Ever feel like you're staring into the abyss when you look at your bank statement? Those lines of debits, credits, and baffling abbreviations can feel like a secret code. But fear not, intrepid financial explorer! This guide is your Rosetta Stone to understanding bank statements, focusing on the concept of "contoh salinan penyata akaun bank," which translates to "sample copy of a bank statement" in Malay.

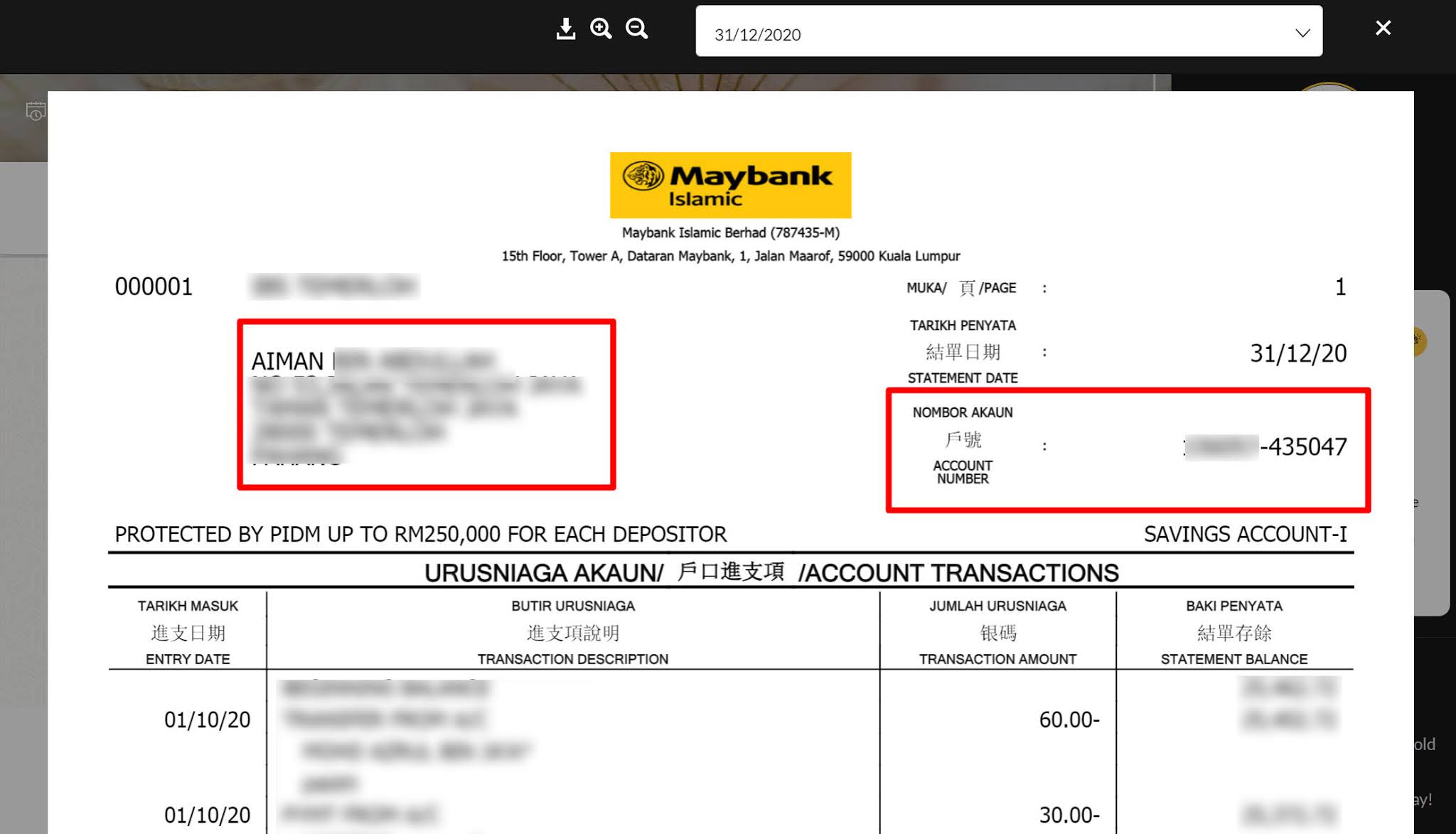

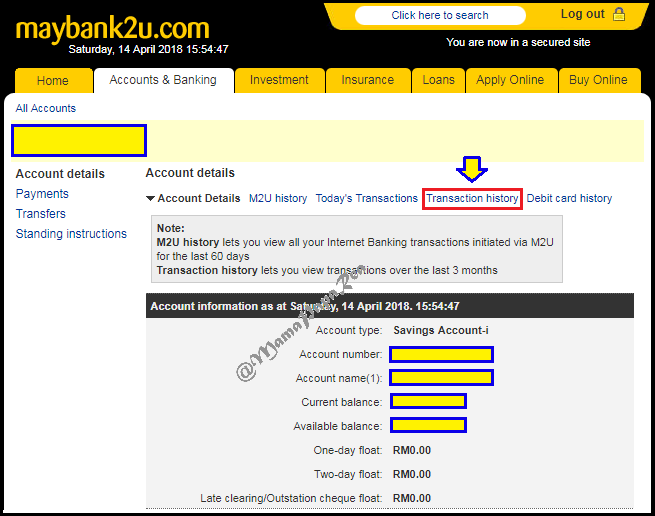

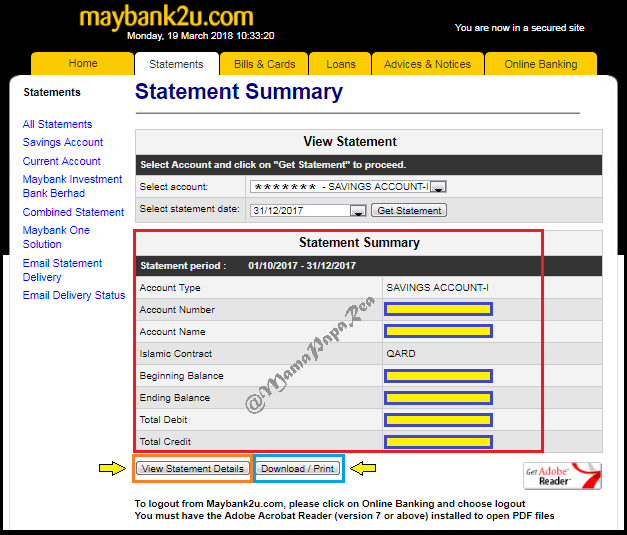

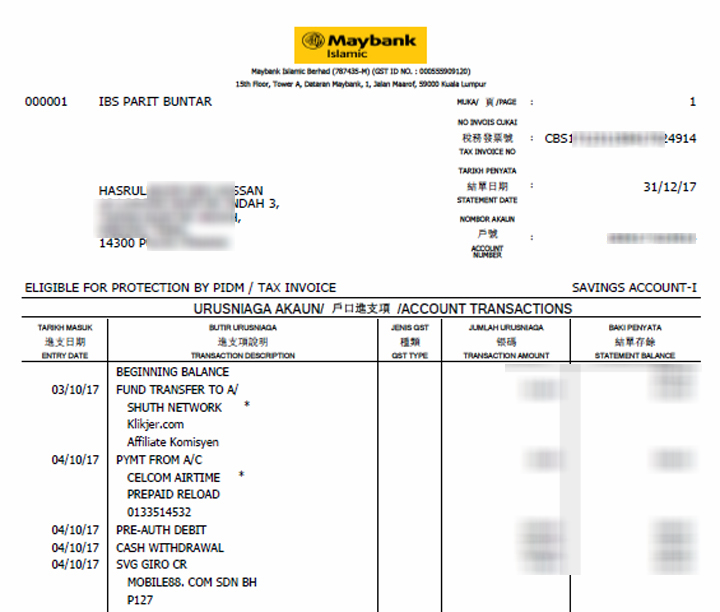

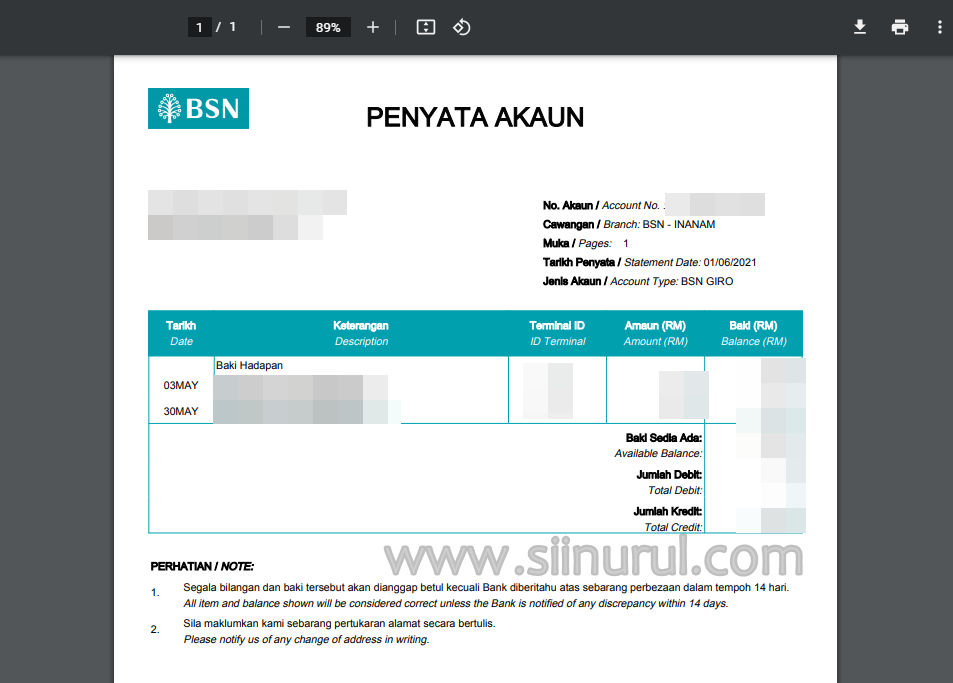

In essence, a "contoh salinan penyata akaun bank" is a representation of your banking activity over a specific period. It's a snapshot of your financial life, showing incoming and outgoing funds, balances, and transaction details. This could be a physical document or a digital file, and it serves as crucial evidence of your financial dealings. Whether you're applying for a loan, tracking your spending, or simply verifying a transaction, understanding your bank statement is fundamental to managing your finances effectively.

Bank statements have a rich history, evolving from handwritten ledgers to the digital statements we access today. Their primary purpose has remained consistent: to provide a record of financial transactions. The importance of a "contoh salinan penyata akaun bank" lies in its ability to provide a clear picture of your financial standing. It's a tool for accountability, allowing you to monitor your spending habits and identify any irregularities. Imagine trying to budget without knowing where your money goes – a bank statement provides that crucial insight.

One key issue related to "contoh salinan penyata akaun bank" is ensuring its accuracy. Errors can occur, and it's your responsibility to review your statement carefully and report any discrepancies to your bank. Another important consideration is security. Protecting your bank statement from unauthorized access is vital to preventing fraud and identity theft. This is especially crucial in the digital age where online banking and electronic statements are prevalent.

A simple example of using a "contoh salinan penyata akaun bank" is when applying for a visa. Embassies often require applicants to provide recent bank statements as proof of sufficient funds. Similarly, landlords might request bank statements from prospective tenants to assess their financial stability. In these instances, the "contoh salinan penyata akaun bank" acts as verification of your financial capability.

One benefit is improved financial management. By analyzing your spending patterns, you can identify areas where you can save money and make informed financial decisions.

Another benefit is fraud detection. Regularly reviewing your bank statement allows you to spot unauthorized transactions and report them promptly, minimizing potential losses.

Lastly, it aids in financial planning. By tracking your income and expenses, you can create a realistic budget and plan for future financial goals, such as buying a house or investing.

Advantages and Disadvantages of Using Bank Statements

| Advantages | Disadvantages |

|---|---|

| Proof of Income and Expenses | Potential for Identity Theft if not secured properly |

| Budgeting and Financial Planning | Can be complex to understand for some |

| Fraud Detection | May not reflect real-time transactions |

Frequently Asked Questions:

1. What is a bank statement? - A record of transactions within a specific period.

2. How often do I receive a bank statement? - Typically monthly, but can be more frequent.

3. What information is included in a bank statement? - Dates, descriptions of transactions, amounts, and balances.

4. What is the purpose of a bank statement? - To provide a record of your financial activity.

5. How can I access my bank statement? - Online banking, mobile apps, or by mail.

6. What should I do if I find an error on my bank statement? - Contact your bank immediately.

7. How long should I keep my bank statements? - Generally recommended to keep them for at least one year, sometimes longer for tax purposes.

8. Can I get a copy of an old bank statement? - Yes, contact your bank.

In conclusion, "contoh salinan penyata akaun bank," or a bank statement copy, is a vital document for managing your finances. From tracking spending to applying for loans, understanding its contents is essential. By actively reviewing your statements, you can maintain control over your financial well-being, detect potential fraud, and make informed decisions about your money. Take the time to familiarize yourself with your bank statement – it’s your key to financial empowerment. Don't let those numbers intimidate you. Embrace them, understand them, and use them to your advantage. Your financial future will thank you for it. Start reviewing your bank statements regularly and take control of your finances today!

Conquering the waves unleash the power of wet sounds rev 10 hd

Bass without the bulk exploring the world of slim subwoofers with built in amps

Sparkling rides top vinyl car seat cleaners

Contoh Salinan Akaun Bank - Khao Tick On

Salinan Akaun Bank Maybank - Khao Tick On

Contoh Surat Memohon Penyata Bank - Khao Tick On

Salinan Slip Muka Depan Akaun Bank 3 Cara Dapatkan Penyata Simpanan - Khao Tick On

Salinan Akaun Bank Maybank - Khao Tick On

Contoh Penyata Bank Islam at Cermati - Khao Tick On

Apa itu informasi bank akaun mysalam - Khao Tick On

Cara Dapatkan Penyata Akaun Bank Statement BSN Melalui myBSN Secara - Khao Tick On

contoh salinan penyata akaun bank - Khao Tick On

contoh salinan penyata akaun bank - Khao Tick On

Semakan Penyata Bank Islam Online - Khao Tick On

Contoh Surat Permohonan Penyata Akaun Bsn Medical - Khao Tick On

Penyata Contoh Bank Statement Maybank - Khao Tick On

salinan akaun bank cimb - Khao Tick On

Contoh Salinan Akaun Bank Maybank Contoh Penyata Kewangan Senang - Khao Tick On