Remember that time you treated yourself to something special, only to find your bank account looking a little sad later? We've all been there. Managing money can feel like a constant juggle, especially if you're not quite sure where it's all going. But what if I told you there's a simple tool that can bring clarity and peace of mind to your finances? It's called budget allocation, and it's like giving your money a roadmap.

In a nutshell, budget allocation is about deciding how much of your income you'll dedicate to different spending categories each month. Think of it like slicing up a delicious pie – you wouldn't want the whole thing to be just one flavor, right? The same goes for your money. By dividing it into portions for needs, wants, and savings, you gain control over where it goes and ensure you're taking care of all your financial priorities.

While the concept of budgeting has been around for centuries, the modern approach to budget allocation, using percentages and tailored categories, has gained popularity with the rise of personal finance education and technology. Apps and online tools make it easier than ever to track spending, set financial goals, and allocate your income accordingly.

One of the main issues people face with budgeting is the feeling of restriction or deprivation. However, allocating your budget isn't about limiting your joy; it's about aligning your spending with your values and goals. By consciously deciding where your money goes, you can make informed choices that bring you closer to what truly matters, whether it's a dream vacation, a down payment on a house, or simply feeling financially secure.

Let's say you earn $2,000 per month after taxes. Using a common budgeting rule like the 50/30/20 method, you would allocate your money like this:

• Needs (50%): $1,000 – This covers essentials like rent/mortgage, groceries, utilities, transportation, and debt payments.

• Wants (30%): $600 – This is for things you enjoy but aren't essential, like dining out, entertainment, hobbies, and shopping.

• Savings (20%): $400 – This includes saving for emergencies, retirement, a down payment, or other financial goals.

Advantages and Disadvantages of Budget Allocation

| Advantages | Disadvantages |

|---|---|

| Increased financial awareness | Can feel restrictive initially |

| Better control over spending | Requires discipline and consistency |

| Reduced financial stress | May need adjustments over time |

| Improved goal setting and achievement | Unexpected expenses can disrupt the budget |

Budgeting might seem intimidating, but it's like any new habit – it gets easier with time and practice. Start by tracking your expenses for a month to understand where your money is currently going. Then, set realistic financial goals that excite you and use a budget allocation method that aligns with your income and priorities. Remember, it's okay to adjust your budget as needed; life is full of surprises! The most important thing is to find a system that works for you and makes you feel empowered about your finances.

Kpop idol with pink hair a cultural phenomenon

Unleash your inner artist exploring the world of tattoo coloring pages free printables

The ultimate guide to navigating the world of cartoon shows

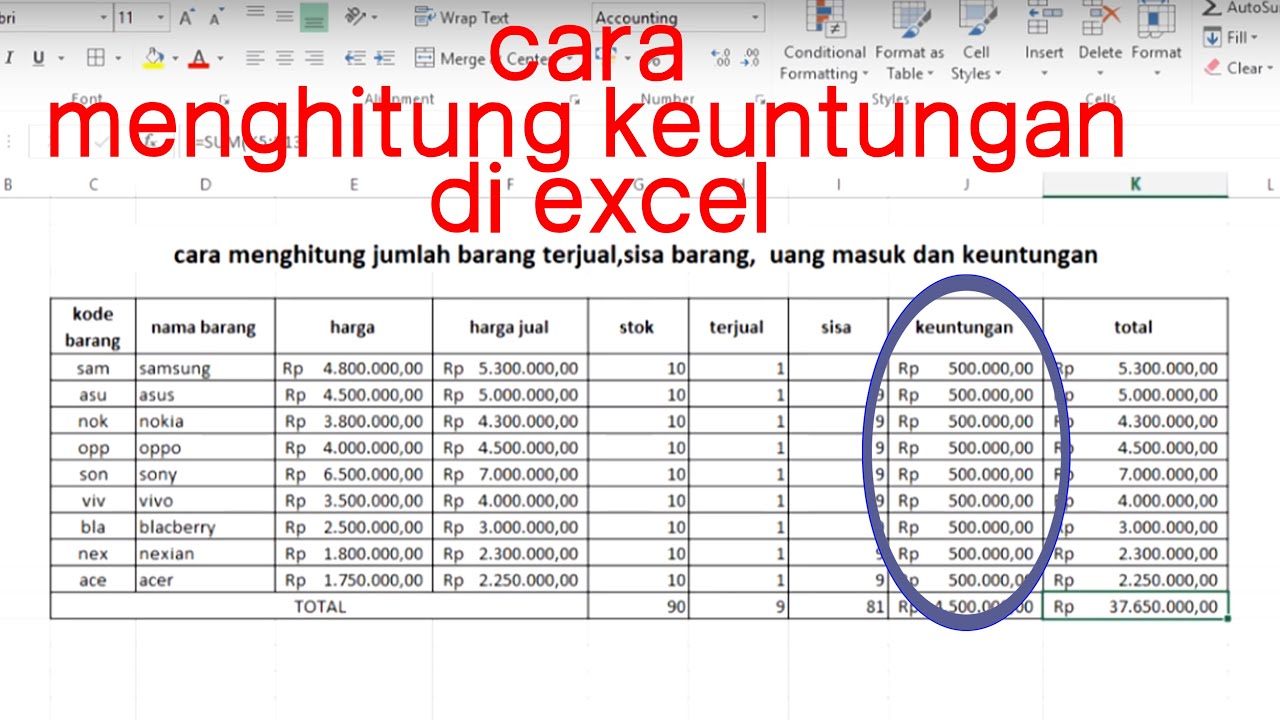

cara menghitung persentase anggaran - Khao Tick On

cara menghitung persentase anggaran - Khao Tick On

cara menghitung persentase anggaran - Khao Tick On

cara menghitung persentase anggaran - Khao Tick On

Rumus Laju Pertumbuhan Penduduk - Khao Tick On

cara menghitung persentase anggaran - Khao Tick On

cara menghitung persentase anggaran - Khao Tick On