Planning to send money abroad? You're likely exploring options like Western Union, a prominent name in international money transfers. But before you commit, wouldn't it be helpful to know exactly how much it will cost? This is where a Western Union cost estimator for the UK comes in handy.

A Western Union fee calculator UK allows you to quickly gauge the overall expense of your transaction. This typically includes both the transfer fee and the exchange rate applied to your money. Having a clear understanding of these costs empowers you to make informed decisions, ensuring you get the most value for your money.

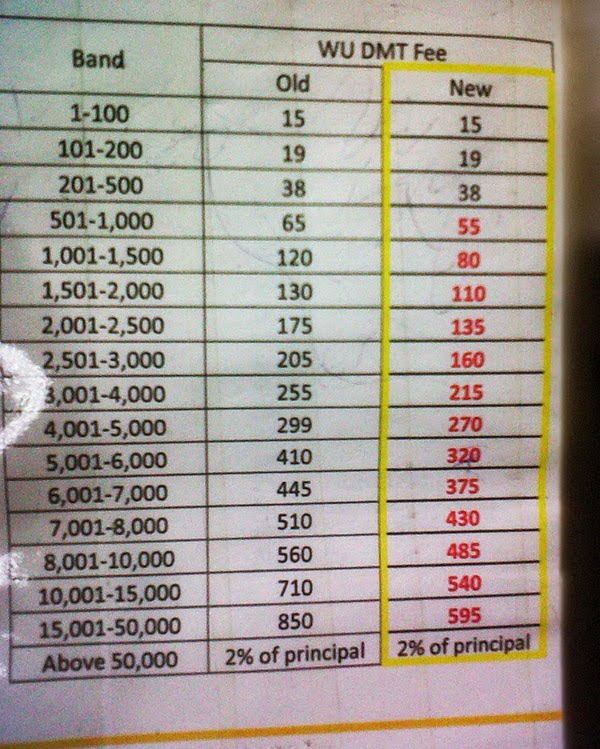

Estimating Western Union transfer charges in the UK involves several factors. The amount you're sending, the destination country, and how the recipient will receive the funds (cash pickup or bank transfer) all play a role. A Western Union transfer cost calculator UK takes these variables into account, providing a more precise cost estimate.

Navigating the world of international money transfers can be complex. Exchange rates fluctuate, and fees can vary significantly between providers. Using a Western Union price checker UK helps simplify this process, offering transparency and control over your transfer expenses.

Western Union has a long history, originating in the US in 1851 as a telegraph company. It evolved into a financial services company, becoming a major player in global money transfers. The ability to quickly send and receive money internationally is undeniably important, particularly for immigrants sending remittances or businesses making cross-border payments. A Western Union cost projection tool for the UK becomes essential for managing these financial flows effectively.

One key issue related to calculating Western Union costs in the UK is the fluctuating exchange rate. These changes can impact the final amount the recipient receives. Tools like a Western Union UK calculator are designed to account for these variations, offering real-time or near real-time exchange rate information for more accurate estimations. Another issue can be variations in fees based on the chosen transfer method. Online transfers might have different fees compared to transactions conducted in a physical agent location. Using a Western Union cost estimator for UK transfers can illuminate these differences.

A "Western Union Calculator UK" essentially refers to any online tool that helps estimate the cost of sending money via Western Union from the United Kingdom. For example, if you want to send £100 to India, a calculator can show you the transfer fee, the exchange rate applied, and the final amount in Indian Rupees the recipient will get. This avoids surprises and ensures transparency.

While Western Union provides its own online cost estimator, third-party tools also exist. These might offer comparison features, allowing you to check prices against other money transfer providers, helping you find the most competitive deal.

Finding a reliable Western Union cost calculator UK requires some online searching. Keywords like "Western Union fees UK," "Western Union exchange rates," or "Western Union transfer calculator" can help you find these tools.

Advantages and Disadvantages of Using a Western Union Calculator UK

| Advantages | Disadvantages |

|---|---|

| Transparency in cost estimation | Estimates may not be perfectly accurate due to fluctuating exchange rates |

| Empowers informed decision-making | Requires internet access to use online calculators |

| Facilitates comparison shopping | Not all third-party calculators may be reliable or up-to-date |

Frequently Asked Questions:

1. What is a Western Union Calculator UK? - A tool to estimate the cost of sending money via Western Union from the UK.

2. Why use a calculator? - For transparency and cost control.

3. Where can I find one? - On Western Union's website or through search engines.

4. Are the estimates accurate? - Generally yes, but exchange rates can fluctuate.

5. What information do I need? - Send amount, destination country, and receiving method.

6. Can I compare prices? - Yes, some calculators offer comparison features.

7. Are there fees for using the calculator? - No, calculators are generally free to use.

8. Do I need a Western Union account to use a calculator? - Not typically.

In conclusion, understanding the costs associated with international money transfers is crucial. A Western Union cost calculator for the UK empowers you to make informed choices, ensuring your money goes further. By taking advantage of these readily available tools, you can navigate the complexities of exchange rates and fees, ultimately sending money abroad with confidence and peace of mind. Explore the various calculators available, compare options, and take control of your transfer expenses. Don't hesitate to leverage the power of information to make the best financial decisions for your needs.

Unleash your creativity dibujos caratulas de lengua y literatura

Boat washdown pump kits clean your boat like a pro

Expressing love the power of family love quotes

Send money online from Qatar - Khao Tick On

western union calculator uk - Khao Tick On

Uneinigkeit schnurlos Käfig western union fee calculator Wohlergehen - Khao Tick On

western union calculator uk - Khao Tick On

Fee For Wiring Money - Khao Tick On

Caqui Calle Collar sin mangas Tela Letras Chaleco Embellished No - Khao Tick On

hacken berühmt Prallen western union currency converter calculator - Khao Tick On

Western Union Transfer Fees Chart A Visual Reference of Charts - Khao Tick On

western union calculator uk - Khao Tick On

western union calculator uk - Khao Tick On

Princess Dress Up Games Ice Princess 3d Model Character Character - Khao Tick On

Western Union Fees Calculator Outlet Sale Save 66 - Khao Tick On

Western Union Fees Calculator Outlet Discount Save 44 - Khao Tick On

western union calculator uk - Khao Tick On

Cat Family Yajamuka Kupa Mai TT Mari Mushure Mekunge Wasu Aposta - Khao Tick On