In today’s fast-paced digital world, the role of a physical bank branch might seem antiquated. Yet, for many, a JPMorgan Chase bank branch remains a vital resource for managing their financial lives. This article dives into the significance of Chase's retail presence, exploring its history, services, and the benefits of engaging with a local branch. We'll examine how these physical locations complement Chase’s digital offerings, providing a comprehensive banking experience.

The sight of a JPMorgan Chase bank branch sign is a familiar one across the American landscape. But what lies behind that familiar blue octagon? More than just a place to deposit checks or withdraw cash, a Chase branch represents a connection to a vast financial network. It's a hub for personalized advice, complex transactions, and building relationships with financial professionals. Whether you're a seasoned investor or just starting your financial journey, understanding the value of a Chase branch can significantly impact your financial well-being.

From its historical roots to its modern iteration, the JPMorgan Chase brand has evolved alongside the changing financial landscape. The bank's extensive network of branches reflects its commitment to serving diverse communities and providing accessible financial services. This commitment extends beyond basic transactions, encompassing wealth management, investment services, and business banking solutions. A Chase bank branch acts as a gateway to this wider ecosystem of financial products and services.

One of the primary advantages of utilizing a Chase bank branch is the opportunity for personalized financial guidance. While digital tools offer convenience, sometimes you need expert advice tailored to your unique circumstances. A Chase banker can help you navigate complex financial decisions, from choosing the right checking account to planning for retirement. This face-to-face interaction can be invaluable, especially when dealing with significant financial milestones.

Beyond personal consultations, a Chase bank location provides essential services that may not be readily available online. These include notary services, safe deposit boxes, foreign currency exchange, and assistance with complex transactions requiring in-person authorization. For businesses, a Chase branch offers dedicated support for managing accounts, processing payments, and accessing specialized financial products. This localized support can be critical for small businesses looking to establish and grow their operations.

JPMorgan Chase & Co. is the result of several mergers and acquisitions throughout history, culminating in the combination of several prominent financial institutions, including J.P. Morgan & Co., Chase Manhattan Bank, Bank One, and others. The history of Chase’s branch network can be traced back to the founding of these individual entities, with a legacy spanning centuries. The importance of the Chase branch lies in its accessibility, offering customers a tangible connection to their finances. One main issue associated with bank branches, including those of Chase, is the cost of maintaining these physical locations, which can contribute to fees and operational expenses.

A JPMorgan Chase bank branch provides the following benefits: personalized financial advice, convenient access to essential services, and a secure environment for managing your finances. For example, you can meet with a financial advisor at your local Chase branch to discuss investment strategies, open a new checking account without needing online access, or deposit a large sum of cash securely.

If you need to open a new account, follow these steps: Visit a Chase branch, speak with a banker, provide the necessary documentation, review and sign the account agreement, and fund your new account.

Before visiting a Chase branch, create a checklist: Verify your identification documents, gather any necessary financial statements, prepare a list of questions for the banker, and note the branch's operating hours.

Advantages and Disadvantages of Using a JPMorgan Chase Bank Branch

| Advantages | Disadvantages |

|---|---|

| Personalized service and advice | Limited operating hours compared to online banking |

| Access to specialized services like safe deposit boxes and notary | Potential wait times during peak hours |

| Secure environment for complex transactions | Branch locations might not be convenient for everyone |

Best Practices: 1. Schedule appointments for complex transactions. 2. Utilize online and mobile banking for routine tasks. 3. Review your statements regularly. 4. Keep your contact information updated. 5. Take advantage of educational resources.

Real Examples: 1. Opening a business checking account. 2. Applying for a mortgage. 3. Depositing a large check. 4. Reporting a lost or stolen debit card. 5. Getting a cashier's check.

Challenges and Solutions: 1. Long wait times – Schedule an appointment. 2. Limited branch hours – Utilize ATMs or online banking. 3. Difficulty reaching a banker – Try calling during off-peak hours. 4. Fees – Explore fee-free account options. 5. Technology issues at the branch – Utilize alternative banking channels.

FAQs: 1. How do I find a Chase branch near me? 2. What are the Chase branch hours? 3. How do I open a checking account at a Chase branch? 4. What documents do I need to open an account? 5. Can I deposit cash at a Chase ATM? 6. How do I report a lost or stolen card? 7. What services are available at a Chase branch? 8. How can I contact Chase customer service?

Tips and Tricks: Use the Chase mobile app to locate nearby ATMs and branches, check balances, and deposit checks. Set up account alerts to stay informed about your transactions. Explore Chase's online resources for financial planning tools and educational materials.

In conclusion, while the digital age has transformed the banking landscape, the JPMorgan Chase bank branch continues to serve as an essential resource for individuals and businesses alike. From personalized financial guidance to specialized services, a Chase branch offers tangible benefits that complement the convenience of online and mobile banking. By understanding the value and services provided by a local Chase bank branch, you can leverage its resources to effectively manage your finances and achieve your financial goals. Take the time to explore the services offered at your nearest JPMorgan Chase branch and discover how it can empower you on your financial journey. Utilizing both the digital tools and the in-person services available can contribute to a more comprehensive and successful financial management strategy. Connecting with a Chase banker can open doors to a wealth of information and tailored solutions designed to help you thrive financially. So, the next time you see that familiar blue octagon, remember it’s more than just a bank; it's a gateway to financial empowerment.

Decoding tiktok bios the ultimate guide

Unveiling the mystery what causes dark spots on the face

Arkansas food assistance accessing snap benefits online

Case Study JPMorgan Chase TPG Architecture - Khao Tick On

JPMorgan Chase Co Bank Branches Ahead Of Earnings Figures Photos and - Khao Tick On

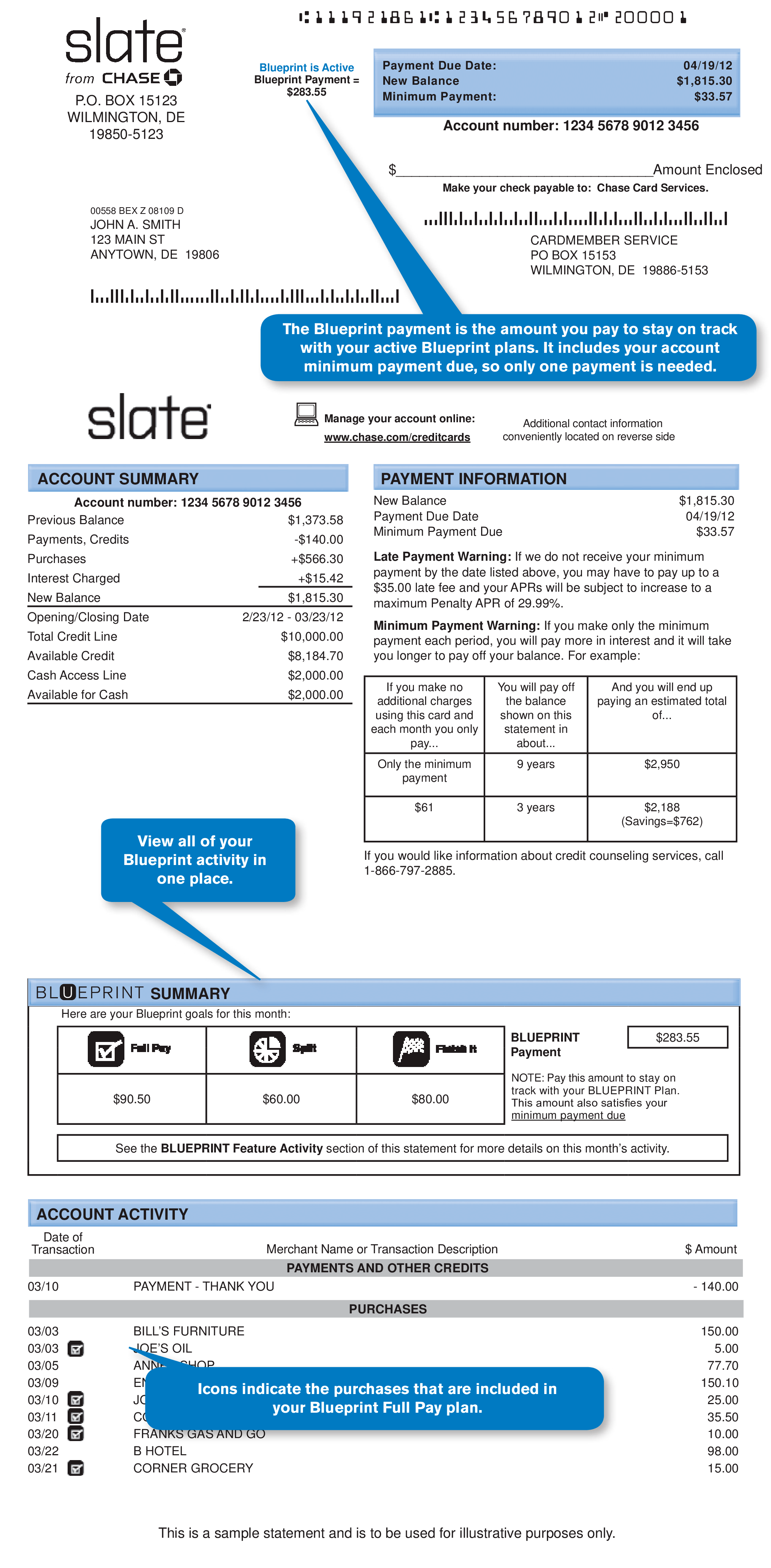

Chase Bank Account Statement - Khao Tick On

Palisades Park NJ Voted As The 38th Least Desirable Place To Live In - Khao Tick On

Chase Cd Rates May 2025 - Khao Tick On

jpmorgan chase bank branch - Khao Tick On

A JPMorgan Chase bank branch sign seen in Chinese and English in - Khao Tick On

Chase Bank JPMorgan Chase Finance Bank Of America PNG Clipart Angle - Khao Tick On

jpmorgan chase bank branch - Khao Tick On

JPMorgan Chase to Be First Big US Bank With Own Cryptocurrency JPM - Khao Tick On

A Chase bank branch in New York US on Wednesday March 29 2023 - Khao Tick On

JPMorgan Tries to Calm Investors on Its Outlook and Oil Defenses - Khao Tick On

19 Letterhead Templates For Google Docs - Khao Tick On

Verify a check from JPMORGAN CHASE BANK NA - Khao Tick On

jpmorgan chase bank branch - Khao Tick On