Remember that little booklet of paper rectangles that felt strangely official? In a world of instant transfers and digital wallets, you might think, "Checks? Are those still a thing?" They are! Sometimes the old-school ways are still the way to go, and you might find yourself needing to write a check for rent, pay a babysitter, or send money to a relative. If you're a Chase customer and need to get your hands on some checks, we've got you covered.

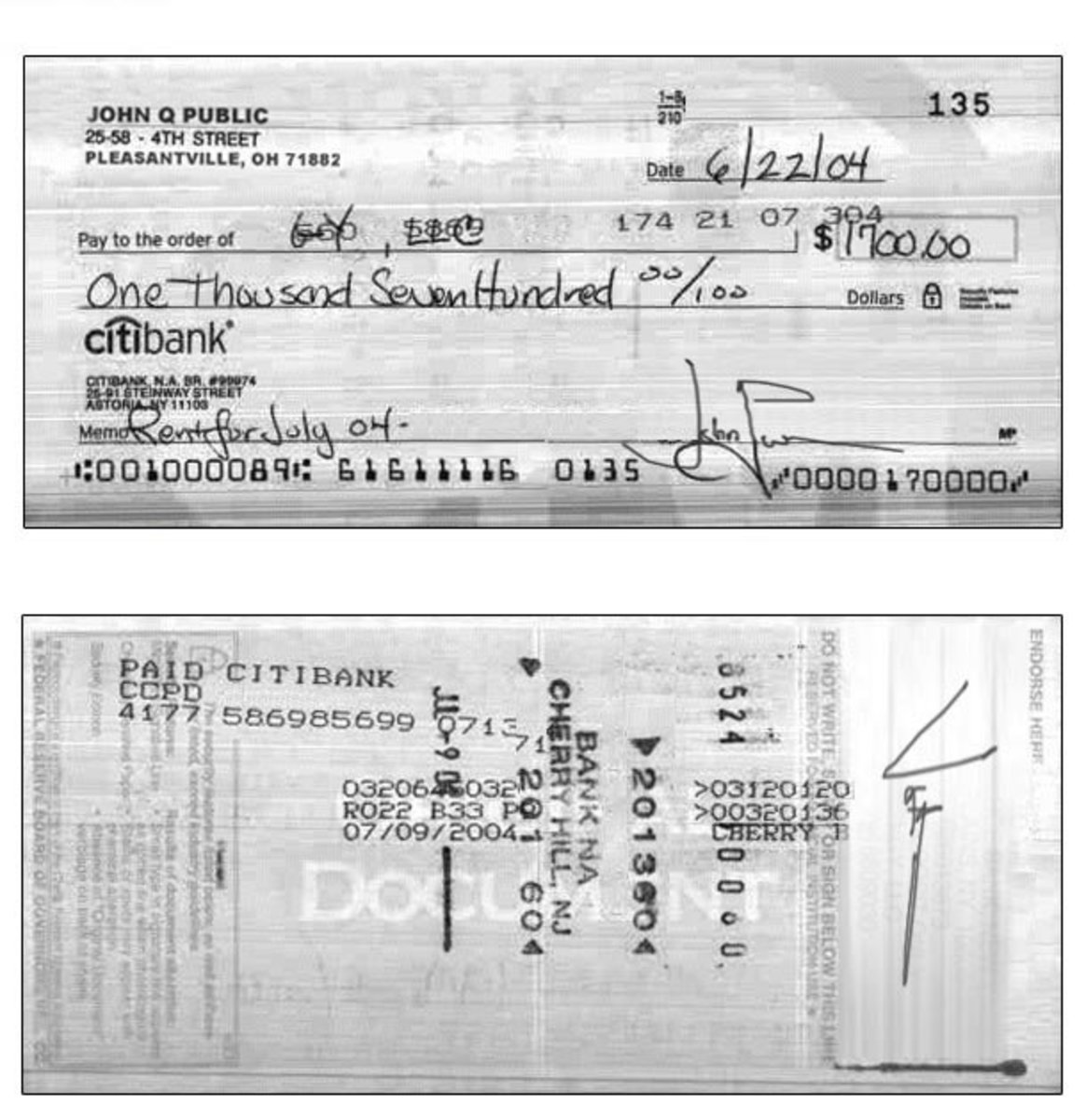

The beauty of checks is their simplicity. They represent a straightforward way to transfer funds, requiring nothing more than your signature. No need to worry about internet connections, app downloads, or complicated technology. This straightforward approach has kept checks relevant for centuries.

Their history goes back to ancient forms of payment, evolving alongside banking systems. While technology has revolutionized how we handle money, checks provide a sense of security and tangibility that digital methods sometimes lack. They offer a paper trail, literally, which can be invaluable for record-keeping and resolving any potential discrepancies.

However, this simplicity also comes with its own set of considerations. The main issue with checks is the potential for loss, theft, or even forgery. That's why it's essential to understand the security features and best practices for ordering, writing, and storing your checks.

Ordering checks from Chase Bank is easier than you might think. You can waltz into your local branch and have a chat with a friendly representative. They'll guide you through the process, answer any questions you might have, and even show you samples so you can choose a design that speaks to you. But if venturing out isn't your cup of tea, no worries! Chase understands the beauty of convenience. You can order checks online through their user-friendly website or even through their mobile app. It's all about making your life easier.

Advantages and Disadvantages of Using Checks

| Advantages | Disadvantages |

|---|---|

| Tangible and familiar | Slower processing time |

| Widely accepted | Risk of loss or theft |

| Clear paper trail | Potential for overdrafts |

While technology has brought us amazing advancements in managing our finances, there's something reassuring about the tangibility of checks. They bridge the gap between the traditional and the modern, offering a sense of familiarity in a fast-paced world.

So, whether you're a seasoned check-writer or a newbie navigating the world of personal finance, remember that getting checks from Chase Bank is a breeze. With multiple convenient options at your fingertips, you can confidently tackle any transaction that comes your way.

Unlocking the legend the mystery of the huang bai american dragon

Unlocking the power of la vaca lola la a comprehensive guide

Navigating medicare supplement plans with part d coverage

Chase Cashier's Check Template - Khao Tick On

Chase Cashier's Check Template - Khao Tick On

6 Best Images of Personalized Printable Play Checks - Khao Tick On

Resultado de imagen para bank of america usa cashiers check samples - Khao Tick On

how do i get checks from chase bank - Khao Tick On

Personal checks printing jets - Khao Tick On

How To Order Checks via Chase: Online, Vendor Site or by Phone - Khao Tick On

how do i get checks from chase bank - Khao Tick On

How to funds a house expansion? - Khao Tick On

Chase Bank, Jpmorgan Chase, Tomball, Beth, Save, Quick - Khao Tick On

chase bank irs refund 9 chase bank cashier s check resume pdf - Khao Tick On

Chase Checks Instantly Print Online On Any Printer Yourself - Khao Tick On

Get Your Funds Faster With Chase Mobile Check Deposits - Khao Tick On

Wiring Money To Chase Bank - Khao Tick On

The Top 5 Most Common Check - Khao Tick On