Remember the satisfying *scratch* of a pen signing a check? In our increasingly digital world, it might seem like checks are going the way of the dinosaurs. But hold on – before you relegate those checkbooks to the back of the drawer, consider this: US Bank new checks are experiencing a surprising resurgence. Why are people returning to this seemingly "old-fashioned" payment method?

It's simple. Sometimes, you need a tangible, physical payment option. Whether you're dealing with a vendor who prefers checks, mailing a birthday gift, or simply want more control over your spending, US Bank new checks provide a reliable and secure way to manage your finances.

US Bank has a long history of providing convenient and secure banking solutions, and their check ordering process is no exception. From online ordering to a wide variety of designs, getting your US Bank new checks is easier than ever. Plus, with enhanced security features to prevent fraud, you can feel confident that your transactions are safe and protected.

Let's face it, not everyone is comfortable navigating the world of online payments or handing over their debit card information. For many, the familiarity and control offered by US Bank new checks provide a sense of security and peace of mind. And let's be honest, there's a certain charm to personalizing your checks with a design that reflects your personality or interests.

This isn't just about nostalgia. US Bank new checks are a practical solution for a variety of financial needs, offering a perfect blend of tradition and modern convenience.

Advantages and Disadvantages of US Bank New Checks

Before you order those new checks, let's weigh the pros and cons:

| Advantages | Disadvantages |

|---|---|

| Tangible and familiar payment method | Slower processing time than electronic payments |

| Increased spending control and budgeting | Risk of loss or theft |

| Widely accepted by vendors and individuals | Requires maintaining sufficient funds in checking account |

| Personalized options and designs | Potential for check fraud if not handled carefully |

| Enhanced security features to prevent fraud | May incur check ordering fees |

Ready to Order?

Ordering your US Bank new checks is a straightforward process:

- Log in: Access your US Bank account online or through the mobile app.

- Navigate to check ordering: Find the "Order Checks" section, typically under account services.

- Select your design and quantity: Choose from a variety of styles and personalize as desired.

- Review and confirm: Double-check your order details and shipping information.

- Submit your order: Confirm your payment method and await delivery of your US Bank new checks!

US Bank New Checks: FAQs

Have questions about US Bank new checks? We've got answers!

Q: How much do US Bank new checks cost?

A: The cost varies depending on the check style, quantity, and any additional features.

Q: Can I order checks if I don't have a US Bank account?

A: No, check ordering is exclusive to US Bank account holders.

Q: How long does it take to receive my new checks?

A: Delivery typically takes 7-10 business days.

Q: What if I need my checks sooner?

A: Expedited shipping options are available for an additional fee.

Q: What should I do if my checks are lost or stolen?

A: Report the incident to US Bank immediately to prevent unauthorized use.

Q: Can I use my old checks if I still have some?

A: Yes, as long as the account information is current and they haven't expired.

Q: Are US Bank new checks secure?

A: Yes, they feature advanced security measures to help prevent fraud.

Q: What if I have a problem with my check order?

A: Contact US Bank customer service for assistance.

US Bank New Checks: Tips and Tricks

* Order in bulk: Save money on per-check costs and shipping by ordering a larger quantity.

* Explore design options: Personalize your checks with a design that reflects your style.

* Review your order carefully: Ensure all information is accurate before submitting.

* Store your checks securely: Prevent loss or theft by keeping your checks in a safe place.

* Monitor your account regularly: Track your check usage and report any discrepancies.

In a world of instant gratification and digital transactions, there's still a place for the simplicity and reliability of US Bank new checks. They offer a sense of control, familiarity, and security that resonates with many. Whether you're sending a birthday gift, paying a local vendor, or simply prefer the tangible nature of checks, US Bank provides a seamless and secure way to manage your finances. So, the next time you reach for your wallet, consider the enduring appeal of US Bank new checks.

Finding your perfect cross pen a guide to buying pre owned and new

Unraveling the enigma what does tian wang bu xin wan american dragon mean

Finding the perfect prop a guide to boat propeller sizing

Free payroll check printing template - Khao Tick On

The Way Home Paper Panda 4 Single Moulded Placemats - Khao Tick On

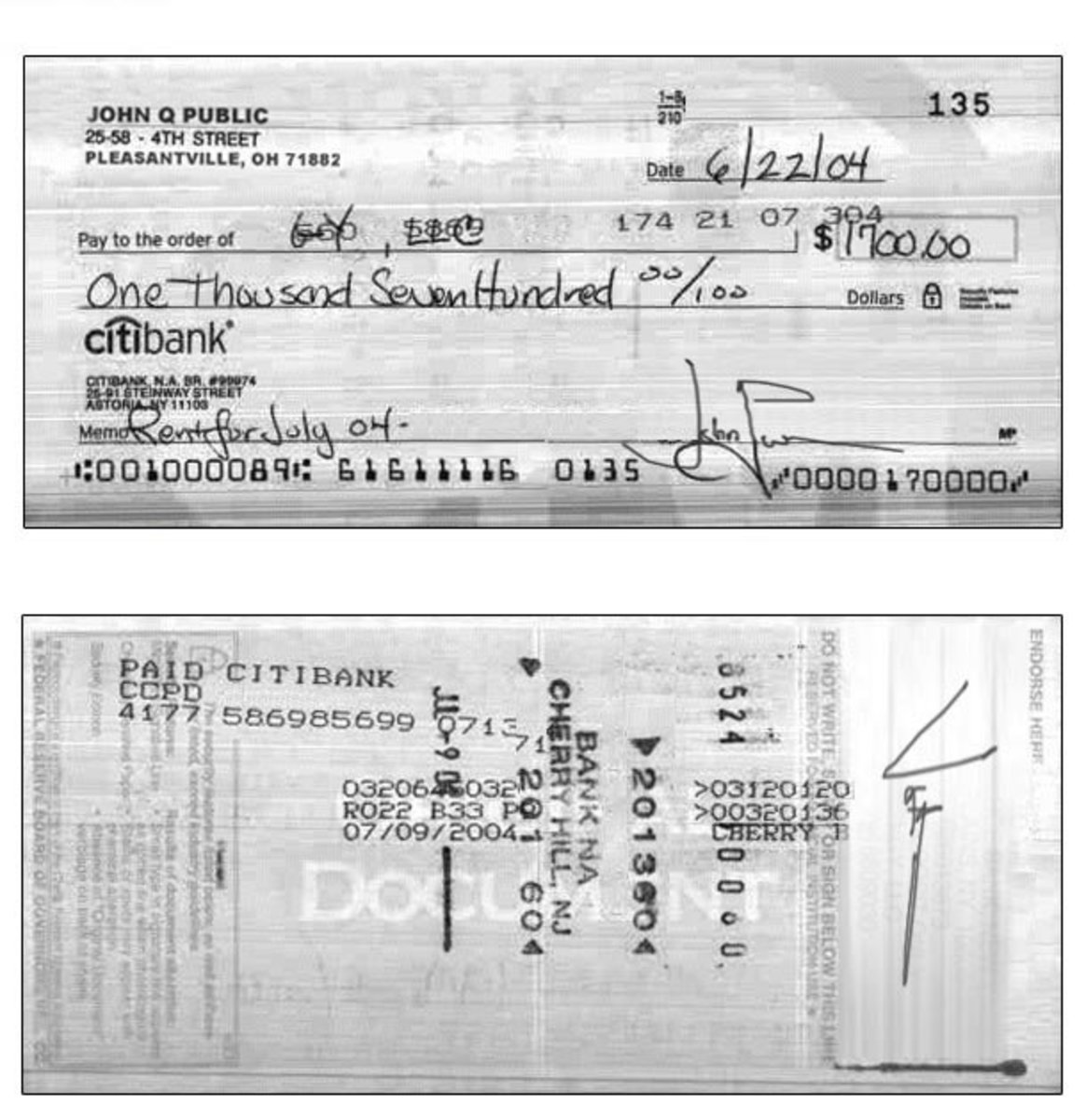

Sample Cheque Writing at Kerry Cruz blog - Khao Tick On

Diagram Of Checks And Balances - Khao Tick On

Routing Number For Chase Bank - Khao Tick On

us bank new checks - Khao Tick On

Where To Buy Checks: Avoid Your Bank To Save Money - Khao Tick On

Meet the Cleveland Retailer in the Business of Everything - Khao Tick On

checks with old address - Khao Tick On

How to spot the Walmart check scam - Khao Tick On

Resultado De Imagen Para Bank Of America Usa Cashiers Check Samples 253 - Khao Tick On

Melamaster Winter Birds Pastry Board - Khao Tick On

us bank new checks - Khao Tick On

us bank new checks - Khao Tick On

us bank new checks - Khao Tick On