In today's competitive job market, attracting and retaining top talent is crucial for any business's success. And while enticing perks and a positive work environment play a significant role, there's one element that remains paramount: accurate and timely salary disbursement. Effectively managing payroll is a fundamental aspect of running a successful business. It involves understanding various components such as gross pay, deductions, taxes, and compliance with labor laws.

Whether you're a seasoned HR professional or a budding entrepreneur, this comprehensive guide will equip you with the knowledge and tools to confidently navigate the intricacies of employee salary calculation. We'll delve into different payment methods, explore common deductions like taxes and insurance, and provide practical tips to streamline your payroll process.

Calculating employee salaries accurately is not just about getting numbers right; it's about building trust and fostering a positive work environment. When employees feel confident that their hard work is acknowledged and compensated fairly, their morale and productivity soar. Conversely, errors or inconsistencies in salary payments can lead to dissatisfaction, disputes, and even legal repercussions.

Navigating the world of payroll can feel like traversing a labyrinth of regulations, deductions, and ever-changing employment laws. This is particularly true for businesses operating in multiple regions or countries, each with unique legal frameworks.

Understanding the intricacies of salary calculations is not merely a task for the finance department; it's a shared responsibility that impacts various aspects of your business. From attracting and retaining top talent to maintaining legal compliance and fostering a culture of transparency and trust, mastering the art of payroll is an investment that pays dividends in the long run. Join us as we demystify the complexities of employee salary computation and empower you with the tools for success.

Advantages and Disadvantages of Different Salary Calculation Methods

| Method | Advantages | Disadvantages |

|---|---|---|

| Hourly Wage | Simple to calculate, suitable for part-time or hourly workers | May not incentivize productivity, requires meticulous time tracking |

| Fixed Salary | Provides stability and predictability for employees | May not reflect individual performance fluctuations |

| Performance-Based Pay | Motivates high performance, directly ties compensation to results | Can create competition, requires clear performance metrics |

Best Practices for Accurate Salary Calculation

Implementing a robust and accurate payroll system is essential for any business. Here are five best practices to ensure smooth and error-free salary calculations:

- Utilize Payroll Software: Leverage technology to automate calculations, deductions, and tax filings, minimizing errors and saving time.

- Stay Updated on Legal Requirements: Regularly review and update your payroll policies to comply with changing labor laws, tax regulations, and minimum wage requirements.

- Maintain Clear Communication: Foster open communication with your employees regarding their pay slips, deductions, and any changes in compensation policies.

- Establish a Consistent Pay Schedule: Implement a regular and predictable pay schedule to manage employee expectations and ensure timely payments.

- Conduct Regular Audits: Periodically review your payroll records to identify and rectify any errors, ensuring accuracy and compliance.

Frequently Asked Questions about Salary Calculation

Here are eight common queries regarding salary computations:

- What are the different components of a salary slip?

- How do I calculate overtime pay for hourly employees?

- What are the mandatory deductions that need to be considered when calculating net pay?

- How can I ensure compliance with tax regulations when processing payroll?

- What are some common payroll mistakes to avoid?

- What is the difference between gross pay and net pay?

- How do I calculate prorated salaries for employees joining mid-month?

- What are the legal consequences of inaccurate salary payments?

Mastering the art of employee salary calculation is a continuous journey. By understanding the various components involved, staying compliant with regulations, and adopting best practices, businesses can ensure a smooth, accurate, and efficient payroll process. Remember, a well-managed payroll system fosters trust, motivates employees, and lays a solid foundation for sustained business growth.

Cat profile picture drawing the purrfect way to show your feline love

Moving mayhem managed your careful moving and storage guide

Copper mountain sherwin williams a deep dive

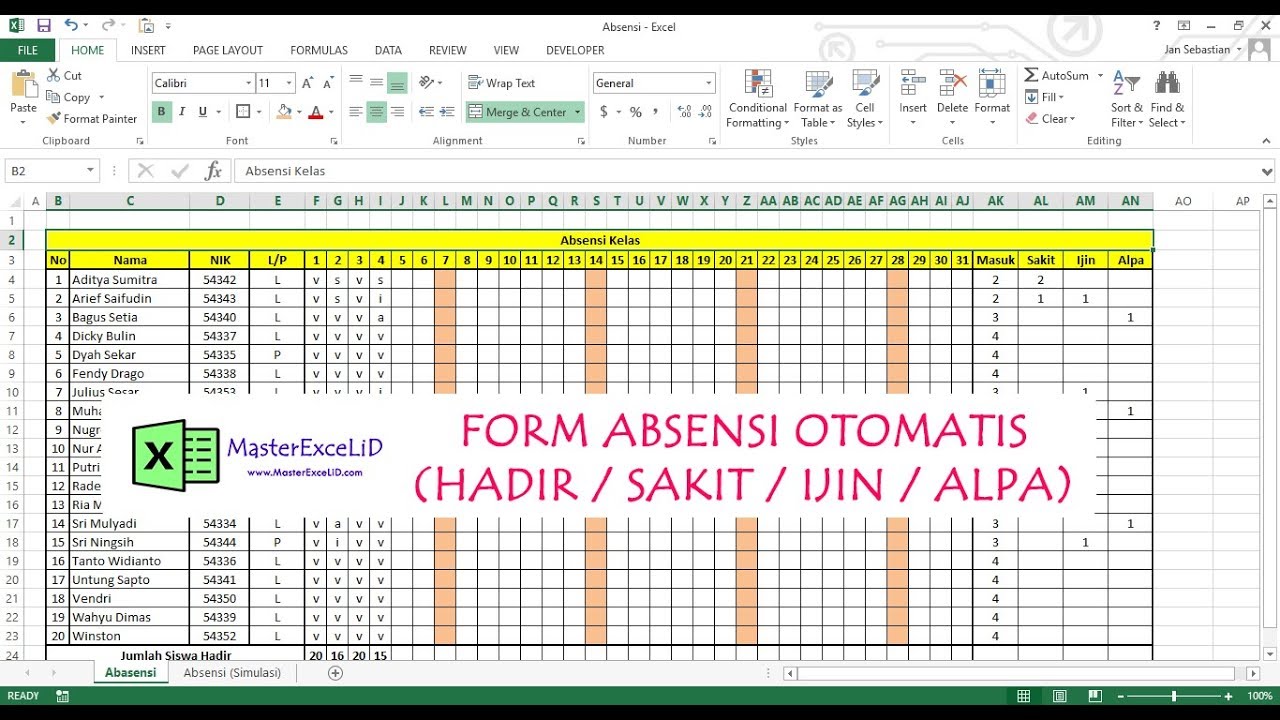

cara menghitung gaji karyawan bulanan - Khao Tick On

Contoh Perhitungan Pph Pasal 21 - Khao Tick On

cara menghitung gaji karyawan bulanan - Khao Tick On

cara menghitung gaji karyawan bulanan - Khao Tick On

cara menghitung gaji karyawan bulanan - Khao Tick On

cara menghitung gaji karyawan bulanan - Khao Tick On

cara menghitung gaji karyawan bulanan - Khao Tick On

cara menghitung gaji karyawan bulanan - Khao Tick On

cara menghitung gaji karyawan bulanan - Khao Tick On

cara menghitung gaji karyawan bulanan - Khao Tick On

cara menghitung gaji karyawan bulanan - Khao Tick On

cara menghitung gaji karyawan bulanan - Khao Tick On

cara menghitung gaji karyawan bulanan - Khao Tick On

cara menghitung gaji karyawan bulanan - Khao Tick On

cara menghitung gaji karyawan bulanan - Khao Tick On