In today's fast-paced financial world, understanding the nuances of banking policies is crucial for smooth transactions and financial security. This is particularly true when dealing with third-party checks, which present unique considerations and potential risks. Chase Bank, like many financial institutions, has specific policies in place governing the deposit and cashing of third-party checks. This article will delve into the intricacies of Chase Bank's third-party check policy, providing you with the knowledge to navigate this aspect of your banking experience confidently.

Whether you're a seasoned business owner or an individual receiving a check from an unfamiliar source, understanding the implications of Chase's third-party check policy is essential. This article will equip you with the insights you need to make informed decisions about handling these checks and avoid potential pitfalls.

Third-party checks, simply put, are checks made payable to someone other than yourself, which you then receive. While seemingly straightforward, these checks can introduce a layer of complexity due to the involvement of an additional party. Chase Bank's policies surrounding these checks are designed to protect both the bank and its customers from potential fraud and financial loss.

Navigating the world of third-party checks can often feel like navigating a financial maze. Terms like "endorsement," "funds availability," and "check verification" come into play, and it's easy to feel overwhelmed. However, understanding Chase Bank's specific policies regarding these checks can provide clarity and peace of mind.

This article aims to be your comprehensive guide to Chase Bank's third-party check policy. We'll demystify the terminology, explore the rationale behind the policies, and provide practical tips for successfully depositing and managing third-party checks. By the end of this article, you'll be well-equipped to handle third-party checks with confidence, ensuring a seamless and secure banking experience.

Advantages and Disadvantages of Chase Bank's Third Party Check Policy

While Chase Bank's third-party check policy aims to provide a secure banking environment, it's important to understand the benefits and drawbacks associated with these policies.

| Advantages | Disadvantages |

|---|---|

| Enhanced Security | Potential Delays in Funds Availability |

| Reduced Risk of Fraud | Additional Verification Requirements |

| Protection for Both Bank and Customer | Limited Acceptance of Certain Third-Party Checks |

By understanding these aspects of Chase Bank's third-party check policy, customers can make informed decisions, weigh the benefits against potential drawbacks, and ensure a smooth and secure banking experience.

Best Practices for Handling Third-Party Checks at Chase Bank

To ensure a smooth and hassle-free experience when dealing with third-party checks at Chase Bank, consider these best practices:

- Communication is Key: Engage in open communication with the payer and the bank. Inform the payer about Chase Bank's policies and seek clarification from bank representatives if needed.

- Thoroughly Review the Check: Before attempting to deposit or cash a third-party check, carefully review all the information on the check. Ensure accuracy in names, dates, and amounts.

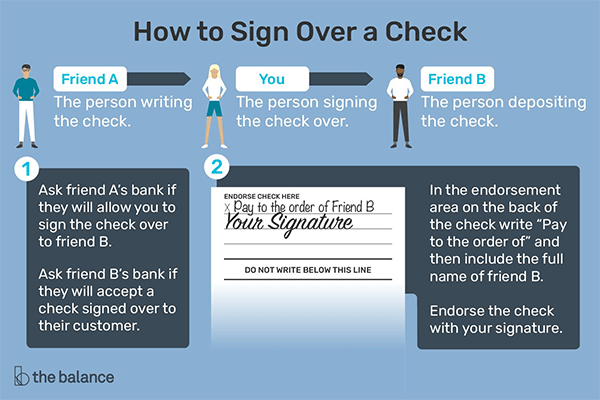

- Understand Endorsement Requirements: Familiarize yourself with Chase Bank's endorsement requirements for third-party checks. Proper endorsement is crucial for successful processing.

- Be Prepared for Verification: Chase Bank may require additional verification for third-party checks. Be prepared to provide identification and answer questions related to the check's origin.

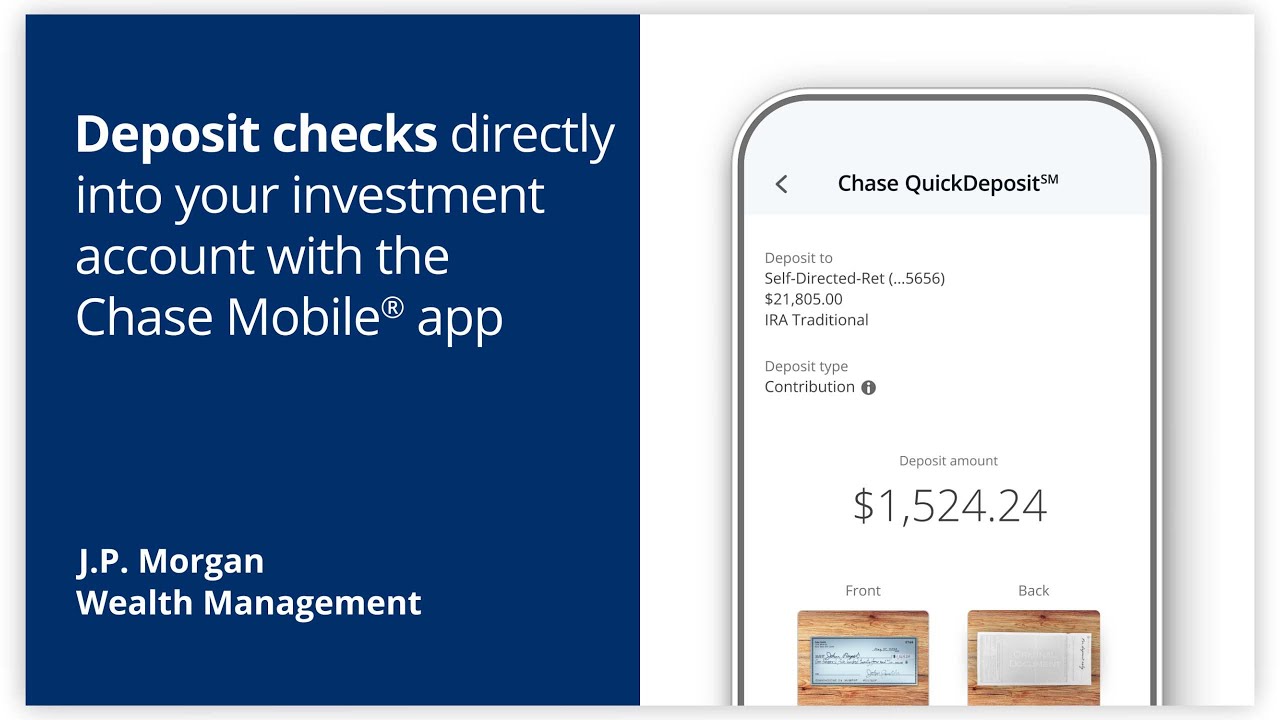

- Explore Alternative Deposit Methods: Consider alternative methods such as mobile check deposit or requesting the payer to use other payment methods like bank transfers or online payment platforms.

By adhering to these best practices, you can mitigate potential issues, minimize delays, and ensure a positive experience when handling third-party checks at Chase Bank.

Common Questions and Answers about Chase Bank's Third-Party Check Policy

Here are answers to some frequently asked questions about Chase Bank's third-party check policy:

- Q: What is Chase Bank's policy on depositing third-party checks?

A: Chase Bank generally allows the deposit of third-party checks, but specific procedures and holds may apply. It's advisable to contact your local branch or refer to their official website for detailed information. - Q: How long does it take for a third-party check to clear at Chase Bank?

A: The clearing time for third-party checks at Chase Bank can vary depending on factors such as the check amount, the payer's bank, and the bank's internal policies. It's recommended to inquire about potential holds on funds availability when depositing the check. - Q: Can I cash a third-party check at Chase Bank if I don't have an account?

A: Chase Bank typically does not cash third-party checks for non-customers. It's advisable to explore check-cashing services or consult with the check issuer for alternative options. - Q: What are some common reasons why Chase Bank might reject a third-party check?

A: Chase Bank might reject a third-party check due to various reasons, including insufficient funds in the payer's account, discrepancies in check information, improper endorsements, or concerns related to potential fraud. - Q: How can I protect myself from fraud when dealing with third-party checks?

A: To mitigate the risk of fraud, be cautious about accepting third-party checks from unfamiliar sources, verify the legitimacy of the check and the payer, and consider alternative payment methods when possible.

If you have further questions or require specific clarification, it's always recommended to contact Chase Bank directly for the most up-to-date and accurate information.

Conclusion

Understanding Chase Bank's third-party check policy is paramount for anyone who deals with checks not directly issued to them. This policy, like those at other financial institutions, is designed to strike a balance between facilitating transactions and mitigating the inherent risks associated with third-party instruments. By familiarizing yourself with the policy's nuances – including potential holds, endorsement requirements, and the bank's approach to fraud prevention – you can ensure smoother transactions and avoid unnecessary delays or complications. Remember, open communication with both the payer and Chase Bank is key. If you have any doubts or questions, don't hesitate to reach out to Chase for clarification. Being proactive and informed is the best way to navigate the world of third-party checks successfully.

Lilo and stitch jumba ship why this unlikely duo is taking the internet by storm

Apakah maksud alam sekitar understanding our environmental tapestry

Decoding your engines cooling blueprint the essential guide to cooling system diagrams

Bank of America Third - Khao Tick On

How To Cash A Third Party Check At Chase - Khao Tick On

How To Cash A Third Party Government Check - Khao Tick On

How To Cash A Third Party Insurance Check - Khao Tick On

How To Cash A Third Party Check Without ID - Khao Tick On

Get Your Funds Faster With Chase Mobile Check Deposits - Khao Tick On

What is a Third Party Check - Khao Tick On

How to Cash a Two Party Check Without the Other Person? - Khao Tick On

How to Cash a Check Without ID or Account: 5 Easy Steps (2023) - Khao Tick On

How To Cash A Third Party Check At Bank Of America - Khao Tick On

How to Endorse Chase Bank Mobile Deposit? - Khao Tick On

Chase Checks Instantly Print Online On Any Printer Yourself - Khao Tick On

Depositing Check With Someone Else's Name On It Hot Sale - Khao Tick On

How to Endorse a Check - Khao Tick On

chase bank third party check policy - Khao Tick On

/back-of-check-endorsed2-57a350e95f9b589aa907ed7e.jpg)