Navigating the world of financial instruments can feel like traversing a complex maze. Among these instruments, rights issues offer existing shareholders the opportunity to purchase additional shares at a discounted price. At the heart of this process lies the offer letter, a critical document that outlines the terms and conditions of the offering. Understanding the structure and nuances of a right issue offer letter is paramount for making informed investment decisions.

A right issue offer letter isn't just a formality; it's a roadmap. It provides existing shareholders with the necessary details to decide whether to participate in the rights offering. Deciphering the letter's structure and content is crucial for capitalizing on potential investment opportunities and safeguarding one's portfolio. This involves understanding the offer price, the ratio of new shares to existing shares, the subscription period, and other vital details.

The prescribed format of a right issue offer letter aims to ensure transparency and clarity for investors. While specific regulations might vary based on jurisdiction, the fundamental components remain consistent. These components often include details about the company's rationale for the rights issue, the intended use of the proceeds, the subscription price, the entitlement ratio, the record date, the timeline for subscribing, and procedures for renouncing rights.

Imagine receiving a right issue offer letter. What should you look for? Key elements include the company's financial performance, the reasons for raising capital, the dilution impact of the new shares, and the potential implications for your existing holdings. A thorough analysis of these factors is essential for making a sound investment decision.

One of the fundamental principles behind a standardized right issue offer letter format is to protect shareholder rights. By ensuring consistent and transparent communication, regulators aim to level the playing field and provide investors with the necessary information to make informed choices. This also helps prevent misunderstandings and potential disputes later on.

Historically, rights issues have been employed by companies to raise capital for various purposes, including expansion projects, debt reduction, acquisitions, or working capital needs. The specific format requirements for offer letters have evolved over time, driven by regulatory changes and best practices. One common challenge is ensuring that the language used is clear and accessible to all shareholders, regardless of their financial expertise.

Benefits of a well-structured offer letter include enhanced investor comprehension, improved participation rates, and a smoother subscription process. For example, a clear explanation of the subscription process can encourage more shareholders to participate, benefiting both the company and its investors.

A step-by-step guide to understanding the offer letter might involve reviewing the company's financial statements, analyzing the terms of the offer, evaluating the potential risks and rewards, and consulting with a financial advisor if needed.

Advantages and Disadvantages of Standardized Right Issue Offer Letter Format

| Advantages | Disadvantages |

|---|---|

| Clarity and Transparency | Potential Rigidity |

| Ease of Comparison | One-size-fits-all approach may not suit all situations |

Best practices for implementing the format include using plain language, avoiding jargon, presenting information logically, and providing clear contact details for inquiries.

Frequently asked questions about right issue offer letters often revolve around the subscription process, the treatment of fractional entitlements, and the implications for tax purposes.

Tips for navigating the offer letter include carefully reviewing all terms and conditions, understanding the implications for your existing shareholding, and seeking professional advice if needed.

In conclusion, the format of a right issue offer letter plays a pivotal role in the success of a rights offering. By providing a clear and comprehensive overview of the terms and conditions, it empowers existing shareholders to make informed investment decisions. Understanding the structure, content, and implications of this document is crucial for navigating the complexities of rights issues and maximizing their potential benefits. This empowers investors to actively participate in the growth and evolution of the companies they invest in. Take the time to thoroughly review the offer letter, seek professional guidance when needed, and make informed choices that align with your investment goals. By understanding the nuances of right issue offer letters, investors can effectively leverage this financial instrument to enhance their portfolios and participate in the dynamic world of capital markets. This proactive approach allows investors to not only protect their investments but also potentially capitalize on new opportunities presented by the rights issue.

Mastering the art of measurement your guide to metric unit conversion worksheet pdf

Unraveling the enigma exploring the meaning of filipino riddles bugtong and examples

Dr michael wong optometrist your vision our priority

Property Consultant Salary Sa at Neil Williams blog - Khao Tick On

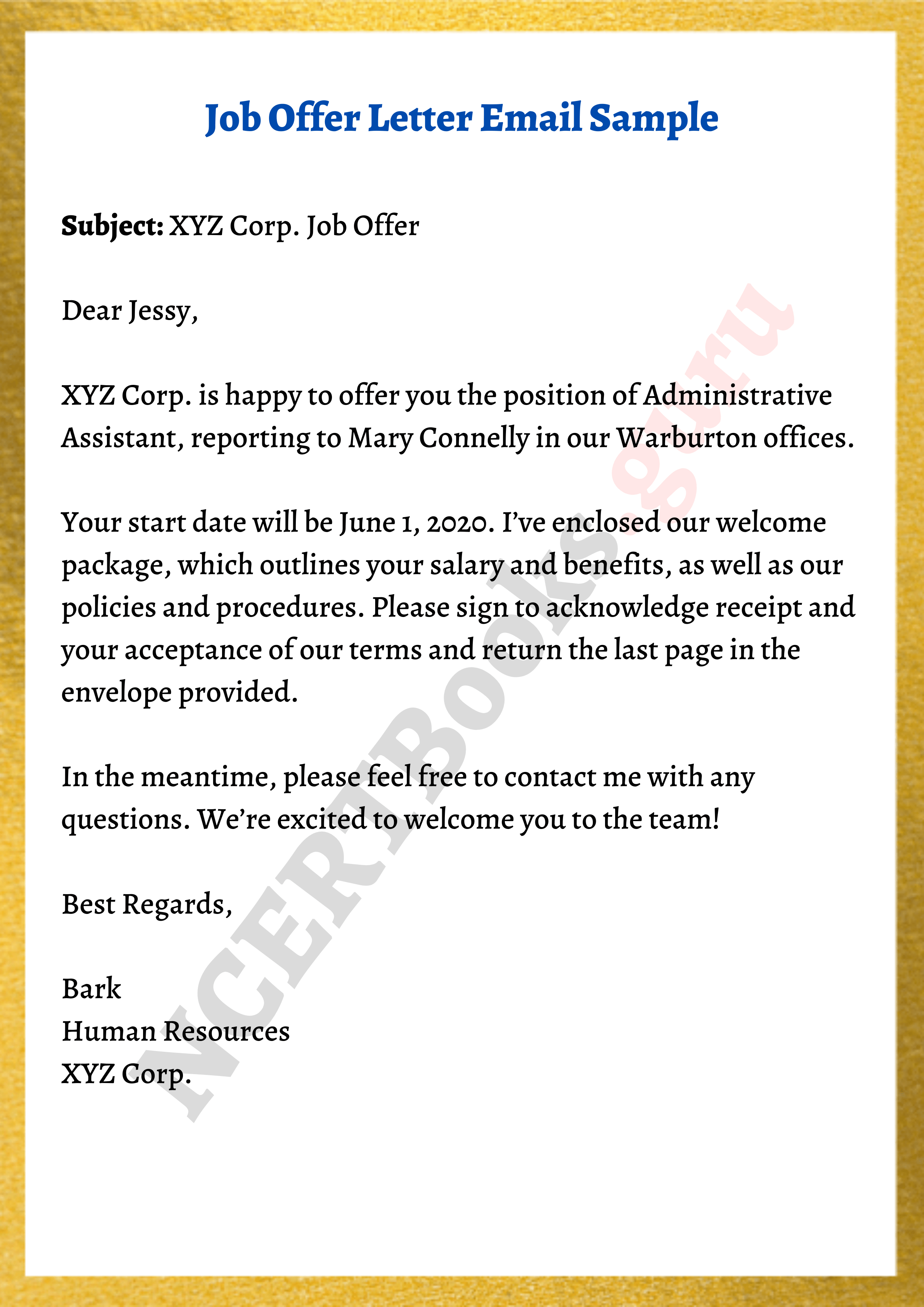

Offer Letter Template Pdf - Khao Tick On

Job Offer Letter Format - Khao Tick On

Reliance offer letter The Epic Buyer Offer Letter That Won Us The - Khao Tick On

Sample Employment Offer Letter Format - Khao Tick On

Writing An Offer Letter - Khao Tick On

format of offer letter in right issue - Khao Tick On

format of offer letter in right issue - Khao Tick On

Writing An Offer Letter - Khao Tick On

Sample Pledge Letter Of Intent Database - Khao Tick On

Writing An Offer Letter - Khao Tick On

Kostenloses Job Offer Letter Template - Khao Tick On

Kostenloses Sample Business Offer Letter Format - Khao Tick On

format of offer letter in right issue - Khao Tick On

Sending Offer Letter Email Template - Khao Tick On