Ever glanced at your paycheck and wondered about the different components that make up your total income? You're not alone! Many individuals, especially those new to the workforce, find themselves puzzled by the distinction between base salary and allowances.

Essentially, your earnings are often a combination of your fixed base pay and variable allowances. Grasping this difference is crucial, not just for managing your personal finances effectively but also for making informed career decisions.

Imagine this: you're comparing two job offers with similar-sounding salaries. However, a closer look reveals that one heavily favors allowances, while the other offers a more substantial base salary. Which one is the better deal? The answer isn't always straightforward and depends heavily on your individual needs and priorities.

Understanding the nuances of base salary versus allowances empowers you to negotiate better, plan for your financial future, and ultimately, make choices that align with your long-term financial goals.

This article delves into the intricacies of your paycheck, clearly differentiating between base salary and allowances. We'll explore the benefits and drawbacks of each, equipping you with the knowledge to navigate the often-confusing world of compensation packages.

Advantages and Disadvantages of Base Salary vs. Allowances

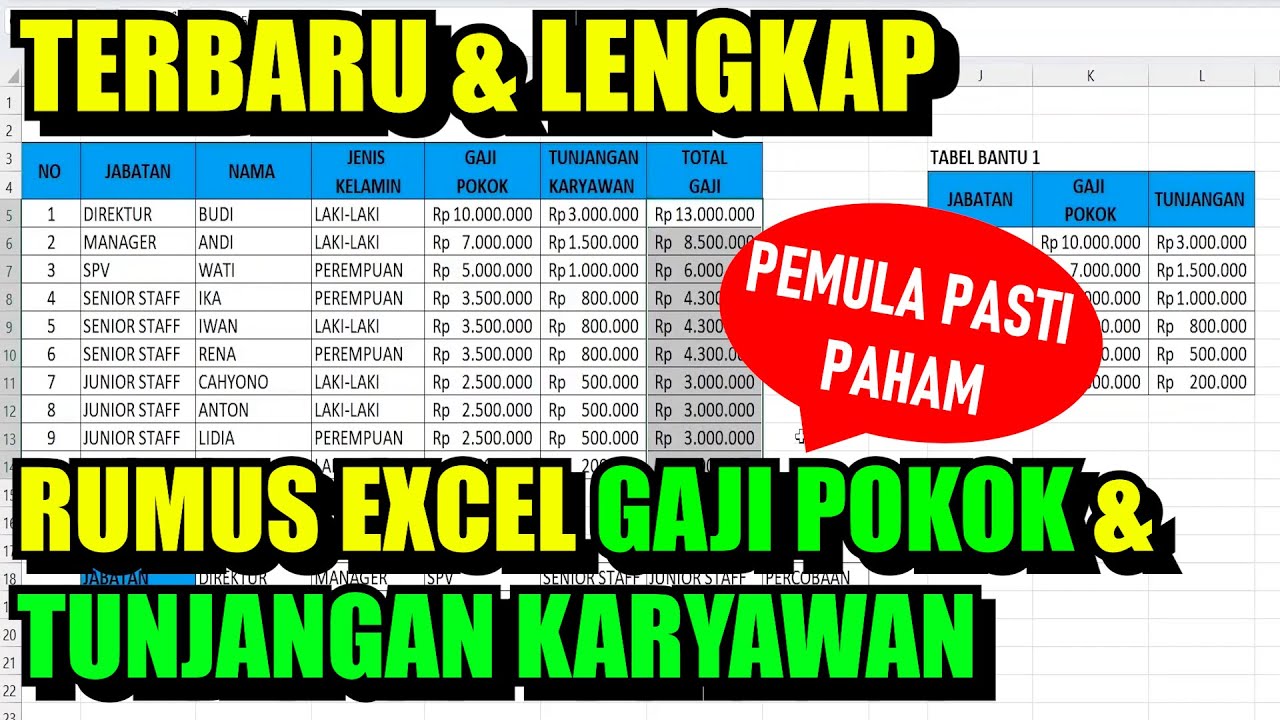

To illustrate the differences more clearly, let's consider a table highlighting the pros and cons of both base salary and allowances:

| Feature | Base Salary | Allowances |

|---|---|---|

| Definition | Fixed amount paid regularly for work performed | Variable payments for specific purposes or expenses |

| Tax Implications | Fully taxable | Taxable or non-taxable depending on the type of allowance |

| Impact on Benefits | Directly impacts calculations for retirement contributions, insurance premiums, etc. | May have limited or no impact on certain benefits |

| Predictability | Highly predictable and stable | Can fluctuate based on factors like performance or work-related expenses |

| Negotiation | Often the starting point for salary negotiations | Can be negotiated separately, offering more flexibility |

By understanding these key differences, you can better evaluate compensation packages and advocate for your worth in salary negotiations. Remember, knowledge is power, and in the realm of personal finance, understanding your paycheck is the first step toward achieving financial well-being.

Unlocking the truth your guide to toyota rav4 consumer reviews

Exploring cute small neck tattoos designs considerations and aftercare

Level up your game exploring detroits video game scene

perbedaan gaji pokok dan tunjangan - Khao Tick On

perbedaan gaji pokok dan tunjangan - Khao Tick On

perbedaan gaji pokok dan tunjangan - Khao Tick On

perbedaan gaji pokok dan tunjangan - Khao Tick On

perbedaan gaji pokok dan tunjangan - Khao Tick On

perbedaan gaji pokok dan tunjangan - Khao Tick On

perbedaan gaji pokok dan tunjangan - Khao Tick On

perbedaan gaji pokok dan tunjangan - Khao Tick On

perbedaan gaji pokok dan tunjangan - Khao Tick On

perbedaan gaji pokok dan tunjangan - Khao Tick On

perbedaan gaji pokok dan tunjangan - Khao Tick On

perbedaan gaji pokok dan tunjangan - Khao Tick On

perbedaan gaji pokok dan tunjangan - Khao Tick On

Kenapa Orang Tua Ingin Anaknya Jadi PNS - Khao Tick On

perbedaan gaji pokok dan tunjangan - Khao Tick On