Have you ever needed to make a wire transfer, set up direct deposit, or receive a payment from abroad? In these situations, you'll inevitably encounter the need for your bank's branch and transit numbers. These seemingly insignificant codes are the backbone of identifying your specific financial institution and branch, ensuring your money lands exactly where it should. But where do you find these crucial numbers, and what exactly do they represent? This guide will unravel the mystery behind these essential banking codes.

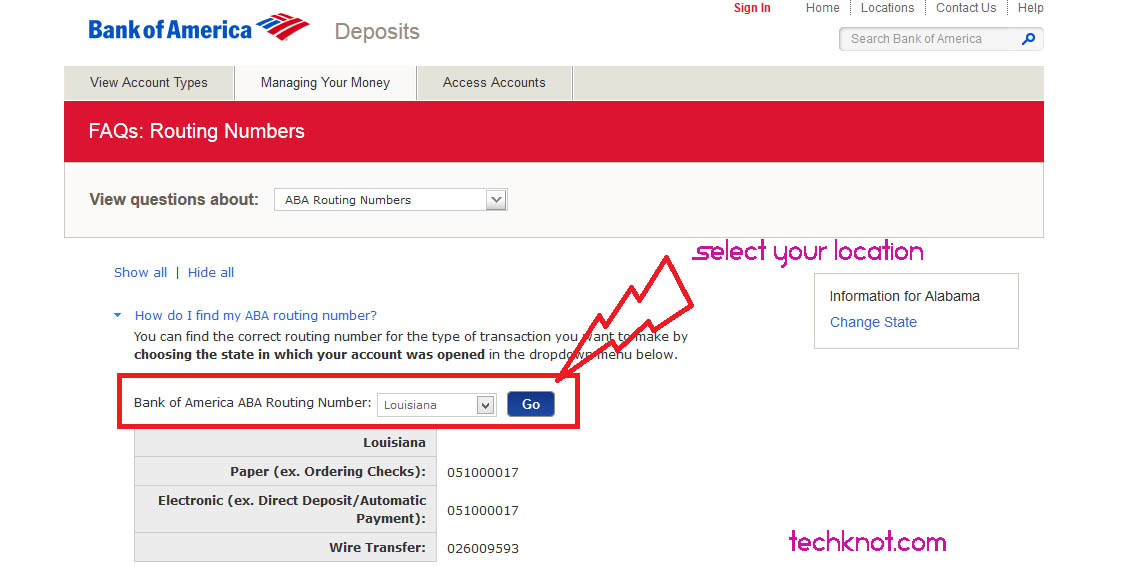

Locating your branch and transit number might seem daunting, but it's actually quite straightforward. These numbers are readily available on your checks, usually printed at the bottom. Your bank's website or mobile app typically displays them within your account details. You can also obtain them by contacting your bank directly or visiting a branch in person.

The branch and transit number work together to pinpoint your bank and its specific location. The transit number, often five digits, identifies your financial institution. The branch number, usually three digits, identifies the specific branch where your account is held. This dual identification system ensures accurate routing of funds within the complex financial network.

These numbers have a rich history tied to the evolution of banking itself. As financial transactions became increasingly complex and widespread, the need arose for a standardized system to identify banks and branches. This led to the development of the branch and transit number system, ensuring accurate and efficient processing of transactions across different financial institutions.

Understanding your bank codes empowers you to manage your finances effectively. Without them, various banking operations would be impossible. These numbers are vital for seamless transactions, allowing you to make deposits, receive payments, and manage your money efficiently. From setting up direct deposit to sending wire transfers, knowing your branch and transit number is essential for navigating the modern financial landscape.

For example, imagine needing to set up direct deposit for your paycheck. Without the correct branch and transit number, your employer wouldn't be able to deposit your earnings into your account. Similarly, when receiving an international wire transfer, providing the correct codes ensures the funds are routed to your account without delays or errors.

One benefit of having ready access to your branch and transit number is the convenience it provides. You can quickly access them whenever needed for various financial transactions, eliminating the need for time-consuming searches or phone calls to your bank.

Another advantage is enhanced security. Providing the correct codes safeguards your transactions and minimizes the risk of errors or fraud. Using the correct information ensures your money is deposited into your designated account and not misdirected.

Lastly, knowing your branch and transit number enables you to participate fully in the modern financial system. From online banking to international transfers, these codes are the key to unlocking a wide range of financial services and opportunities.

To find your branch and transit number quickly, check your checks, online banking platform, or contact your bank directly. Keep a record of these numbers in a secure location for easy access.

Advantages and Disadvantages of Using Online Banking to Find Your Codes

| Advantages | Disadvantages |

|---|---|

| Instant access 24/7 | Requires internet access and account login |

| Convenient and efficient | Potential security risks if not accessed through secure channels |

Best Practices for Securely Handling Your Bank Information:

1. Never share your bank codes via email or unsecure messaging platforms.

2. Verify the recipient's legitimacy before providing any banking details.

3. Regularly monitor your bank statements for any unauthorized transactions.

4. Use strong passwords and enable two-factor authentication for your online banking.

5. Keep your banking information in a secure location, separate from other sensitive documents.

Frequently Asked Questions:

1. What is the difference between a branch number and a transit number? (A: The transit number identifies the financial institution, while the branch number specifies the location.)

2. Where can I find my bank codes? (A: Check your checks, online banking, or contact your bank.)

3. What if my check doesn't display the codes? (A: Contact your bank or visit a branch.)

4. Are these numbers the same as my account number? (A: No, they are distinct identifiers for the bank and branch.)

5. What should I do if I suspect fraudulent activity? (A: Contact your bank immediately.)

6. How often do these numbers change? (A: Rarely, but they can change due to mergers or acquisitions.)

7. Can I use these numbers for international transactions? (A: Yes, often along with a SWIFT code for international transfers.)

8. Are these numbers required for all banking transactions? (A: They are essential for various transactions, especially electronic transfers and direct deposits.)

Tips and tricks for managing your bank codes include storing them securely in a password manager or a safe place and double-checking them when making transactions.

In conclusion, understanding your branch and transit number is fundamental to navigating the modern financial landscape. These codes are not mere numbers; they are essential keys that unlock a seamless banking experience. From facilitating direct deposits to ensuring accurate wire transfers, knowing and protecting these codes empowers you to manage your finances with confidence and efficiency. Take the time to locate your codes, store them securely, and understand their significance. By doing so, you'll be equipped to navigate the complexities of the financial world and ensure your transactions proceed smoothly. Don’t underestimate the importance of these small codes – they play a big role in your financial well-being. Act today, locate your codes, and empower yourself to manage your finances effectively.

Sound waves on the water fusion marine audio

Ea fc 24 ultimate edition xbox deep dive

Finding solace and strength exploring the impact of all my sins are forgiven lyrics

How to find your Bank Routing Number in Canada 2024 - Khao Tick On

How To Find Your Transit Number Td Bank - Khao Tick On

000104702 Bank of Montreal 69 Bramalea Rd Routing Number Transit - Khao Tick On

Canadian Bank Account Number Format - Khao Tick On

What Is The Transit Number On A Rbc Cheque Pre Authorized Debit Pad - Khao Tick On

Find Your Transit Number And Account Number Cansumer - Khao Tick On

How to Add a Bank Account to your Organization - Khao Tick On

How to Find the BMO Routing Number Transit More - Khao Tick On

How To Find Your TD Bank Routing Number - Khao Tick On

Find Your Transit Number and Account Number - Khao Tick On

Sending and receiving wires - Khao Tick On

How to find your Bank Routing Number in Canada 2024 - Khao Tick On

what is my branch and transit number - Khao Tick On

Customize your business manual cheque from DH - Khao Tick On

Find Your Transit Number and Account Number - Khao Tick On