Need to make a quick online payment? Setting up direct deposit? Knowing where to find your checking account number on your checkbook is essential for various financial transactions. This comprehensive guide will walk you through the process of locating your account number, explain its significance, and provide best practices for keeping your financial information safe.

Dealing with financial matters often requires having your checking account number readily available. From setting up bill pay to transferring funds, this crucial piece of information acts as the key to accessing and managing your funds. Understanding how to locate your account number on your checks prevents delays and ensures smooth financial transactions.

Checks, despite the rise of digital banking, remain a common method of payment and a tangible record of your transactions. Each check contains key identifying numbers, including your account number, the bank's routing number, and the check number. Locating these numbers is straightforward once you understand their placement on a standard check.

Historically, checks were handwritten documents used for transferring funds. The modern check, with its pre-printed information and standardized format, evolved to simplify and secure financial transactions. Knowing where to find your account number on a check is a fundamental aspect of managing your personal finances.

Identifying your account number is vital for numerous financial operations. It is required for setting up direct deposit, making electronic payments, transferring money between accounts, and verifying your identity for various banking services. Without ready access to your account number, completing these tasks becomes cumbersome and sometimes impossible.

Your checking account number is a unique series of digits assigned to your account by your financial institution. This number typically appears at the bottom of your check, printed alongside the bank's routing number and the check number. It is usually the second set of numbers, positioned between the routing number and the check number.

Finding your checking account number is simple. Look at the bottom of your check. You’ll see three groups of numbers. The first group is the routing number, the middle group is your account number, and the third group is the check number.

Benefits of knowing where your checking account number is located include efficient transaction processing, convenient access to online banking services, and the ability to quickly provide the necessary information when required for various financial activities.

Here’s a step-by-step guide: 1. Grab a check from your checkbook. 2. Examine the bottom of the check. 3. Locate the three sets of numbers. 4. Your account number is the middle set of numbers.

Advantages and Disadvantages of Knowing Where to Find Your Account Number

| Advantages | Disadvantages |

|---|---|

| Faster Transactions | Potential Security Risk if Check is Lost |

Best practices for keeping your account number safe include storing your checkbook in a secure location, shredding voided checks, and refraining from sharing your account information with unauthorized individuals.

Real-world examples: Setting up direct deposit, making online bill payments, transferring funds between accounts, verifying your identity for banking services, and providing your account information for loan applications.

Frequently Asked Questions:

1. What if I can’t find my checkbook? Contact your bank.

2. What if my account number is illegible? Order new checks.

3. Is my account number the same as my debit card number? No.

4. How can I protect my account number? Store checks securely.

5. What if someone else has my account number? Notify your bank.

6. How long is a checking account number? It varies by bank.

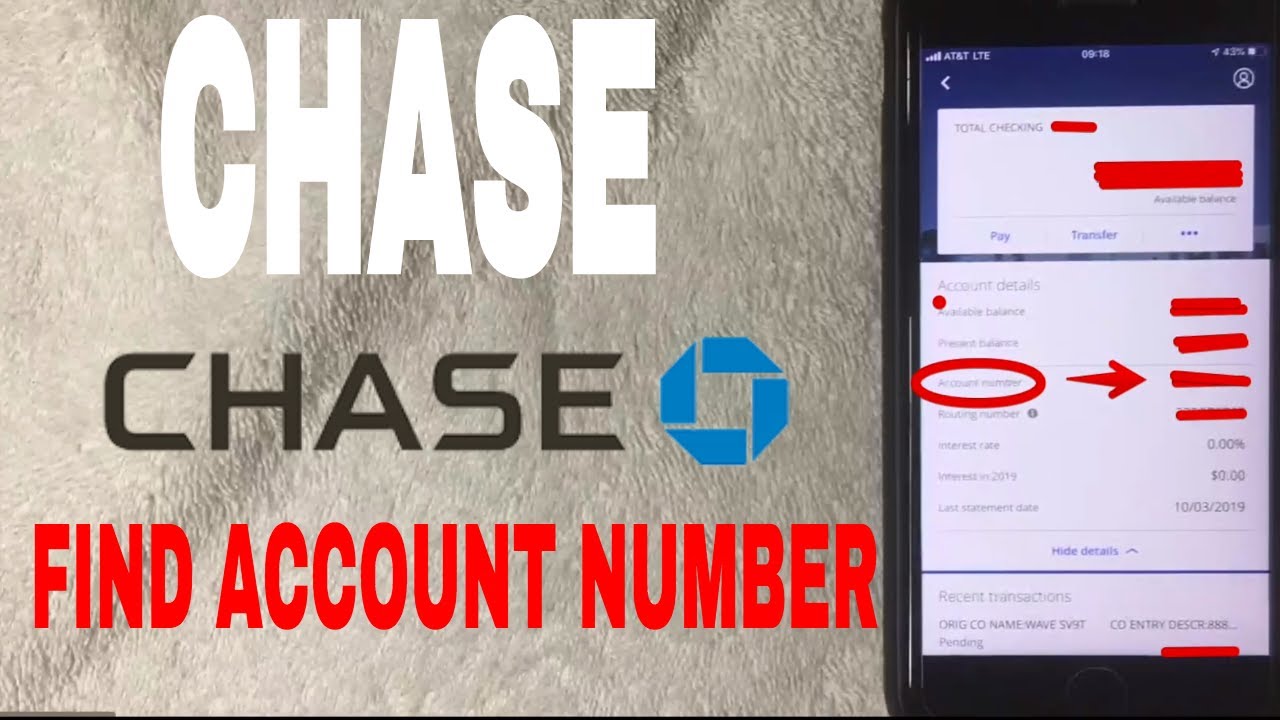

7. What if I don't have any checks left? Online banking often displays your account number.

8. Can I find my account number on my bank statement? Yes.

Tips: Keep your checkbook in a safe place. Regularly check your bank statements for any discrepancies.

In conclusion, knowing where to find your checking account number on your checkbook is crucial for managing your finances effectively. Understanding its placement on your check enables quick access to your account information for various transactions, from online bill pay to setting up direct deposit. Protecting this vital information through secure storage and responsible handling is essential for safeguarding your financial well-being. By familiarizing yourself with the location of your account number and practicing safe banking habits, you can streamline your financial activities and ensure the security of your funds. Remember to always contact your bank immediately if you suspect any unauthorized access to your account information.

The ultimate guide to send this to your best friend memes

Navigating indiana employment law your essential guide

Unlocking numbers exploring addition and subtraction

Bank Of America Aba Wiring Number - Khao Tick On

Unveiling the Secrets of Transferring Funds from Forex Cards to Chase - Khao Tick On

How to Find Your Banks Routing Number - Khao Tick On

Hvad er rutingnummeret på en check og hvordan fungerer det - Khao Tick On

How To Check Account Number In Electricity Bill - Khao Tick On

Where do I find my routing number - Khao Tick On

How to get direct deposit form CIBC App PC - Khao Tick On

where to find account number on check book - Khao Tick On

Checking Account Check Registers 1 Answers at Linda Greenfield blog - Khao Tick On

Where Do I Find My Virtual Account Number For Us Visa - Khao Tick On

where to find account number on check book - Khao Tick On

How To Wire Transfer Navy Federal - Khao Tick On

where to find account number on check book - Khao Tick On

Is Wells Fargo Bank In Trouble 2024 - Khao Tick On

where to find account number on check book - Khao Tick On

:max_bytes(150000):strip_icc()/where-is-the-account-number-on-a-check-315278_final-30e94da21d1644329716939bef5107ac.png)