Imagine this: you're about to receive a crucial international payment. You excitedly share your bank account details, but then, a nagging thought – did you include the right CIMB bank code? In the intricate world of finance, these codes act as your financial fingerprint, ensuring smooth and secure transactions. Just like a ship needs its coordinates to navigate, your money needs the correct bank code to reach its destination.

A CIMB bank code, also commonly referred to as a SWIFT code, is a unique combination of letters and numbers that identifies CIMB Bank Berhad within the global financial network. Think of it as your bank's unique identifier in a sea of financial institutions. This code plays a crucial role in various financial transactions, especially international wire transfers, ensuring your money ends up in the right hands, at the right bank, across the globe.

The need for these standardized codes arose from the increasing complexity of international banking. Without a universal system, tracking down the correct bank and branch for every transaction would be like finding a needle in a haystack. The SWIFT system, and by extension, CIMB bank codes, brought order to the chaos, streamlining cross-border payments and fostering trust in the global financial ecosystem.

But what makes these codes so important? Imagine sending money without them – it would be like mailing a letter without an address. CIMB bank codes eliminate confusion, minimize errors, and guarantee that your funds are routed correctly. Whether you're receiving money from a client overseas or sending funds to a family member abroad, these codes are your silent partners, working behind the scenes to ensure a seamless and secure transaction.

While using CIMB bank codes might seem straightforward, there can be stumbling blocks. One common issue is using outdated or incorrect codes, potentially leading to delays or even misdirection of funds. It's crucial to always double-check the code with either your recipient or directly with CIMB Bank to avoid any hiccups in your transactions. Remember, accuracy is key in the world of finance.

Advantages and Disadvantages of Bank Codes

| Advantages | Disadvantages |

|---|---|

| Secure and reliable transactions | Potential for delays if the code is incorrect |

| Globally recognized standard | Requires careful attention to detail when providing the code |

| Facilitates efficient cross-border payments | Can be confusing for first-time users |

While the concept of bank codes may appear technical, understanding their function and significance empowers you to navigate your international finances with confidence. Just like learning the rules of the road before driving, familiarizing yourself with these codes ensures smoother, more secure, and ultimately, more successful financial journeys.

Unlock harmony at home with these powerful feng shui tips

Unveiling the mystery products containing borax

Unit 6 similar triangles homework 2 key

bank code for cimb - Khao Tick On

bank code for cimb - Khao Tick On

bank code for cimb - Khao Tick On

bank code for cimb - Khao Tick On

bank code for cimb - Khao Tick On

Thông tin ngân hàng - Khao Tick On

bank code for cimb - Khao Tick On

bank code for cimb - Khao Tick On

bank code for cimb - Khao Tick On

bank code for cimb - Khao Tick On

bank code for cimb - Khao Tick On

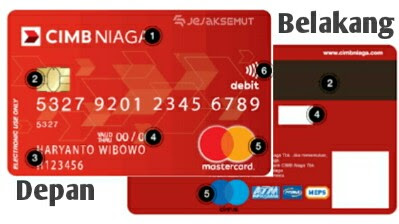

No Cvv Kartu Kredit - Khao Tick On

bank code for cimb - Khao Tick On

bank code for cimb - Khao Tick On

bank code for cimb - Khao Tick On