Imagine a scenario where you've overpaid on a financial obligation – perhaps taxes, rent, or an invoice. You're rightfully due a refund, but navigating the process of reclaiming your money feels like venturing into uncharted territory. This is where the concept of "surat bayaran balik hasil" comes into play, a term often shrouded in bureaucratic jargon and procedural complexities.

While the literal translation of "surat bayaran balik hasil" from Malay to English is "letter of refund," its implications extend far beyond a simple request for money back. This process, deeply rooted in financial regulations and legal frameworks, often involves navigating a web of documentation, deadlines, and specific requirements.

Understanding the intricacies of "surat bayaran balik hasil" is crucial for individuals and businesses alike, especially in contexts where financial transactions are commonplace. Whether you're dealing with tax overpayments, security deposits, or contractual reimbursements, a clear grasp of this process can empower you to reclaim your rightful funds efficiently and effectively.

This exploration aims to demystify "surat bayaran balik hasil," providing a comprehensive understanding of its importance, practical applications, and potential challenges. We'll delve into its historical context, shed light on its significance in various financial domains, and equip you with the knowledge to navigate this process with confidence.

From defining key terms and outlining essential steps to highlighting potential pitfalls and offering expert tips, this guide serves as your roadmap to mastering the often-confusing world of "surat bayaran balik hasil." By the end, you'll be empowered to approach these situations proactively, ensuring that you receive the financial restitution you deserve without unnecessary hassle or delay.

Advantages and Disadvantages of Utilizing "Surat Bayaran Balik Hasil"

While the concept of "surat bayaran balik hasil" presents a pathway to financial recourse, it's essential to weigh its advantages and disadvantages before diving in headfirst. Understanding both sides of the coin can help you make informed decisions and approach the process strategically.

| Advantages | Disadvantages |

|---|---|

|

|

Best Practices for Implementing "Surat Bayaran Balik Hasil" Effectively

To maximize your chances of success and streamline the process of obtaining a "surat bayaran balik hasil," consider these best practices:

- Thorough Documentation: Ensure all supporting documents are accurate, complete, and submitted within specified deadlines.

- Clarity and Specificity: Clearly state the purpose of your request, the amount being claimed, and the relevant legal or contractual basis.

- Professional Tone: Maintain a formal and respectful tone throughout all communications and documentation.

- Follow-Up Diligently: Don't hesitate to follow up on the status of your request and address any queries promptly.

- Seek Expert Guidance: If needed, consult with a financial advisor or legal professional for personalized advice and support.

Common Questions and Answers About "Surat Bayaran Balik Hasil"

Here are some frequently asked questions to provide further clarity:

- Q: What types of situations warrant a "surat bayaran balik hasil?"

A: It can be used for various situations like tax overpayments, rental deposit refunds, contract breaches with financial implications, and more. - Q: Is there a specific format or template for this letter?

A: While there might be general guidelines, the format can vary depending on the context. It's best to research specific requirements or consult with relevant authorities. - Q: What happens if my request is rejected?

A: You might have the option to appeal or resubmit with additional documentation. Consulting with a legal professional can be beneficial in such cases. - Q: Are there any fees associated with this process?

A: Fees, if any, depend on the specific context and the involved parties. It's best to inquire about potential costs beforehand. - Q: How long does the entire process usually take?

A: The timeline can vary significantly depending on factors like the complexity of the case and the efficiency of the involved parties.

Conclusion

Navigating the intricacies of "surat bayaran balik hasil" can seem daunting, but armed with the right knowledge and proactive approach, it doesn't have to be an insurmountable challenge. By understanding its nuances, utilizing best practices, and seeking expert guidance when needed, you can confidently navigate this process and increase your likelihood of a successful outcome. Remember, securing your financial well-being often requires taking proactive steps, and understanding "surat bayaran balik hasil" is a crucial tool in your arsenal.

Crafting unforgettable moments the essence of a malaysian wedding script

Discovering webster cantrell hall decatur il

The moons rhythm in delhi unveiling lunar influence

Contoh Surat Permohonan Tuntutan Balik Bayaran Levi Daripada Majikan - Khao Tick On

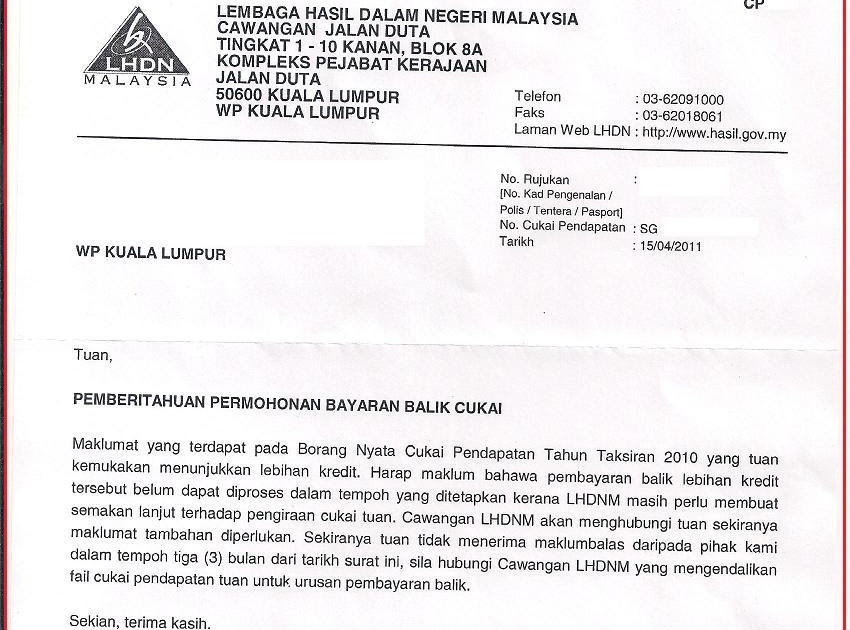

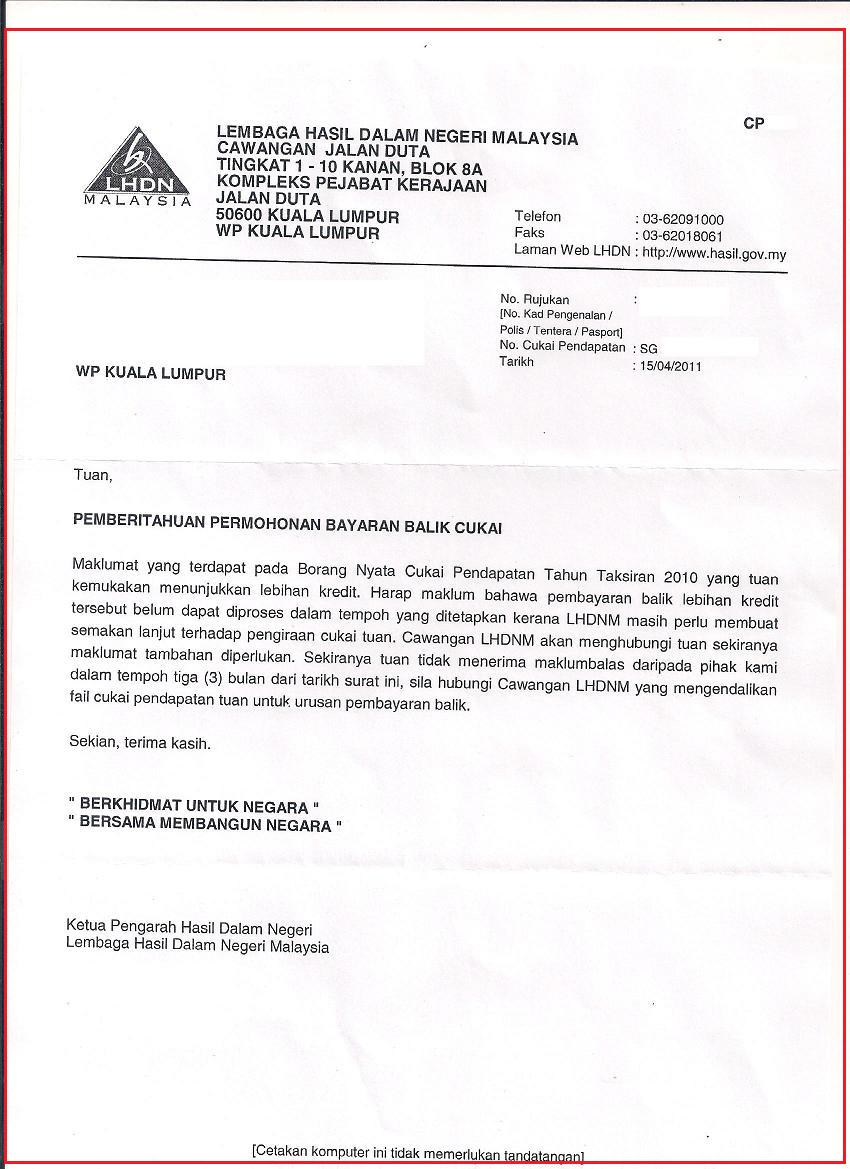

Cukai Pendapatan Contoh Surat Rayuan Lembaga Hasil Dalam Negeri - Khao Tick On

Contoh Surat Tuntutan Bayaran Kontraktor - Khao Tick On

Surat Tuntutan Bayaran Balik - Khao Tick On

Contoh Surat Rasmi Permohonan Tuntutan Bayaran Balik - Khao Tick On

Contoh Surat Tuntutan Bayaran Hutang Tertunggak - Khao Tick On

Contoh Surat Pembayaran Balik Gaji Nicola Rampling - Khao Tick On

Surat Tuntutan Bayaran Balik - Khao Tick On

Contoh Surat Tuntutan Bayaran Balik Gaji - Khao Tick On

Contoh Surat Akuan Penerimaan Bayaran - Khao Tick On

Contoh Surat Rayuan Pengurangan Bayaran - Khao Tick On

Contoh Surat Permohonan Bayaran Ansuran - Khao Tick On

Contoh Surat Rasmi Permohonan Tuntutan Bayaran Balik - Khao Tick On