance companies offering Plan B in your area. Second, get quotes from multiple insurers. Third, compare the premiums and benefits offered by each plan. A successful example would be finding a plan with a lower-than-average premium while still providing the desired coverage.

Advantages and Disadvantages of Focusing on Average Costs

| Advantages | Disadvantages |

|---|---|

| Provides a starting point for comparison shopping | Averages can be misleading, not reflecting individual circumstances |

| Helps with initial budgeting | Doesn't account for variations in coverage and benefits |

Best practices for evaluating Plan B costs include comparing quotes, understanding plan benefits, considering your health needs, checking insurer ratings, and consulting with a Medicare expert if needed.

Challenges related to understanding Plan B costs include information overload, varying premiums, and complex terminology. Solutions include using online comparison tools, consulting with licensed insurance agents, and focusing on reputable resources.

FAQ: What is the average cost of Plan B? This varies by location and insurer. How do I find the best Plan B price? Compare quotes. What factors influence Plan B costs? Age, location, and insurance company. Does Plan B cover all my medical expenses? No, it supplements Original Medicare. Is Plan B the right plan for me? It depends on your individual needs and budget. How do I enroll in Plan B? Contact the insurance company directly. Can I switch from one Plan B to another? Yes, during certain enrollment periods. What are the alternatives to Plan B? Other Medigap plans and Medicare Advantage.

Tips for navigating Plan B costs include using online resources, talking to local insurance brokers, and attending Medicare workshops or seminars.

In conclusion, understanding the average cost of Medicare Supplement Plan B is a crucial step in preparing for your healthcare needs in retirement. While averages provide a helpful starting point, remember to consider individual factors that influence premiums. By comparing quotes, understanding the benefits, and making informed decisions, you can secure a Plan B that fits your budget and provides the necessary coverage. Take control of your healthcare planning today – research, compare, and choose wisely. Your future self will thank you for the peace of mind that comes with well-planned healthcare coverage.

Mastering three digit addition printables

Taming the wild west how to draw a cattle skull

Reap what you ink the allure of the evil grim reaper sleeve tattoo

Medicare Plans 2024 Ppo Ohio - Khao Tick On

Cost Of Medicare Part C In 2024 - Khao Tick On

Aetna Medicare Supplement Insurance Costs Options - Khao Tick On

Medicare Part D Plans 2024 Florida - Khao Tick On

What Is Medicare Plan J - Khao Tick On

Chart Supplement User Guide - Khao Tick On