Need to send money quickly and securely to a Wells Fargo account? Wire transfers offer a reliable method for transferring funds electronically, making them a popular choice for various transactions, from large purchases to international remittances. This guide will walk you through the process of initiating a wire transfer to a Wells Fargo account, covering essential details and best practices.

Moving money across accounts or even across borders is a fundamental aspect of modern finance. While various methods exist, wire transfers remain a cornerstone for larger sums or time-sensitive transactions. Understanding the mechanics of a wire transfer empowers you to manage your finances effectively. Whether you're sending money for a down payment, supporting family abroad, or conducting business transactions, knowing how to initiate a wire transfer to Wells Fargo is a valuable skill.

Wire transfers have a long history, evolving from telegraphic transfers in the 19th century. Today, they leverage sophisticated electronic networks to move money swiftly and securely. The importance of understanding this process lies in its widespread use and its ability to facilitate crucial financial operations. However, navigating the complexities of wire transfers can sometimes be challenging, particularly when dealing with international transfers or ensuring accuracy in recipient details.

The core of sending a wire transfer to Wells Fargo, whether domestically or internationally, revolves around accurate information. This includes the recipient's full name and account number, the Wells Fargo bank's routing number (for domestic transfers) or SWIFT code (for international transfers), and the receiving bank's address (for international transfers). Missing or incorrect information can lead to delays, returned transfers, or even loss of funds. Therefore, meticulous attention to detail is paramount.

Before initiating a wire transfer, gather all the necessary details. For domestic transfers, you'll need the recipient's Wells Fargo account number and the bank's routing number. International transfers require the recipient's account number, the Wells Fargo SWIFT code, and the receiving bank's full address. Contact Wells Fargo or the recipient to confirm these details. Double-checking information is crucial to avoid errors and ensure a smooth transfer.

Benefits of using wire transfers include speed, security, and reliability. They are generally faster than other methods like checks, offering same-day or next-day delivery in many cases. The secure electronic systems used for wire transfers minimize the risk of fraud or theft. Finally, their reliability makes them suitable for important transactions where timely and secure delivery is essential.

Steps to initiate a wire transfer: 1) Gather recipient and bank information. 2) Visit your bank or use their online platform. 3) Fill out the wire transfer form accurately. 4) Review and confirm the details. 5) Authorize the transfer.

Advantages and Disadvantages of Wire Transfers

| Advantages | Disadvantages |

|---|---|

| Speed | Cost |

| Security | Irreversible |

| Reliability | Requires accurate information |

Best Practices: 1) Double-check recipient details. 2) Use secure banking platforms. 3) Keep transfer records. 4) Be wary of fraud. 5) Contact your bank for any issues.

Frequently Asked Questions: What information is needed for a domestic wire transfer? What is a SWIFT code? How long does a wire transfer take? What are the fees associated with wire transfers? Can I cancel a wire transfer? What if the recipient's information is incorrect? How can I track my wire transfer? Who should I contact if I encounter problems?

Tips for sending wire transfers: Always verify information. Use reputable banking institutions. Be aware of potential scams. Keep records of your transactions. If anything seems amiss, contact your bank immediately.

Sending a wire transfer to a Wells Fargo account offers a secure and efficient method for moving funds. By understanding the process, gathering the correct information, and following best practices, you can ensure a seamless transaction. The ability to quickly and reliably transfer funds empowers individuals and businesses to manage their finances effectively, facilitating various crucial transactions. From paying for large purchases to supporting loved ones across borders, wire transfers play a vital role in the modern financial landscape. Take the time to understand the process, and don't hesitate to contact your bank or Wells Fargo if you have any questions or concerns. A little preparation can go a long way in ensuring a smooth and successful transfer experience.

Unleash your inner child the power of playful backgrounds

Unlocking opportunities your guide to universidad mariano galvez san jose pinula

Exploring the world of deku and bakugou fanfiction families

FREE 15 Wire Transfer Form Samples PDF MS Word Google Docs Excel - Khao Tick On

How to Do a Wire Transfer With Wells Fargo A Step - Khao Tick On

Wells Fargo Credit Card Autopay - Khao Tick On

Wells Fargo Bank Transfer - Khao Tick On

Transfer from Wells Fargo Online to Prepaid Card - Khao Tick On

Wells Fargo Routing Numbers and Swift Code How to send online - Khao Tick On

Top 10 what information do i need to receive an international wire - Khao Tick On

Blank Wells Fargo Bank Statement Template - Khao Tick On

Wire Transfer Domestic An Easy WayTto Send Money - Khao Tick On

Wells Fargo Wire Transfer edit and sign form - Khao Tick On

Wiring Money With Wells Fargo - Khao Tick On

Wells Fargo Check Template - Khao Tick On

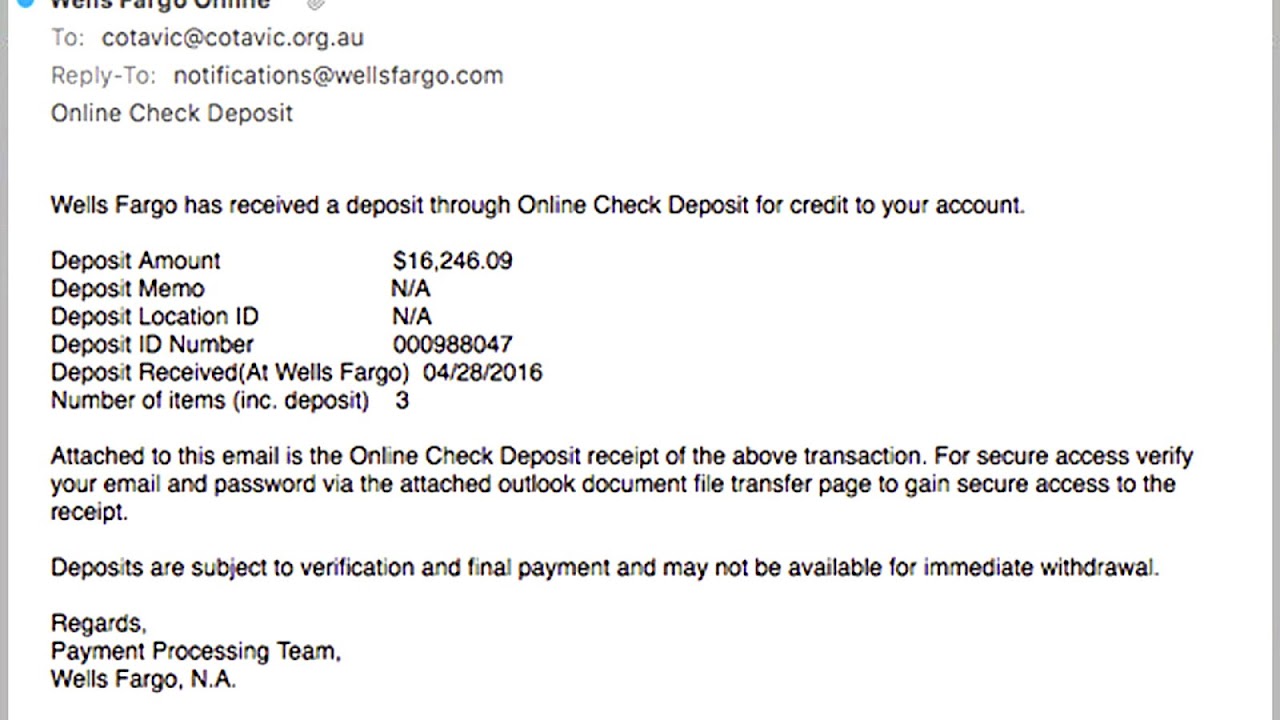

ANZ Wells Fargo Westpac The Latest Bank Brands Used By CyberCrime - Khao Tick On

Wells Fargo My Routing Number - Khao Tick On

Wiring Instructions For Wells Fargo - Khao Tick On