In an age where digital transactions increasingly dominate the financial landscape, the humble paper check might seem like a relic of the past. Yet, for many, checks remain a tangible and trusted method of transferring funds. But what happens when a check is issued to you, and you wish to pass it along to someone else? Can you simply endorse it over, or does the world of third-party checks hold unexpected complexities?

This seemingly simple question often leads to a tangle of uncertainties. Do banks readily accept third-party checks? Are there risks involved for both the recipient and the original payee? And in a world teeming with sophisticated financial instruments, why do these paper promises continue to hold relevance?

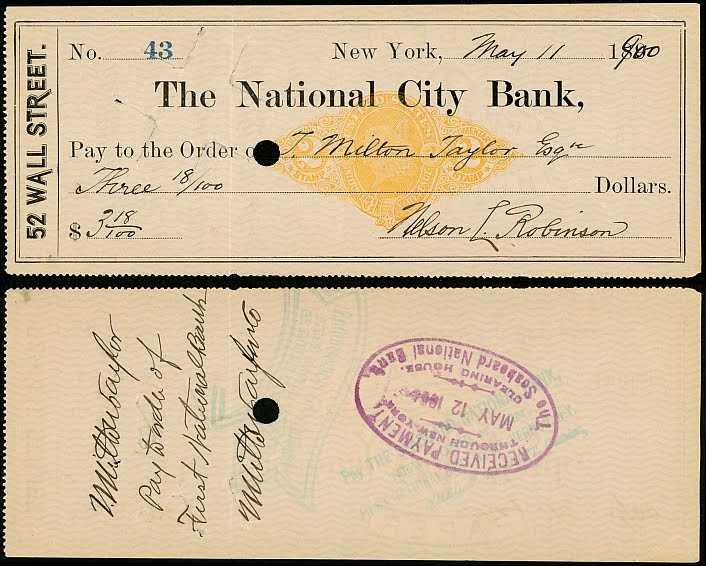

To understand the intricacies of third-party checks, we must first understand their nature. A third-party check is simply a check that has been made payable to someone, who then endorses it over to a third person or entity. Imagine, for instance, receiving a check as a birthday gift. You could endorse this check and pass it on to a friend to settle a debt, making it a third-party check. While seemingly straightforward, the acceptance of these checks by banks often hinges on a delicate balance of factors.

Banks operate in an environment where mitigating risk is paramount. Third-party checks, by their very nature, introduce an additional layer of complexity. Unlike a check you deposit from the original payee, a third-party check carries the history of an additional transaction, increasing the possibility of fraud or complications. This is not to say that all third-party checks are inherently risky, but banks are understandably cautious in their approach.

The acceptance of third-party checks can vary significantly depending on the bank, the specific circumstances surrounding the check, and even the individuals involved. Some banks may readily accept them as part of their regular operations, while others might have stricter policies in place. Understanding these nuances is crucial for navigating the world of third-party checks effectively and avoiding potential pitfalls.

Advantages and Disadvantages of Accepting Third-Party Checks

| Advantages | Disadvantages |

|---|---|

| Convenience for the payee | Increased risk of fraud |

| Can be used to settle debts or make payments | Potential for delays in funds availability |

| May be one of the few options for unbanked individuals | Some banks may be hesitant to accept them |

While the world of finance continues to evolve, the enduring relevance of checks, including third-party checks, cannot be ignored. Understanding their intricacies empowers individuals and businesses alike to navigate the financial landscape with confidence and clarity.

Unveiling the comfort your guide to hotel seri malaysia kepala batas

The rollercoaster of emotions understanding borderline personality disorder symptoms

Decoding the world of virginia public servants

List of 10+ Third Party Check Cashing Places Near Me 2023 - Khao Tick On

does walmart cash third party checks - Khao Tick On

How To Cash Third Party Check Online Instantly - Khao Tick On

do banks take third party checks - Khao Tick On

Where Can I Cash a Third Party Check? - Khao Tick On

Finance Tips: Where Can I Cash a Third - Khao Tick On

What Banks Cash Third Party Checks - Khao Tick On

do banks take third party checks - Khao Tick On

Why do Banks Hold Checks? (with pictures) - Khao Tick On

When taking home financing, the prominent or loan amount is the biggest - Khao Tick On

How To Cash A Third Party Business Check - Khao Tick On

Who Cashes Third Party Checks Near Me? [+Endorsing] - Khao Tick On

Cashing Third Party Checks (Everything to Know) - Khao Tick On

Everything You Need to Know About Cashing a Third Party Check - Khao Tick On

do banks take third party checks - Khao Tick On

![Who Cashes Third Party Checks Near Me? [+Endorsing]](https://i2.wp.com/bucksandcents.com/wp-content/uploads/2021/05/Third-Party-Checks.jpg)