In today's rapidly evolving world, traditional classroom learning often falls short in equipping students with the skills needed to thrive in complex, real-world scenarios. This is particularly true for fields like taxation, where practical application and problem-solving are paramount. Project-based learning (PBL) has emerged as a dynamic and engaging approach to address this gap, offering students an immersive and hands-on learning experience.

Imagine a classroom where students aren't just memorizing tax codes, but are actively engaged in analyzing real-world case studies, developing tax planning strategies, and presenting their findings to their peers. This is the essence of PBL in taxation. By simulating real-life situations, PBL allows students to develop a deeper understanding of tax concepts, enhance their critical thinking abilities, and hone their communication and collaboration skills.

But how did PBL come to be, and why is it gaining traction in taxation education? While the roots of PBL can be traced back to ancient apprenticeship models, its modern iteration emerged in the late 20th century as a response to the limitations of traditional lecture-based teaching. Educators and researchers began to recognize the need for active, student-centered learning that fostered deeper understanding and practical application. This led to the development of PBL as a structured approach, with a focus on real-world projects, collaboration, and critical thinking.

The importance of PBL in taxation, in particular, cannot be overstated. Tax laws and regulations are constantly changing, requiring professionals to be adaptable, analytical, and resourceful. PBL equips students with the skills to not only understand complex tax concepts but also to apply them in dynamic and often unpredictable situations. By working on projects that simulate real-world scenarios, students develop a deeper understanding of the practical implications of tax law, gain experience in research and analysis, and build confidence in their ability to tackle complex tax issues.

However, implementing PBL in taxation education does come with its own set of challenges. One of the main hurdles is the need for educators to design engaging and relevant projects that effectively cover the necessary learning objectives. This requires careful planning, creativity, and a deep understanding of both the subject matter and the needs of the students. Additionally, assessing student learning in a PBL environment can be more nuanced than traditional assessment methods, requiring educators to adopt a more holistic approach that considers not just the final product but also the process, collaboration, and problem-solving skills demonstrated by students throughout the project.

Despite these challenges, the benefits of PBL in taxation education far outweigh the obstacles. By providing students with a dynamic, engaging, and practical learning experience, PBL prepares them not just for exams, but for the real world of taxation.

Decoding the it offer letter a comprehensive guide

Decoding behr premium plus paint sds a deep dive

Lucifer 4k hd wallpapers a glimpse into the devilishly detailed

Pocketbook InkPad X Pro is coming out soon - Khao Tick On

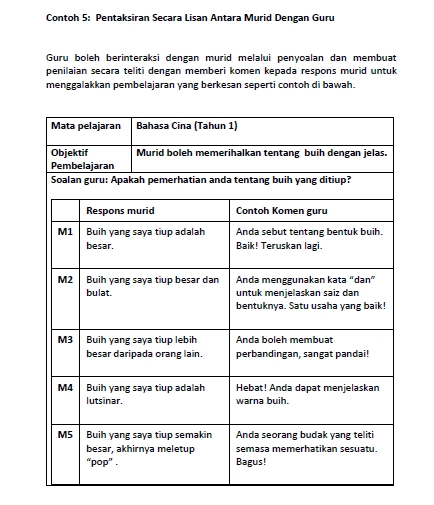

ulasan pbd subjek pjk - Khao Tick On

ulasan pbd subjek pjk - Khao Tick On

ulasan pbd subjek pjk - Khao Tick On

ulasan pbd subjek pjk - Khao Tick On

ulasan pbd subjek pjk - Khao Tick On

ulasan pbd subjek pjk - Khao Tick On

ulasan pbd subjek pjk - Khao Tick On

ulasan pbd subjek pjk - Khao Tick On

ulasan pbd subjek pjk - Khao Tick On

ulasan pbd subjek pjk - Khao Tick On

ulasan pbd subjek pjk - Khao Tick On

ulasan pbd subjek pjk - Khao Tick On