Need to send money quickly and securely? Wire transfers are a common choice, and if you're a Wells Fargo customer, understanding the process is key. This article covers essential information about Wells Fargo wire transfers, helping you navigate the system effectively.

When it comes to moving funds electronically, wire transfers offer a reliable method, especially for larger sums. Whether you're sending money domestically or internationally, Wells Fargo provides options for initiating these transactions. However, knowing where to find the appropriate contact information and understanding the associated procedures is crucial for a smooth experience.

Locating a specific Wells Fargo wire transfer phone number can sometimes be challenging. Information may be dispersed across the Wells Fargo website or available through their customer service line. This article aims to simplify the process by providing helpful tips and insights into accessing the necessary resources.

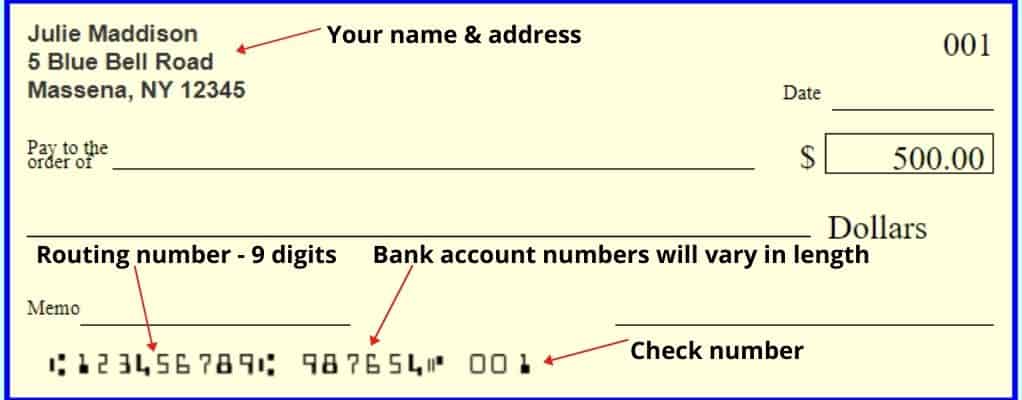

Before initiating a Wells Fargo wire transfer, it's essential to gather all the required information. This typically includes the recipient's bank details, such as their account number and SWIFT code for international transfers. Having accurate information readily available can prevent delays and ensure your transfer goes through without a hitch.

Understanding the fees associated with Wells Fargo wire transfers is another important consideration. Fees can vary depending on whether the transfer is domestic or international, and it's wise to familiarize yourself with the current fee schedule before initiating a transaction. This information can usually be found on the Wells Fargo website or by contacting customer service.

The history of wire transfers dates back to the late 19th century with the invention of the telegraph. Financial institutions began using this technology to transmit funds electronically between branches and other banks. Today, wire transfers are a vital component of the global financial system.

Security is paramount when it comes to Wells Fargo wire transfers. The bank employs various measures to protect your financial information, and it's essential to be aware of these security protocols. For instance, verifying recipient information carefully and being cautious of phishing scams can help safeguard your funds.

One benefit of using Wells Fargo for wire transfers is the established network and infrastructure. Wells Fargo is a major financial institution with a vast network, facilitating efficient transfer processing. Additionally, their customer service is available to assist with any questions or concerns.

Another benefit is the speed of wire transfers. While not instant, they are typically faster than other transfer methods like ACH transfers. This can be particularly advantageous when time is of the essence.

Before initiating a Wells Fargo wire transfer: gather the recipient's bank details, understand the associated fees, and ensure you have the correct contact information for initiating the transfer. This can be a Wells Fargo wire transfer phone number or using their online platform.

Advantages and Disadvantages of Wire Transfers

| Advantages | Disadvantages |

|---|---|

| Speed | Cost |

| Security | Irreversible |

Best practices: Verify recipient details, use strong passwords, be wary of phishing scams, keep records of your transactions, and contact Wells Fargo customer service if you encounter any issues.

Frequently Asked Questions: What information do I need to send a wire transfer? How long does a wire transfer take? What are the fees? How do I track my wire transfer? What if there's an error? Is it safe? What are the alternatives to wire transfers? Who do I contact for support?

Tips: Use Wells Fargo's online platform for convenience. Keep your login credentials secure. Double-check all information before submitting a transfer.

In conclusion, Wells Fargo wire transfers offer a reliable and efficient method for sending money electronically. By understanding the process, associated fees, and security measures, you can ensure a smooth and secure transaction. Utilizing the resources available, such as the Wells Fargo website and customer service, can help you navigate the system effectively and address any questions or concerns. Remember to prioritize security, verify recipient information carefully, and stay informed about best practices to protect your financial interests. Taking these steps can empower you to make informed decisions and utilize Wells Fargo wire transfers with confidence. Remember to always contact Wells Fargo directly for the most up-to-date and accurate information regarding their services and policies.

Level up your life why final fantasy vi advance is more than just a game

Decoding the evil eye color chart meanings and myths

Finding the perfect fit your guide to baseball skull caps with visors

Wells Fargo Wire Transfers Guide For Global Use - Khao Tick On

Reading Your Credit Card Statement - Khao Tick On

Wells fargo aba routing number for wire - Khao Tick On

How Long Does a Wire Transfer Take With Wells Fargo - Khao Tick On

Routing Account Number Information for Your Wells Fargo Accounts - Khao Tick On

Check Wells Fargos SWIFTBIC Code Before You Transfer - Khao Tick On

How Long Does a Wells Fargo Wire Transfer Take - Khao Tick On

Wells Fargo Routing Number Heres How to Find Yours Instantly - Khao Tick On

How to Do a Wire Transfer With Wells Fargo A Step - Khao Tick On

How Long Does a Wire Transfer Take With Wells Fargo - Khao Tick On

How to Do a Wells Fargo Wire Transfer - Khao Tick On

Wells Fargo SWIFTBIC Code is WFBIUS6S - Khao Tick On

How To Quickly Spot a Wells Fargo Scam Text 2023 Update - Khao Tick On

How Long Do Wells Fargo Wire Transfers Take - Khao Tick On

Routing Account Number Information for Your Wells Fargo Accounts - Khao Tick On