Navigating the world of taxes can seem daunting, especially in a new country. In Indonesia, understanding the ins and outs of income tax calculation is essential for both employees and employers. Whether you're a recent graduate starting your career or an experienced professional, having a firm grasp of how your salary is taxed can empower you to make informed financial decisions.

This comprehensive guide will walk you through the intricacies of the Indonesian income tax system, shedding light on the calculation process, key factors, and potential benefits. By the end, you'll be equipped with the knowledge to confidently manage your income tax obligations and optimize your financial well-being.

The Indonesian tax system operates on a self-assessment principle, meaning individuals are responsible for calculating and reporting their income tax liability. This system relies heavily on transparency and accurate reporting to ensure fairness and compliance. For salaried individuals, the process typically involves understanding your tax bracket, allowable deductions, and employer withholding obligations.

A crucial aspect of the Indonesian income tax system is the concept of progressive taxation. This means that individuals with higher incomes pay a larger percentage of their income in taxes compared to those with lower incomes. The tax brackets are designed to ensure a fairer distribution of the tax burden and support social welfare programs.

Staying informed about potential changes in tax regulations and rates is paramount. The Indonesian government periodically revises its tax policies to adapt to economic conditions and social priorities. Therefore, regularly checking official government websites or consulting with tax professionals will keep you updated and ensure compliance with the latest regulations.

Advantages and Disadvantages of the Indonesian Income Tax System

Like any tax system, the Indonesian income tax structure has its own set of advantages and disadvantages:

| Advantages | Disadvantages |

|---|---|

| Promotes social equity through progressive taxation. | Can be complex for individuals with multiple income sources. |

| Provides essential funding for public services and infrastructure. | Potential for tax evasion due to the self-assessment system. |

| Offers various tax deductions and incentives to encourage investment and savings. | May not always effectively address income inequality. |

By understanding these aspects, individuals can develop a more comprehensive view of the Indonesian income tax landscape and its implications for their financial planning.

Best Practices for Managing Your Indonesian Income Tax

Effectively managing your Indonesian income tax requires diligence, accurate record-keeping, and a proactive approach. By implementing these best practices, you can streamline the process and minimize the risk of errors or penalties:

- Maintain Thorough Records: Keep meticulous records of all income sources, tax-deductible expenses, and relevant documentation. This will facilitate accurate tax calculations and simplify the filing process.

- Understand Your Tax Obligations: Familiarize yourself with the tax brackets, deductions, and regulations applicable to your income level and employment status. Seek professional advice if needed to clarify any uncertainties.

- Utilize Tax Software or Seek Professional Assistance: Consider using reputable tax software or consulting with a qualified tax advisor to ensure accurate calculations and optimize your tax liability.

- File On Time: Adhere to tax filing deadlines to avoid late fees or penalties. The Indonesian tax year aligns with the calendar year, and deadlines are typically in March for individual taxpayers.

- Stay Informed: Keep abreast of any changes in tax laws, regulations, or deadlines by regularly checking official government websites or subscribing to relevant publications.

By adopting these best practices, individuals can navigate the Indonesian income tax system with confidence and ensure compliance while optimizing their financial outcomes.

Frequently Asked Questions (FAQs)

Here are some common questions about the Indonesian income tax system:

- Q: What is the tax-free income threshold in Indonesia?

A: The tax-free income threshold is adjusted periodically, so it's essential to check the latest regulations. However, there is a basic allowance for every individual. - Q: Can I claim deductions for work-related expenses?

A: Certain work-related expenses might be deductible, but specific criteria and limitations apply. Consulting a tax professional can provide clarity on eligible deductions. - Q: How do I file my income tax return in Indonesia?

A: You can file your income tax return online through the official tax portal or manually by submitting the required forms to the tax office.

Conclusion

Mastering the Indonesian income tax system is an essential aspect of financial literacy for anyone earning income in the country. By understanding the mechanics of tax calculation, allowable deductions, and filing procedures, individuals can ensure compliance, optimize their tax liabilities, and make informed financial decisions. Utilizing the information and tips provided in this guide can simplify a potentially complex process and empower individuals to confidently manage their financial obligations in Indonesia. Remember, staying informed about any changes in regulations and seeking professional advice when needed are crucial steps in navigating the ever-evolving landscape of taxation.

Ann arbor movies your fandango guide

Unlocking opportunities your guide to kerja kosong kulai johor mpku

Unlocking creativity the power of printable letter cutouts

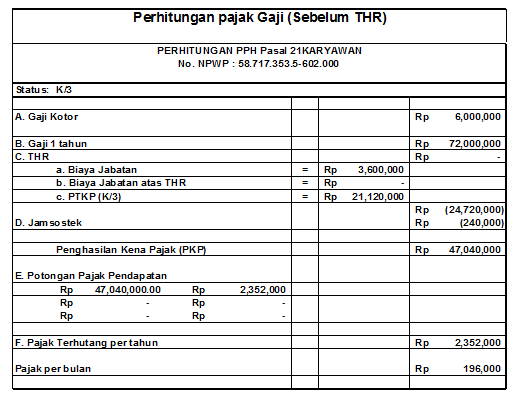

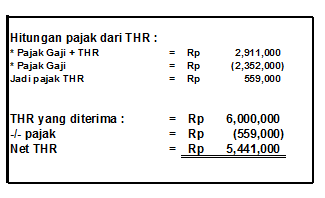

cara perhitungan pajak gaji - Khao Tick On

cara perhitungan pajak gaji - Khao Tick On

cara perhitungan pajak gaji - Khao Tick On

cara perhitungan pajak gaji - Khao Tick On

Implementasi Tarif Efektif Rata - Khao Tick On

cara perhitungan pajak gaji - Khao Tick On

cara perhitungan pajak gaji - Khao Tick On

cara perhitungan pajak gaji - Khao Tick On

cara perhitungan pajak gaji - Khao Tick On

cara perhitungan pajak gaji - Khao Tick On

cara perhitungan pajak gaji - Khao Tick On

cara perhitungan pajak gaji - Khao Tick On

cara perhitungan pajak gaji - Khao Tick On

cara perhitungan pajak gaji - Khao Tick On

cara perhitungan pajak gaji - Khao Tick On