In the bustling world of finance, navigating the complexities of banking procedures can often feel like navigating a labyrinth. One such procedure that often leaves individuals scratching their heads is the "Surat Pengesahan Bank," particularly when dealing with Maybank, a prominent banking institution in Malaysia. This document, often shrouded in bureaucratic mystery, plays a pivotal role in numerous financial transactions.

Imagine this: you're about to embark on a significant life event - purchasing your dream home, securing a crucial loan, or even applying for a visa. Suddenly, you're asked to produce a "Surat Pengesahan Bank Maybank." What exactly is this document, and why is it so important?

Simply put, "Surat Pengesahan Bank Maybank" translates to "Maybank Bank Confirmation Letter" in English. This seemingly simple document serves as a crucial piece of the puzzle in verifying your financial standing with Maybank. It acts as an official acknowledgment from the bank, confirming your account details, transaction history, and overall financial credibility.

But why is this confirmation so crucial? In an era where financial security and transparency are paramount, the Surat Pengesahan Bank Maybank acts as a safeguard against fraud and misrepresentation. It provides a tangible and verifiable link between you and your financial history, assuring third parties of your financial credibility.

While the concept might appear straightforward, obtaining and understanding the nuances of a Surat Pengesahan Bank Maybank can be a daunting task. This is where a comprehensive guide becomes indispensable, providing clarity amidst the complexities. In this article, we delve deep into the intricacies of Surat Pengesahan Bank Maybank, demystifying its purpose, exploring its significance, and guiding you through the process of obtaining one.

Advantages and Disadvantages of Surat Pengesahan Bank Maybank

While the Surat Pengesahan Bank Maybank offers a multitude of benefits, like any financial tool, it also comes with its own set of considerations. Understanding these can help you navigate the process more effectively.

| Advantages | Disadvantages |

|---|---|

| Enhanced Credibility | Processing Time |

| Fraud Prevention | Potential Fees |

| Simplified Transactions | Limited Validity |

While the advantages of the Surat Pengesahan Bank Maybank often outweigh the disadvantages, being aware of both sides of the coin empowers you to make informed financial decisions.

In conclusion, navigating the world of finance can often feel like traversing a complex maze. The Surat Pengesahan Bank Maybank, though seemingly simple, plays a crucial role in ensuring transparency, security, and credibility in various financial transactions. By understanding its purpose, significance, and the process of obtaining it, you equip yourself with the knowledge to confidently navigate your financial journey. Remember, clarity is key, and with the right information, you can confidently navigate even the most intricate financial procedures.

Unleash your power finding the perfect punching bag for your workout

The ultimate guide to scrubs for tall women with long inseam

Mastering the upside down smiley face emoji copy paste and conquer

surat pengesahan bank maybank - Khao Tick On

Contoh Surat Pengesahan Akaun Bank Maybank Cara Mendapatkan Statement - Khao Tick On

Surat Pengesahan Akaun Bank - Khao Tick On

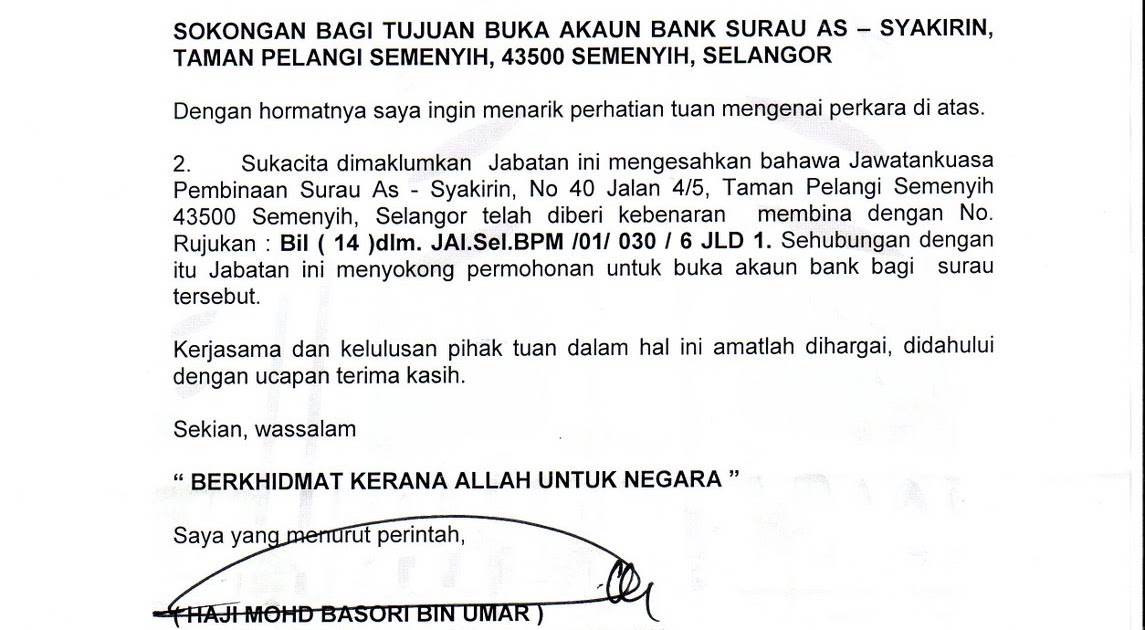

Contoh Surat Buka Akaun Bank Untuk Pekerja - Khao Tick On

Surat Pengesahan Bank Maybank - Khao Tick On

Maybank Contoh Surat Buka Akaun Bank Untuk Pekerja - Khao Tick On

Pengesahan Majikan Maybank Contoh Surat Buka Akaun Bank Untuk Pekerja - Khao Tick On

Contoh Surat Pengesahan Untuk Buka Akaun Bank - Khao Tick On