Okay, let's be real. "ERISA Qualifying Life Event Rules" doesn't exactly scream "fun Friday night read." It's a mouthful, it sounds bureaucratic, and it probably makes you want to dive headfirst into a pile of freshly folded laundry instead of dealing with it. But trust me on this one, because sometimes life throws you curveballs, and understanding this stuff can be surprisingly empowering.

Imagine this: you just landed your dream job (cue the confetti!). New gig, new city, new you, right? But wait, what about your health insurance? Or your 401(k)? Suddenly, you're knee-deep in paperwork with words like "qualifying event" and "election period" swimming before your eyes. This, my friend, is where ERISA comes in—the often-overlooked but surprisingly significant set of rules governing employer-sponsored benefits in the U.S.

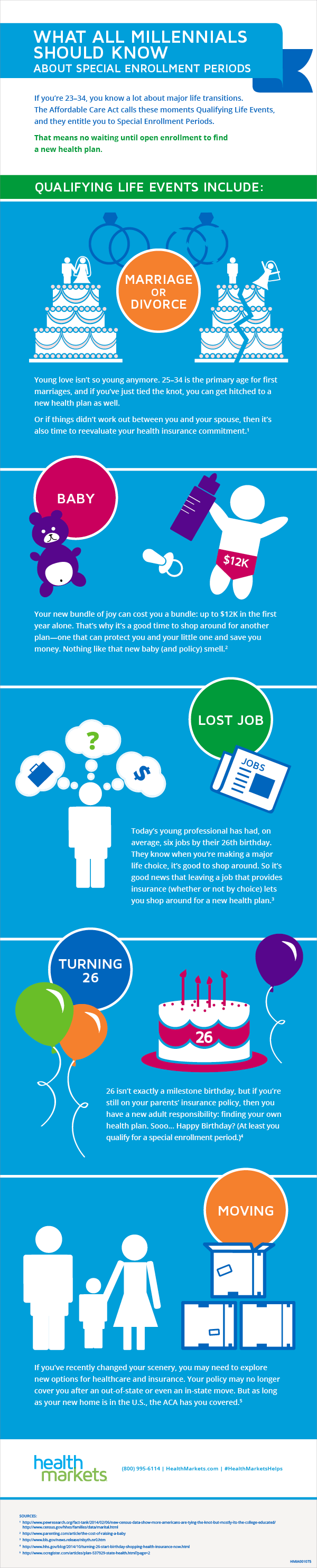

We're talking about those big life moments—getting married, welcoming a new baby (fur babies totally count!), switching jobs, or even the not-so-fun stuff like divorce or losing a loved one. These events can trigger changes to your benefits, and ERISA is essentially the rulebook that dictates how, when, and why those changes happen.

Now, you might be thinking, "Can't I just ignore this and hope for the best?" And hey, we've all been there. But here's the thing: not understanding ERISA can cost you. We're talking missed deadlines, lost coverage, and potentially some serious financial headaches. Nobody wants that, especially when you're already juggling the ups and downs of life's biggest moments.

So, let's ditch the legal jargon and break this down. Consider this your crash course in all things ERISA qualifying life events. We'll cover the basics, the important deadlines, and even some real-life examples to help you navigate it all like a pro. Because knowledge is power, right? And who doesn't love feeling empowered, especially when it comes to something as important as your well-being and financial security?

Advantages and Disadvantages of ERISA Qualifying Life Events

| Advantages | Disadvantages |

|---|---|

| Provides flexibility to adjust benefits during major life changes. | Strict deadlines for making changes, which can be easily missed. |

| Protects your rights as an employee to access and manage benefits. | Navigating the rules and regulations can be complex and confusing. |

| Offers potential cost savings by allowing you to choose the best coverage options for your new situation. | Limited opportunities to make changes outside of qualifying events. |

Best Practices for Navigating ERISA Qualifying Life Events

1. Don't Procrastinate: As soon as you experience a qualifying life event, start gathering information about your benefits options and deadlines.

2. Read the Fine Print: Familiarize yourself with your employer's specific benefits plan documents to understand your rights and responsibilities.

3. Ask for Help: Don't be afraid to reach out to your HR department or a benefits specialist for guidance.

4. Document Everything: Keep records of all communication, enrollment forms, and important dates related to your benefits.

5. Review Regularly: Even without a qualifying event, it's wise to review your benefits annually to ensure they still meet your needs.

Common Questions About ERISA Qualifying Life Events:

1. What are some examples of ERISA qualifying life events?

Common examples include marriage, divorce, birth or adoption of a child, death of a spouse or dependent, job loss or change in employment status, and changes in residence.

2. How long do I have to make changes to my benefits after a qualifying life event?

Generally, you have 30-60 days from the date of the event, but it's crucial to check your plan documents for specific deadlines.

3. Can I add or remove a domestic partner from my benefits under ERISA?

Whether or not you can add or remove a domestic partner depends on your employer's specific plan and state laws.

4. What happens to my benefits if I lose my job?

You may have options like COBRA continuation coverage or enrolling in a new plan through the Affordable Care Act Marketplace.

5. Do I have to change my benefits if I experience a qualifying life event?

No, you're not required to make changes, but it's generally in your best interest to review your options and see if adjustments are necessary.

6. What if my employer denies my request for a benefits change?

You have the right to appeal the decision. Start by contacting your HR department and follow their appeal procedures.

7. Where can I find more information about my rights under ERISA?

The U.S. Department of Labor's Employee Benefits Security Administration (EBSA) is an excellent resource for information about ERISA.

8. What if I still have questions?

Consulting with an employee benefits attorney or certified financial planner can provide personalized guidance based on your specific situation.

Tips and Tricks for Navigating ERISA:

- Set calendar reminders for important deadlines.

- Keep digital copies of all benefits-related documents in a secure location.

- Don't be afraid to ask questions and seek clarification until you fully understand your options.

- If you're facing a particularly challenging situation, consider seeking professional advice from an attorney or financial advisor.

Alright, so we've covered a lot of ground here. But the main takeaway? Don't let the world of ERISA qualifying life events intimidate you. While it may seem like a maze of rules and regulations, understanding the basics can save you time, money, and a whole lot of stress. Remember, knowledge is power, and when it comes to your well-being and financial security, a little bit of empowerment goes a long way. So, go forth, navigate those life changes with confidence, and don't be afraid to advocate for yourself every step of the way!

Beyond the ink exploring puerto rican flag tattoo ideas

Elevate your spirit the power of queens timeless anthems

Convert 32 euros to mexican pesos your quick guide

erisa qualifying life event rules - Khao Tick On

erisa qualifying life event rules - Khao Tick On

What Is a Qualifying Life Event? - Khao Tick On

Qualifying Life Events and the Impact on Health Insurance - Khao Tick On

erisa qualifying life event rules - Khao Tick On

What is a qualifying life event for health insurance? - Khao Tick On

What is a qualifying life event for health insurance? - Khao Tick On

ERISA Beneficiary Designation Rules - Khao Tick On

Qualifying Life Event (QLE) - Khao Tick On

What is a TRICARE Qualifying Life Event? > Air Force Wounded Warrior - Khao Tick On

The Amazing Truth About Qualifying Life Events for Millennials - Khao Tick On

Updating your benefits through a qualifying status change (life event) - Khao Tick On

What Is a Qualifying Life Event for Health Insurance? - Khao Tick On

Relay For Life Event rules - Khao Tick On

erisa qualifying life event rules - Khao Tick On

/what-is-a-qualifying-event-for-health-insurance-4174114_4-54f1444bbef84c2aa79485ceffd1cee7.png)