We live in a world increasingly reliant on digital transactions, yet the paper check persists. It’s a tangible symbol of a promise kept, a debt settled, or a gift given. But what happens when you need to transfer that promise, that payment, to someone else? You might need to endorse a check to a third party. Let's unravel the mystery behind this financial maneuver, specifically focusing on how it works with Chase Bank.

Imagine this: your friend owes you money, but instead of sending it directly, their kind aunt sends you a check. Now you need to use that money to pay your landlord, who only accepts checks. Instead of going through the hassle of depositing the check and waiting for it to clear, you can endorse it directly to your landlord.

Endorsing a check over to a third party is a common practice, but it comes with its own set of rules and precautions. Chase Bank, like all financial institutions, has specific procedures to ensure the security of these transactions. Understanding these steps is vital to ensure your money ends up in the right hands.

We'll delve into the intricacies of third-party check endorsements at Chase, covering everything from the basic definition to potential pitfalls and best practices. By the end of this, you'll be well-equipped to navigate this financial transaction with confidence.

Whether you're a seasoned check-writer or new to the world of paper transactions, this guide will equip you with the knowledge to endorse checks to third parties at Chase without a hitch.

Advantages and Disadvantages of Third-Party Check Endorsements

| Advantages | Disadvantages |

|---|---|

| Convenience: Enables quick transfer of funds without needing separate deposits. | Security Risks: Increases the possibility of fraud or loss if not handled carefully. |

| Speed: Can be faster than waiting for a deposited check to clear. | Limited Acceptance: Not all businesses or individuals may accept third-party checks. |

Best Practices for Endorsing Checks to Third Parties at Chase

To ensure a smooth and secure transaction, follow these best practices:

- Confirm with the Recipient: Before endorsing, ensure the third party (and their bank) accepts third-party checks.

- Use the Correct Endorsement: Write "Pay to the order of [Third Party's Name]" clearly above your signature.

- Provide Identification: Be prepared to present valid identification at the bank if required.

- Communicate with the Third Party: Inform them about the check and confirm receipt.

- Keep Records: Retain a copy of the endorsed check and any related documentation for your records.

Common Questions and Answers

1. Is there a limit on the amount I can endorse to a third party?

Chase Bank may have specific limits for third-party check endorsements, especially for large amounts. It's advisable to contact them directly or refer to their policies.

2. What if I make a mistake while endorsing the check?

It's crucial to endorse the check correctly. If you make an error, it's best to void the check and request a new one from the issuer.

3. Can I endorse a check to a third party if it's made out to multiple people?

If the check is payable to multiple parties, all payees may need to endorse it for the third-party endorsement to be valid.

4. What happens if a third-party check I endorsed is lost or stolen?

Immediately report the lost or stolen check to Chase Bank. They can advise on the necessary steps to prevent fraudulent use.

5. Can I endorse a check to a third party at a Chase ATM?

Chase ATMs are generally not equipped to process third-party check endorsements. You'll likely need to visit a branch or contact customer service.

6. How long does it take for a third-party check to clear at Chase?

The clearing time for third-party checks can vary. Chase Bank may place a hold on the funds, especially for larger amounts.

7. Are there any fees associated with endorsing a check to a third party at Chase?

Chase Bank may charge fees for certain transactions, including third-party check endorsements. It's essential to inquire about potential fees beforehand.

8. What if the third party has an account at a different bank?

The process remains largely the same. The third party can deposit the endorsed check into their account at their respective bank.

Tips and Tricks for Smooth Check Endorsements

- Write Legibly: Ensure all information on the endorsement is clear and easy to read.

- Double-Check Everything: Carefully review the payee's name and endorsement details before finalizing.

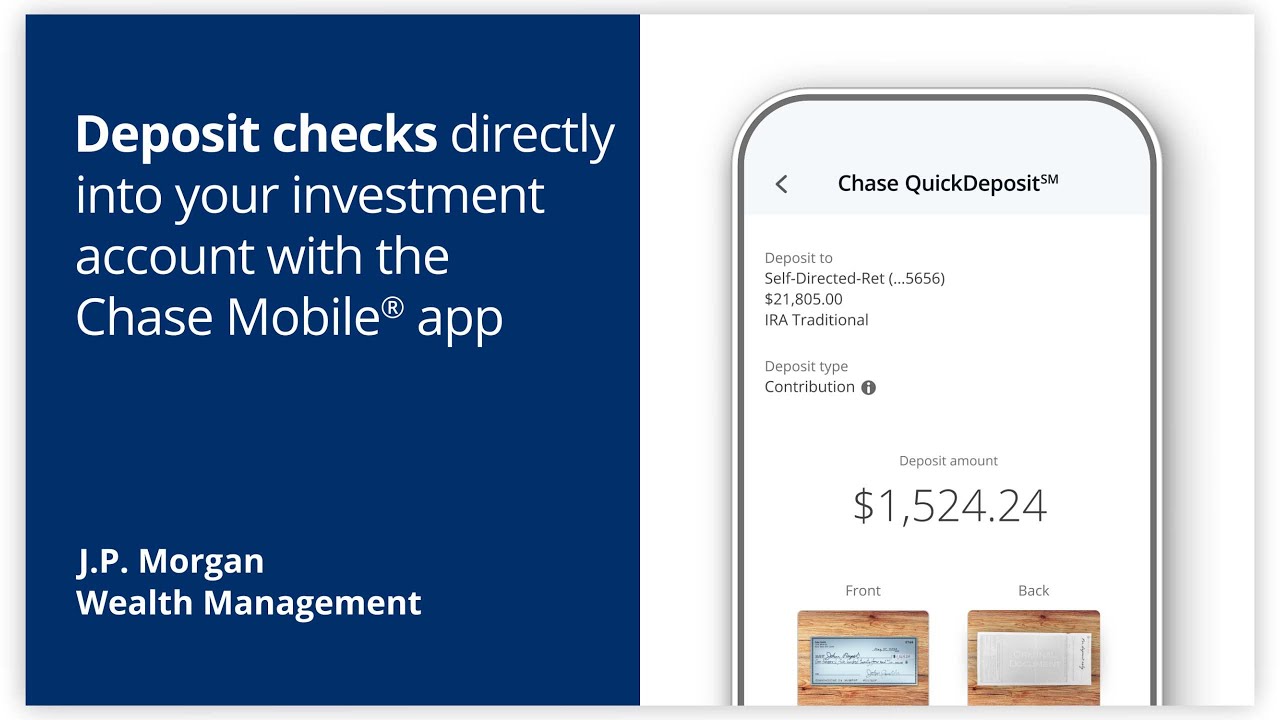

- Consider Mobile Deposit: If possible, explore depositing the check yourself via mobile banking and then transferring the funds electronically to the third party.

Endorsing a check to a third party might seem like navigating a labyrinth of financial regulations. However, armed with the right knowledge and a cautious approach, it becomes a straightforward process. Remember to prioritize security, communicate clearly, and always clarify any doubts with your bank. Whether you're splitting rent with a roommate or helping a family member, mastering this financial tool empowers you to manage your money with confidence and ease.

Navigating midlife transformation carl jungs 7 tasks

Reflecting style elevating your bathroom with modern farmhouse vanity mirrors

Discover the royal ballroom maryland experience

Everything You Need to Know About Cashing a Third Party Check - Khao Tick On

ATM deposits » RBC Bank - Khao Tick On

Check stock is dead, long live the 3rd Party Check - Khao Tick On

Chase Bank Name And Address (How To Receive Direct, 50% OFF - Khao Tick On

how to endorse a check to third party chase - Khao Tick On

Expert Advice on How to Endorse a Check - Khao Tick On

Cách để Ký Phát Một Tấm Séc: 12 Bước (kèm Ảnh) - Khao Tick On

When Writing Checks As Power Of Attorney - Khao Tick On

How to Endorse a Check: Step - Khao Tick On

How to Endorse a Check for Mobile Deposit - Khao Tick On

Expert Advice on How to Endorse a Check - Khao Tick On

Get Your Funds Faster With Chase Mobile Check Deposits - Khao Tick On

How To Cash Check With Someone Else's Name On It Hotsell - Khao Tick On

Endorse a Multi Party Check - Khao Tick On

How to Endorse Chase Bank Mobile Deposit? - Khao Tick On

:max_bytes(150000):strip_icc()/how-to-endorse-a-check-5188585-final-ab454e2011404be5a1fd65f1453db0ce.png)