Managing your finances effectively means staying organized and informed. A crucial aspect of this is having access to your bank statements. In Malaysia, these documents, known as "salinan penyata akaun bank," are essential for various financial tasks. If you're a Maybank customer, understanding how to obtain and utilize your Maybank bank statement copy is crucial for seamless financial management.

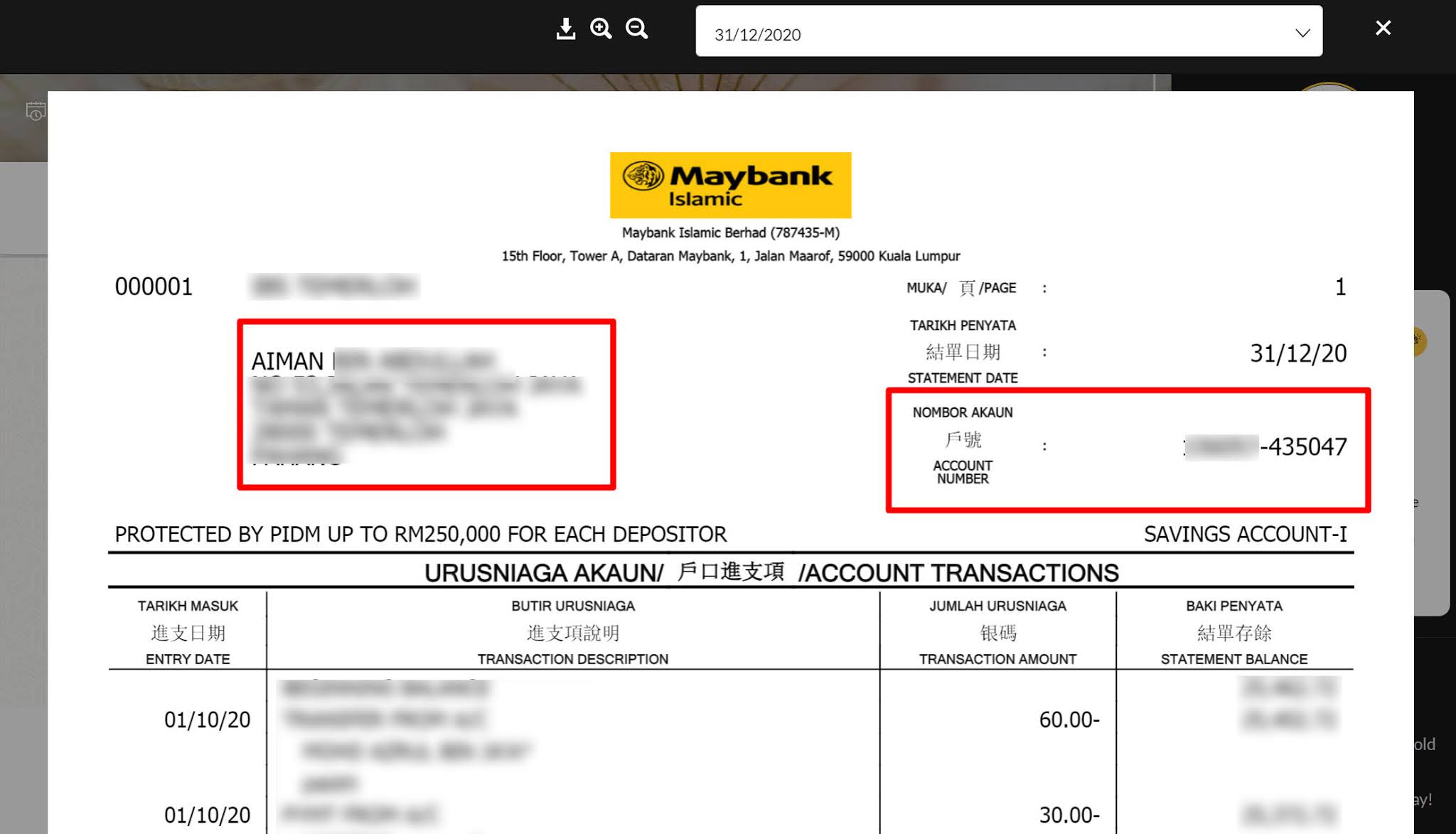

Whether you're applying for a loan, tracking your spending, or simply need proof of your financial history, a "salinan penyata akaun bank Maybank" acts as a verifiable record of your transactions. This guide will explore everything you need to know about Maybank bank statement copies, from obtaining them to understanding their importance in your financial journey.

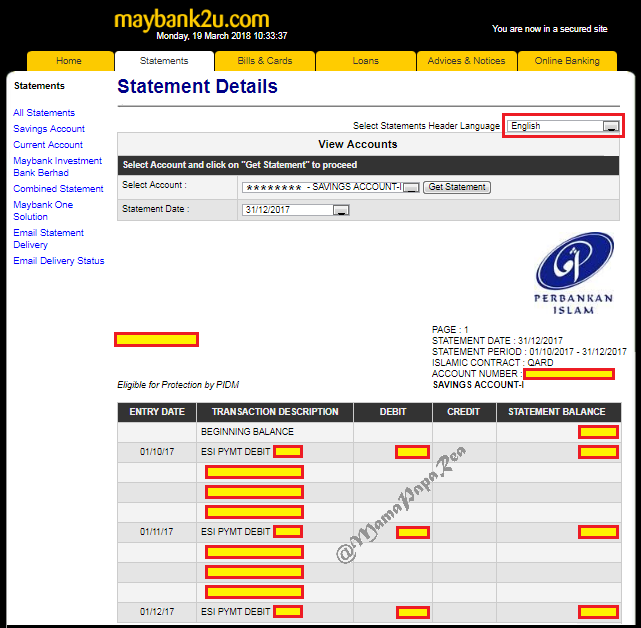

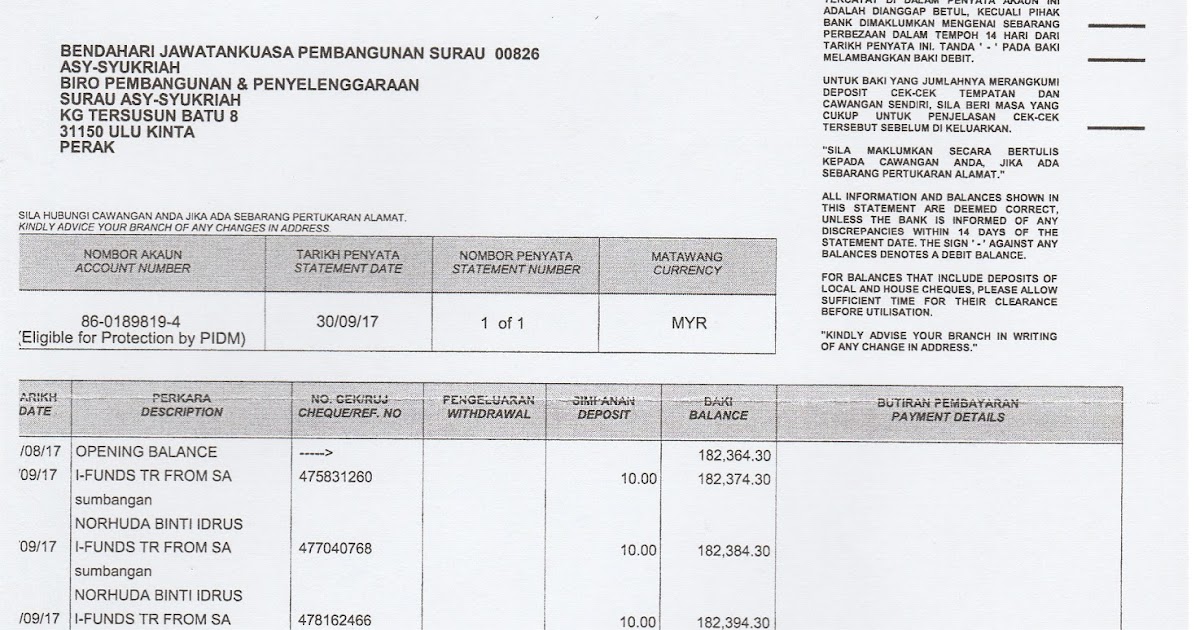

"Salinan penyata akaun bank Maybank" is simply the Malay term for "Maybank bank statement copy." This document provides a detailed record of all transactions associated with your Maybank account over a specific period. This includes deposits, withdrawals, transfers, fees, and interest earned. It essentially acts as a financial diary, providing a transparent view of your income and expenses.

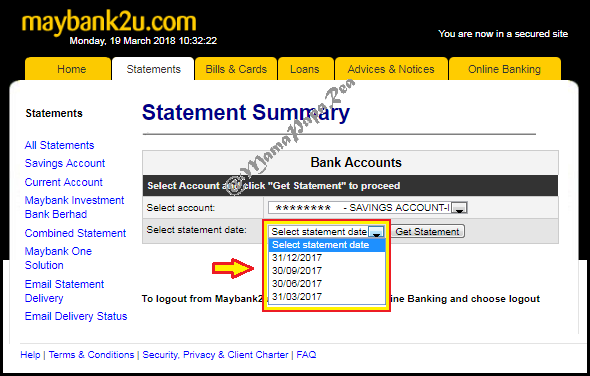

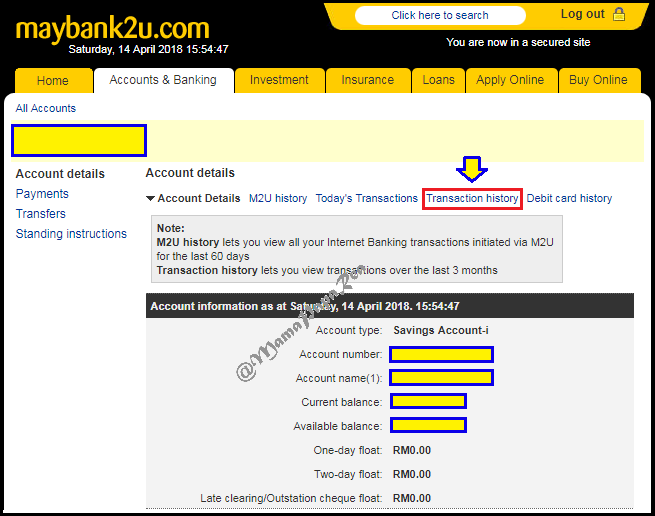

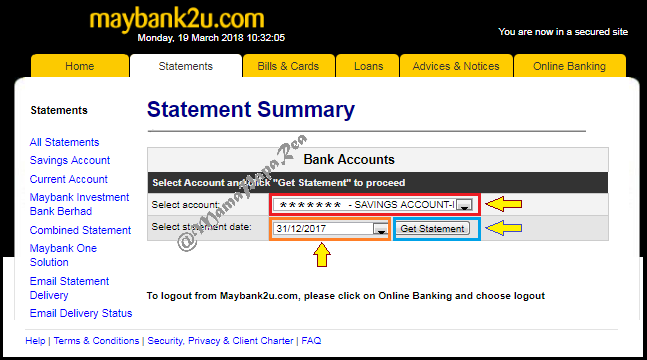

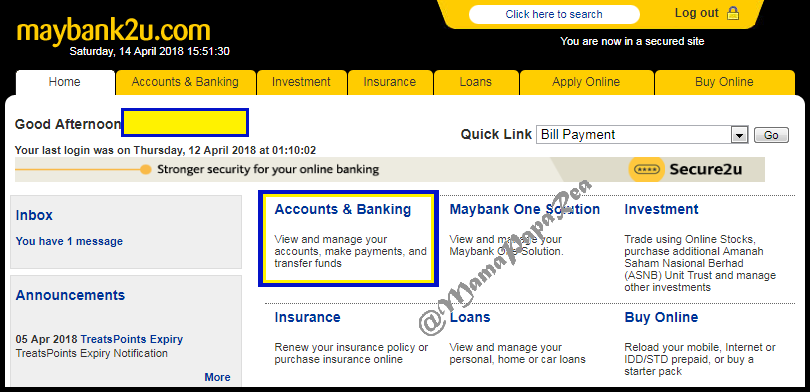

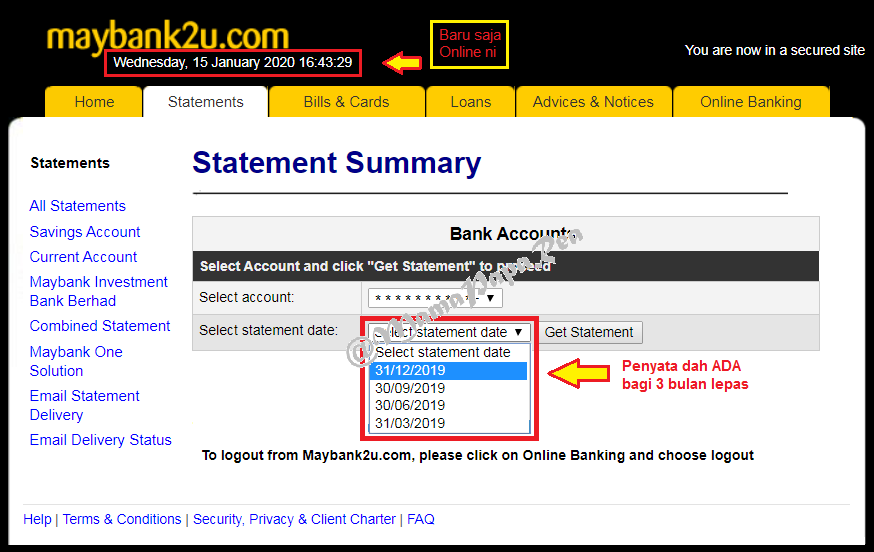

Before the digital age, obtaining a "salinan penyata akaun bank" often involved physically visiting a bank branch. Thankfully, Maybank, like many modern banks, has simplified this process, offering various convenient methods to access your bank statements.

Having access to your "salinan penyata akaun bank Maybank" isn't just about fulfilling bureaucratic requirements; it empowers you to take control of your finances. By regularly reviewing your bank statements, you can track your spending habits, identify areas for improvement, and make informed financial decisions.

While this guide focuses on Maybank bank statement copies, it's important to remember that the principles and benefits apply to understanding and utilizing bank statements from any institution. Taking the time to manage your financial records is a key step toward financial well-being.

Advantages and Disadvantages of Online Banking

While online banking offers incredible convenience, it's essential to be aware of both the advantages and potential drawbacks.

| Advantages | Disadvantages |

|---|---|

| 24/7 Account Access | Security Risks (Phishing, Hacking) |

| Convenient Transactions | Technical Issues or Outages |

| Easy Statement Access | Limited Personal Interaction |

By being aware of both sides, you can make informed decisions and take steps to mitigate any potential risks associated with online banking.

Gifts for her finding the perfect present para una gran mujer

Stopping school violence the power of slogans

Uninterrupted anime bliss exploring ad free viewing experiences

salinan penyata akaun bank maybank - Khao Tick On

Cara Dapatkan Bank Statement Maybank - Khao Tick On

salinan penyata akaun bank maybank - Khao Tick On

Salinan Akaun Bank Maybank - Khao Tick On

10 Cara Dapatkan Penyata Bank / Statement All Bank Malaysia - Khao Tick On

Salinan Akaun Bank Maybank - Khao Tick On

Contoh Salinan Akaun Bank Islam - Khao Tick On

Contoh Salinan Akaun Bank at Cermati - Khao Tick On

Salinan Akaun Bank Maybank - Khao Tick On

Contoh Salinan Akaun Bank Islam - Khao Tick On

Salinan Akaun Bank Maybank - Khao Tick On

Contoh Penyata Bank Cimb - Khao Tick On

8 Cara Dapatkan Penyata Bank / Statement Bank Malaysia - Khao Tick On

Salinan Akaun Bank Maybank - Khao Tick On

Contoh Salinan Akaun Bank - Khao Tick On