Ever feel like you're stuck in a financial hamster wheel, running and running but getting nowhere? That's the soul-crushing reality of debt. But what if you could finally step off? Imagine the weight lifted, the freedom to pursue your dreams. Today, we're talking about taking that powerful step – specifically, in the context of Indonesia's financial system. We're diving into the world of "surat permohonan pelunasan pinjaman bank" – essentially, your weapon for slaying that debt dragon and reclaiming your financial kingdom.

Let's break it down. "Surat permohonan pelunasan pinjaman bank" translates to "letter of application for loan settlement with the bank." It might sound bureaucratic and intimidating, but think of it as your official declaration of war on debt. This letter is your direct line to the bank, outlining your plan to conquer your loan once and for all. No more minimum payments, no more interest quietly chipping away at your future – just pure, glorious freedom.

Now, you might be thinking, "Why bother with a formal letter? Can't I just walk in and pay off my loan?" Well, while spontaneity is admirable, in the world of finance, a structured approach reigns supreme. This letter serves as a documented agreement between you and the bank, outlining the terms of your final payment. Think of it as your financial peace treaty.

This isn't some ancient relic of banking practices either. In our fast-paced digital world, the "surat permohonan pelunasan pinjaman bank" remains a cornerstone of the Indonesian financial system. It provides clarity, security, and peace of mind for both you and the bank.

But enough with the background, let's talk about you. You, the intrepid soul ready to break free from the shackles of debt and embark on a journey towards financial independence. The "surat permohonan pelunasan pinjaman bank" is your trusty steed in this quest.

Advantages and Disadvantages of Using a "Surat Permohonan Pelunasan Pinjaman Bank"

Like any tool, it's important to understand both the benefits and drawbacks. Here's a quick rundown:

| Advantages | Disadvantages |

|---|---|

| Provides a clear and documented agreement with your bank | Requires a formal process, potentially involving paperwork and processing time |

| Ensures transparency and avoids misunderstandings regarding your final payment | May not be necessary for very small loans, depending on the bank's policy |

| Offers peace of mind, knowing your loan is fully settled and documented |

So, there you have it. While it requires a bit of effort, the "surat permohonan pelunasan pinjaman bank" is a powerful tool in your arsenal for achieving financial freedom. By understanding its purpose and utilizing it effectively, you can take control of your finances and pave the way for a brighter, debt-free future.

Seeking refuge and mercy exploring the significance of qunut supplication and its meaning

Langley farm market maple ridge your gateway to freshness

Step up your style the ultimate guide to colores para unas de los pies

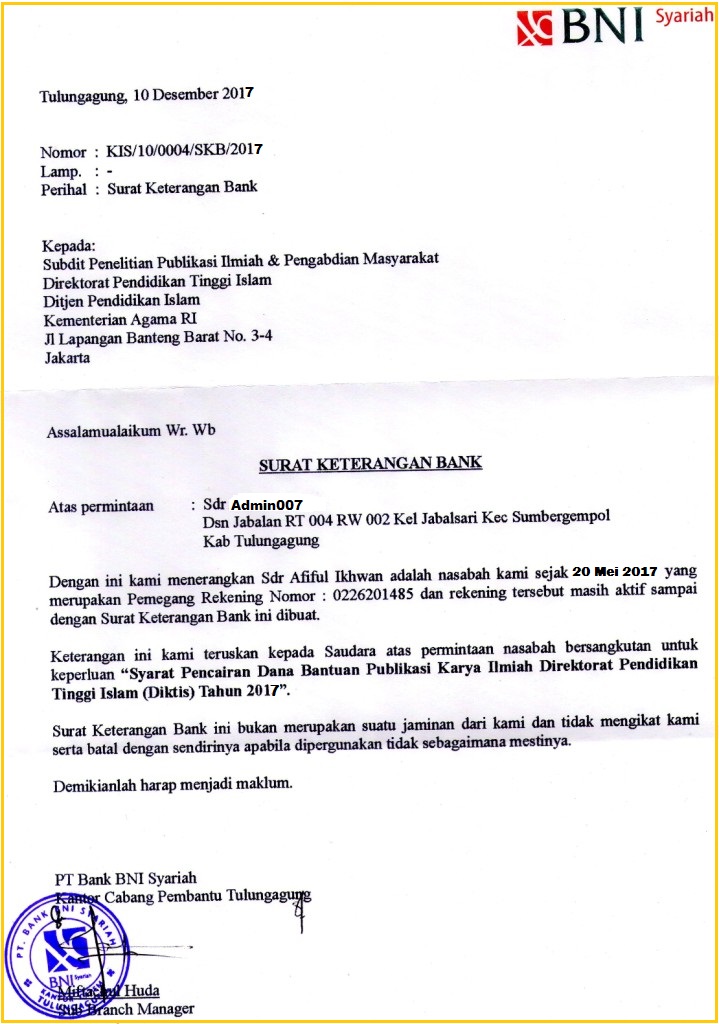

Contoh Surat Permohonan Pelunasan Pinjaman Bank - Khao Tick On

5 Contoh Surat Permohonan Keringanan Pembayaran KPR - Khao Tick On

3 Contoh Surat Permohonan Pelunasan KPR Paling Baru - Khao Tick On

Contoh Surat Permohonan Pengajuan Pinjaman Ke Bank - Khao Tick On

Surat Permohonan Ke Bank - Khao Tick On

Surat Permohonan Pelunasan Bank - Khao Tick On

Contoh Surat Permohonan Pelunasan Pinjaman Bank Word - Khao Tick On

Contoh Surat Permohonan Pelunasan Pinjaman Bank - Khao Tick On

Contoh Surat Pelunasan Hutang Bank Bri 14 Contoh Surat Permohonan - Khao Tick On

Surat Permohonan Keringanan Pelunasan Hutang Bank - Khao Tick On

Contoh Surat Pelunasan Hutang Bank - Khao Tick On

Contoh Surat Keterangan Pelunasan Cc Dari Bank Bca - Khao Tick On

Contoh Surat Permohonan Referensi Bank Bri 8 Contoh - Khao Tick On

Surat Permohonan Pengajuan Pinjaman - Khao Tick On

Contoh Surat Permohonan Ke Bank Bri Homecare24 - Khao Tick On