Have you ever needed to quickly find your bank account number and realized your online banking app wasn't accessible? Your checkbook might hold the key. This seemingly simple piece of paper contains crucial financial information, including your account number. Understanding where to find it and the implications of having it printed on your checks is vital for managing your finances effectively and securely.

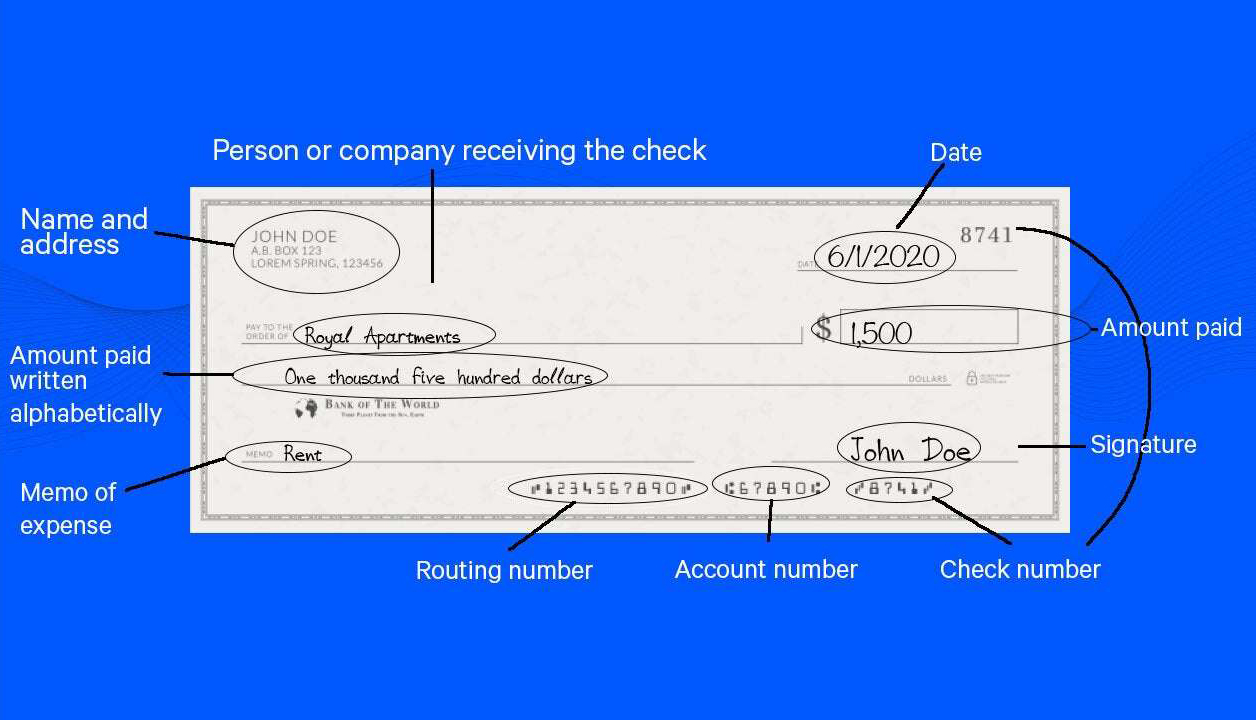

Finding your account number on a check is often a straightforward process. Typically, you'll find it printed at the bottom of the check. Look for a string of numbers, usually between nine and twelve digits, appearing along the bottom edge. It’s often positioned between two sets of special symbols and may be repeated further to the right, alongside the check number.

The practice of printing account details on checks has evolved alongside the banking system itself. In the early days of banking, checks were handwritten, and identifying information was less standardized. As banking became more formalized, printed checks with pre-filled information, including account numbers, became the norm. This streamlined the processing of checks and helped reduce errors. However, the visibility of this information raises security concerns.

The bank account number printed on a check plays a crucial role in identifying the account from which funds should be drawn. It ensures that transactions are processed accurately and efficiently. This number, along with the routing number, allows banks to communicate and transfer funds seamlessly. Without it, the check would be invalid, making financial transactions impossible. While convenient, this ease of access also presents potential vulnerabilities.

The primary security concern associated with having your bank account number printed on checks is the risk of fraud or identity theft. If your checks fall into the wrong hands, unauthorized individuals could potentially access your account. Therefore, it's crucial to store your checkbook securely and monitor your account activity regularly for any unauthorized transactions. Understanding this delicate balance between convenience and security is essential in today’s digital age.

Three primary benefits of having your account number readily accessible on your check include streamlined transactions, convenient access to account information, and simplified bill payments. The pre-printed number eliminates the need for manual entry, reducing errors and saving time during transactions. It also offers a quick way to retrieve your account number when needed for online banking or other financial activities. Finally, it facilitates bill payments, especially for those who prefer traditional methods.

Best practices for safeguarding your financial information when using checks include securely storing your checkbook, regularly reviewing your bank statements, and shredding discarded checks. If you notice any discrepancies in your statement or suspect unauthorized access, contact your bank immediately. Using checks cautiously and responsibly is paramount in maintaining the security of your financial information.

While many utilize online banking, understanding how to locate your bank account number on checks remains a practical skill. It’s a simple task that can provide access to vital information when digital resources are unavailable.

Advantages and Disadvantages of Bank Account Number on Checks

| Advantages | Disadvantages |

|---|---|

| Faster Transactions | Security Risk (Identity Theft/Fraud) |

| Easy Access to Account Number | Potential for Misuse if Checks are Lost or Stolen |

| Convenient for Bill Payments | Requires Careful Handling and Storage |

Frequently Asked Questions:

1. Where is the bank account number located on a check? It’s typically at the bottom, between two symbols.

2. What if my check doesn’t have a pre-printed account number? Contact your bank.

3. How many digits are in a bank account number? Usually between nine and twelve.

4. Can someone access my account with just the number on my check? It makes it easier, so protect your checks.

5. What should I do if I lose my checkbook? Report it to your bank immediately.

6. How can I prevent check fraud? Store checks securely and monitor your account.

7. Is it safer to use online banking instead of checks? Both have risks and benefits. Use caution with both.

8. Are there alternative ways to access my account information besides checks? Yes, online banking, mobile apps, and bank statements.

A simple tip for added security: Consider ordering checks that don't prominently display your account number. Some banks offer options with truncated account numbers, further mitigating the risk of fraud.

In conclusion, understanding how to find and interpret the bank account number on a check remains an important aspect of personal finance management. While digital banking is prevalent, checks continue to play a role in various financial transactions. The convenience of having your account number pre-printed on checks facilitates quicker transactions, especially for routine payments. However, this convenience comes with the responsibility of safeguarding your checks to prevent potential misuse. By practicing safe check handling, regularly monitoring your account activity, and staying informed about potential security risks, you can effectively manage your finances and protect yourself from fraud. Take the time to familiarize yourself with these simple yet crucial practices to ensure the safety and security of your financial information. Remember, proactive measures are key to maintaining financial well-being in today's increasingly digital world.

Decoding the sherwin williams stain spectrum

Decoding the chin hin group berhad annual report

Deciphering the noon book enigma a guide to midday appointments

Exemplary Info About How To Write A Check Usa - Khao Tick On

Planters First Routing Number at Andrew Dejesus blog - Khao Tick On

Show Me Usa Number at Tracy Washington blog - Khao Tick On

Us Bank Account Number On Check - Khao Tick On

Wire Transfer Navy Federal Credit Union Limit - Khao Tick On

Where do I find my routing number - Khao Tick On

How to Order Checks Identify Numbers on a Check - Khao Tick On

When Depositing A Check Online Do I Sign The Back at Mike Murray blog - Khao Tick On

Account Number Bank Bri - Khao Tick On

What Is The Starting Check Number at Krystle Jordan blog - Khao Tick On

How to Find Citibank Routing Number In September 2024 - Khao Tick On

bank account number on checks find - Khao Tick On

Deposit Account Number On Check - Khao Tick On

bank account number on checks find - Khao Tick On

bank account number on checks find - Khao Tick On