Need to send or receive money quickly and securely? Wire transfers are a common solution, and if you're dealing with JPMorgan Chase, understanding their specific processes is crucial. This guide will walk you through the essentials of JPMorgan Chase wire information, providing clarity and helping you navigate the process with confidence.

A wire transfer is an electronic method of moving funds between banks. Unlike ACH transfers, which can take several business days, wire transfers are typically completed much faster, often on the same day. When working with JPMorgan Chase, you'll need specific information, including routing numbers and account details, to ensure the transfer goes smoothly. This information acts as an address, directing the funds to the correct destination.

The JPMorgan Chase wire number, sometimes referred to as the routing number for wire transfers, is a key piece of this puzzle. It identifies the specific Chase bank branch involved in the transfer. Using the correct routing number is crucial for avoiding delays or even having the transfer rejected. Different types of transfers, such as domestic vs. international, may require different routing numbers, so it’s essential to use the correct one for your specific situation.

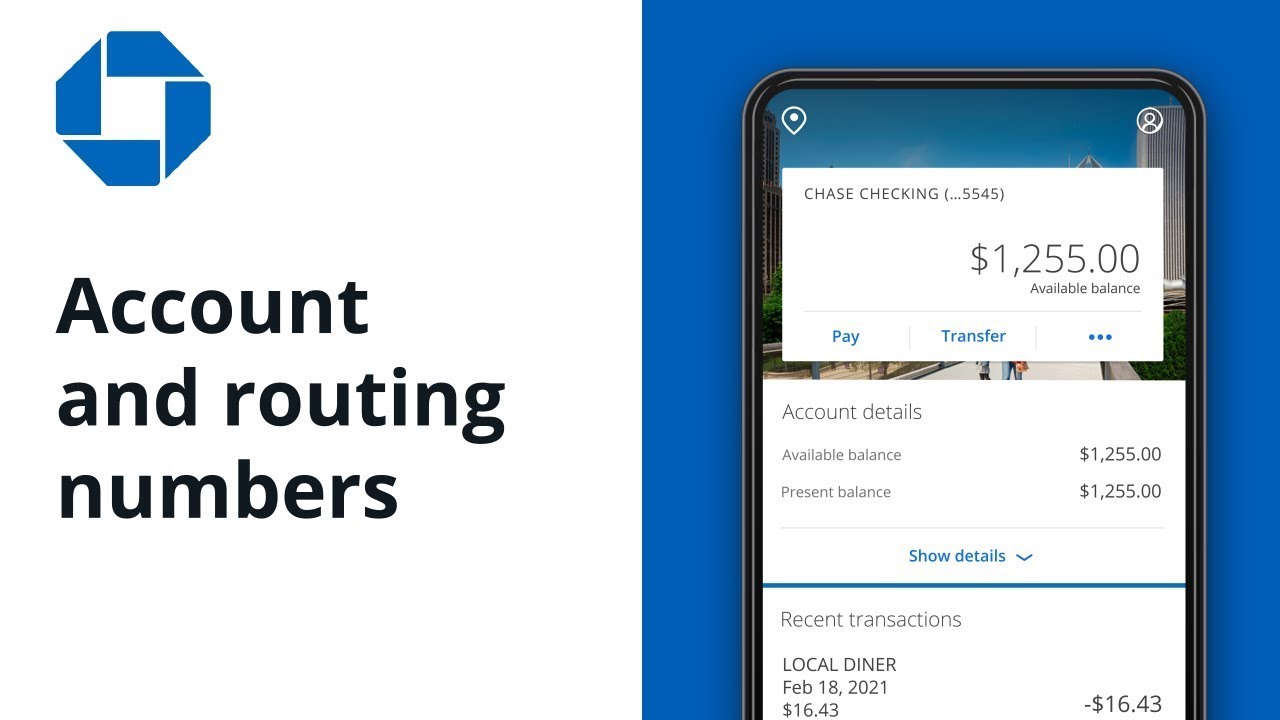

Locating your JPMorgan Chase wire information is generally straightforward. You can typically find it on your Chase online banking platform, on your monthly statements, or on the back of your checks. You can also contact Chase customer service directly to obtain the required information. However, be cautious about sharing this sensitive data, as it can be misused for fraudulent purposes. Always verify the recipient's details and the requested information before initiating a transfer.

The history of wire transfers dates back to the 19th century with the invention of the telegraph. While the technology has evolved significantly, the core principle remains the same: rapid electronic transfer of funds. Today, wire transfers are a vital part of the global financial system, facilitating transactions ranging from personal remittances to large-scale business deals. JPMorgan Chase, as a leading financial institution, plays a key role in facilitating these transactions.

One of the primary benefits of using wire transfers with JPMorgan Chase is the speed and efficiency. Compared to other methods like checks, wire transfers offer a much faster turnaround, often completing within the same business day. This speed can be critical for time-sensitive transactions.

Another advantage is the security offered by wire transfers. While no system is entirely foolproof, wire transfers are generally considered a secure way to move funds. JPMorgan Chase employs various security measures to protect against fraud and unauthorized access.

A third benefit is the global reach of wire transfers. JPMorgan Chase facilitates international wire transfers, enabling you to send and receive money across borders. This is particularly beneficial for businesses engaged in international trade or individuals sending remittances to family members abroad.

Advantages and Disadvantages of Wire Transfers with JPMorgan Chase

| Advantages | Disadvantages |

|---|---|

| Speed and efficiency | Cost (typically higher than other transfer methods) |

| Security | Irreversible nature (difficult to recover funds if sent to the wrong account) |

| Global reach | Potential for delays (though less common than with other methods) |

Frequently Asked Questions about JPMorgan Chase Wire Transfers:

1. Where can I find my JPMorgan Chase wire number? (Answer: Online banking, statements, or by contacting customer service.)

2. What is the difference between a domestic and international wire transfer? (Answer: Different routing numbers and potentially different fees and processing times.)

3. How long does a JPMorgan Chase wire transfer take? (Answer: Typically same business day, but can vary.)

4. What are the fees associated with wire transfers? (Answer: Varies depending on the type of transfer and account details.)

5. Is it safe to send wire transfers? (Answer: Generally secure, but take precautions to protect your information.)

6. What should I do if my wire transfer is delayed? (Answer: Contact JPMorgan Chase customer service.)

7. Can I cancel a wire transfer? (Answer: Potentially, if it hasn't been processed yet. Contact customer service immediately.)

8. What information do I need to receive a wire transfer? (Answer: Your account number, routing number, and potentially other details depending on the sender's bank.)

In conclusion, understanding the nuances of JPMorgan Chase wire transfers is essential for anyone looking to move funds quickly and securely. From locating your wire information to understanding the associated fees and timelines, this guide has provided a comprehensive overview. By following the advice outlined above, you can navigate the process with confidence, minimizing potential issues and ensuring your funds reach their intended destination smoothly. While wire transfers offer significant benefits in terms of speed and security, it’s also crucial to be aware of the associated costs and potential risks. Always double-check the recipient’s information and use secure channels to share your banking details. If you have any doubts or questions, contacting JPMorgan Chase customer service is always the best course of action. They can provide personalized assistance and clarify any specific concerns you may have. By staying informed and taking appropriate precautions, you can leverage the power of wire transfers effectively and securely manage your finances.

Unlocking fluency your guide to conquering contoh karangan bi form 4

Crafting killer captions your facebook bios secret weapon

Whispers of the soul meaningful word tattoos for women

jpmorgan chase wire number - Khao Tick On

bank fractional number lookup - Khao Tick On

jpmorgan chase wire number - Khao Tick On

Chase Bank Wiring Routing Number - Khao Tick On

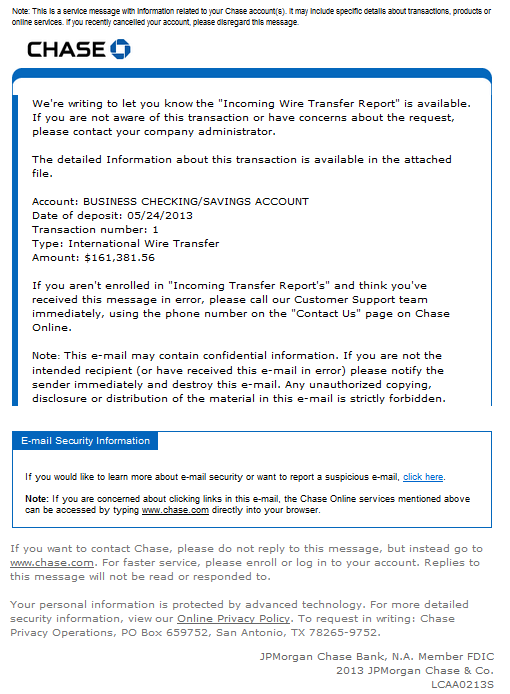

Dynamoos Blog Chase Incoming Wire Transfer spam incomingwire - Khao Tick On

Incoming Wire Transfer and ACH Instructions - Khao Tick On

JPMorgan Chase Blocks 100 Chocolate Purchase Approves 49000 Illicit - Khao Tick On

Bank Account Number On Check Chase - Khao Tick On

jpmorgan chase wire number - Khao Tick On

How do I find my routing number on my Chase app credit card - Khao Tick On

Chase Bank Wiring Number - Khao Tick On

jpmorgan chase wire number - Khao Tick On

Bank Sort Code Chase - Khao Tick On

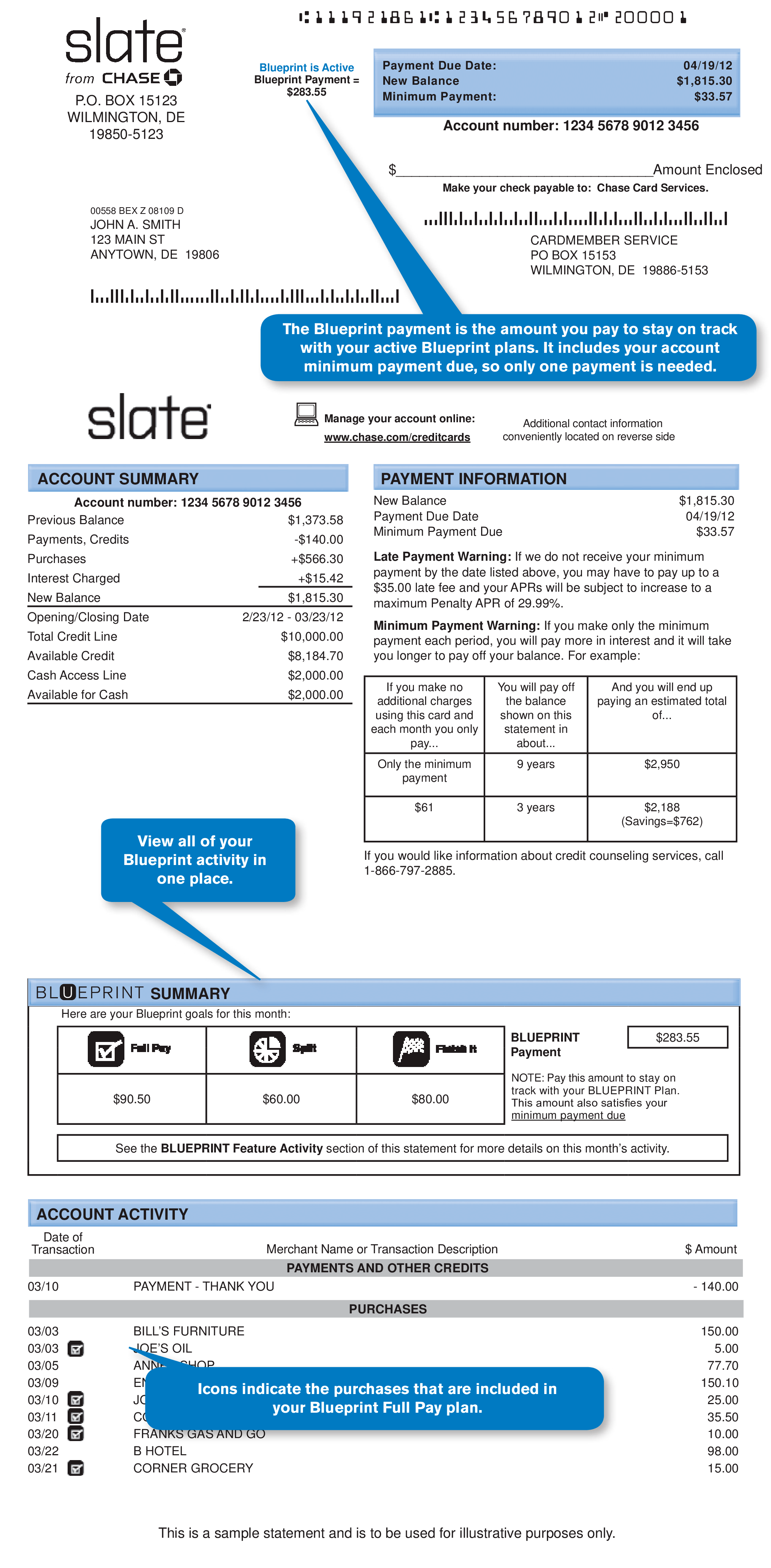

Chase Bank Statement Template Fresh 8 Chase Bank Statement - Khao Tick On

Chase Bank Statement Template - Khao Tick On