In the bustling state of Selangor, amidst the pursuit of success and prosperity, lies a fundamental pillar of Islamic faith: Zakat. This act of worship, deeply rooted in principles of social justice and compassion, requires Muslims to contribute a portion of their wealth to benefit the less fortunate. One crucial aspect of this is "Zakat Pendapatan" - zakat on income earned. Navigating the intricacies of Zakat calculation might seem daunting, but understanding the principles of "Kira Zakat Pendapatan Selangor" can simplify the process, allowing you to fulfill this religious obligation with ease and confidence.

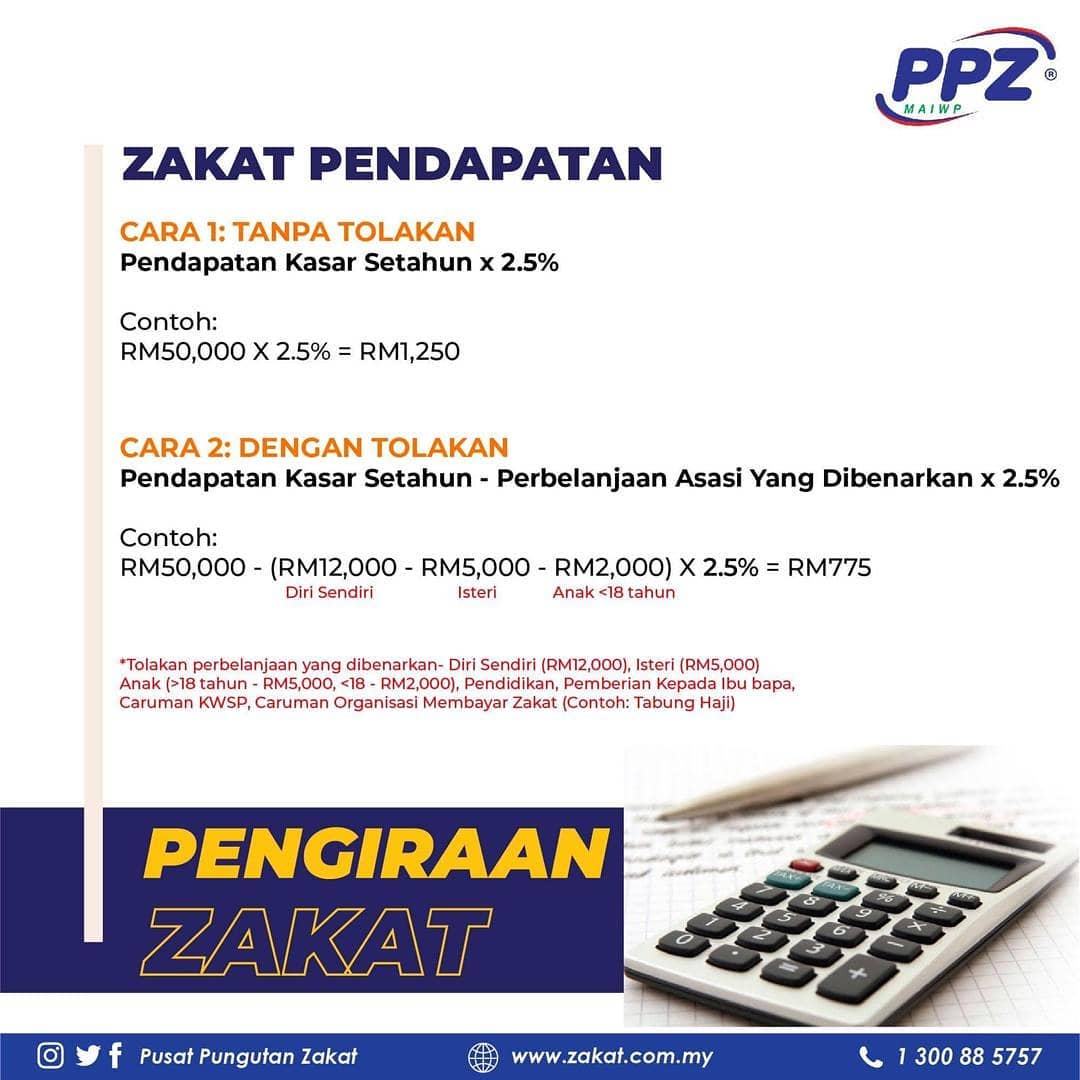

"Kira Zakat Pendapatan Selangor" refers to the calculation of zakat on income earned by residents of Selangor, Malaysia. This calculation considers various factors, including your income sources, allowable deductions, and the current Nisab value (the minimum threshold of wealth that obligates zakat payment). By accurately calculating your zakat, you're not only fulfilling a religious duty but also contributing to the well-being of the community and fostering a spirit of shared prosperity.

Zakat, being one of the five pillars of Islam, holds immense historical and religious significance. It's mentioned extensively in the Quran and Hadith, underscoring its vital role in Islamic society. Historically, zakat served as a structured system of social welfare, ensuring the equitable distribution of wealth and fostering a sense of unity and support within the community. In contemporary society, its relevance remains undiminished, addressing issues of poverty, inequality, and social welfare.

One of the primary issues related to "Kira Zakat Pendapatan Selangor" is the lack of awareness and understanding surrounding its calculation. Many individuals remain unsure about the specific guidelines, deductions, and methods to accurately determine their zakat obligation. This often leads to either underpayment or delayed payments, hindering the full potential of this vital Islamic practice. To address this, accessible and reliable resources, like those provided by the Selangor Zakat Board, play a crucial role in simplifying the process and promoting greater compliance.

"Kira Zakat Pendapatan Selangor" is not merely a financial obligation but a multifaceted practice deeply intertwined with spiritual growth, social responsibility, and economic empowerment. By understanding its principles and fulfilling this obligation, Muslims in Selangor contribute to a more just and equitable society while reaping the spiritual rewards associated with this act of worship.

Advantages and Disadvantages of Kira Zakat Pendapatan Selangor

While the concept of Zakat inherently carries numerous benefits, understanding the practical aspects of "Kira Zakat Pendapatan Selangor" requires acknowledging both its advantages and potential challenges:

| Advantages | Disadvantages |

|---|---|

| Fulfillment of religious obligation | Potential for calculation errors if not done correctly |

| Purification of wealth and income | Lack of awareness about specific deductions and exemptions |

| Contribution to social welfare and poverty alleviation | Possible administrative hurdles or delays in payment processing |

Best Practices for Kira Zakat Pendapatan Selangor

- Utilize Online Zakat Calculators: Leverage the convenience of online zakat calculators provided by reputable Islamic institutions or the Selangor Zakat Board. These tools simplify the calculation process, ensuring accuracy and saving you time.

- Consult Official Guidelines: Refer to the official guidelines and FAQs provided by the Selangor Zakat Board for detailed information on income categories, deductions, and payment methods. This ensures compliance with the latest regulations.

- Maintain Accurate Financial Records: Keep thorough records of your income, expenses, and assets to facilitate accurate zakat calculation. This practice also proves beneficial for personal financial management.

- Seek Professional Advice: If you have complex financial situations or uncertainties regarding zakat calculation, consult a qualified Islamic scholar or financial advisor specializing in zakat matters.

- Automate Your Zakat Payments: Explore options for automated zakat deductions offered by some banks or financial institutions. This simplifies the payment process and ensures timely fulfillment of your obligation.

Common Questions and Answers About Kira Zakat Pendapatan Selangor

1. What types of income are zakatable in Selangor?

Zakat is obligatory on various income sources, including salaries, business profits, rental income, investments, and pensions, provided they meet the Nisab threshold.

2. What is the Nisab value for Zakat in Selangor?

The Nisab value fluctuates based on the current market price of gold or silver. It's advisable to refer to the Selangor Zakat Board website for the most up-to-date Nisab value.

3. Are there any deductions allowed when calculating Zakat Pendapatan?

Yes, certain expenses like basic living costs, debt repayments, and business expenses are deductible when calculating your taxable income for zakat.

4. Where can I pay my Zakat in Selangor?

You can conveniently pay your zakat through various channels, including the Selangor Zakat Board's official website, authorized banks, zakat collection centers, or online payment platforms.

5. What are the consequences of not paying Zakat?

Failing to pay zakat when obligated is considered a serious religious transgression. It deprives the needy of their due rights and hinders the circulation of wealth within the Muslim community.

6. Can I choose to whom my Zakat is distributed?

While it's generally advisable to entrust zakat distribution to authorized bodies like the Selangor Zakat Board, you can also distribute a portion of your zakat directly to eligible recipients within specific categories.

7. Is there a specific time frame for paying Zakat?

Zakat becomes due upon reaching the Nisab threshold and completing a lunar year (Hawl). However, you can pay your zakat anytime throughout the year based on your preference.

8. What are the benefits of paying Zakat?

Beyond fulfilling a religious duty, paying zakat brings numerous benefits, including purification of wealth, spiritual growth, fostering social harmony, and contributing to economic empowerment within the Muslim community.

Tips and Tricks for Kira Zakat Pendapatan Selangor

* Utilize the Zakat calculators provided by LZS (Lembaga Zakat Selangor) for accurate and easy calculations.

* Download the LZS mobile app for quick access to information, zakat payment options, and updates on your zakat contributions.

* Opt for online payment methods through LZS's website or authorized banks for convenient and secure transactions.

* Set reminders on your phone or calendar to keep track of your zakat due date and ensure timely payments.

In conclusion, understanding and fulfilling your "Kira Zakat Pendapatan Selangor" is an integral part of being a responsible Muslim in Selangor. It goes beyond a mere financial obligation, signifying a commitment to social justice, shared prosperity, and spiritual growth. By embracing the principles of zakat and utilizing the available resources, you can confidently navigate the calculation process, ensure accurate payments, and contribute to the well-being of your community. As we strive for success and prosperity, let us not forget the importance of compassion, empathy, and uplifting those in need. By fulfilling our zakat obligations, we actively participate in building a more equitable and harmonious society, embodying the true spirit of Islam.

Conquer anime worlds your roblox tower defense guide

Spread joy with buon sabato snoopy immagini

Decoding the ya no aguanto meme phenomenon

Cara Mudah Kira Zakat Pendapatan - Khao Tick On

kira zakat pendapatan selangor - Khao Tick On

Cara Kira Zakat Simpanan Yang Wajib Anda Tahu » EduBestari - Khao Tick On

kira zakat pendapatan selangor - Khao Tick On

Kira Zakat Ternakan Di KL & Selangor - Khao Tick On

Pengiraan Kalkulator Zakat Pendapatan Selangor Online - Khao Tick On

kira zakat pendapatan selangor - Khao Tick On

Cara Kira Zakat Pendapatan - Khao Tick On

Pengiraan Kalkulator Zakat Pendapatan Selangor Online - Khao Tick On

Syarat & Cara Kira Zakat Perniagaan Selangor Online - Khao Tick On

Cara Pengiraan Zakat Pendapatan dan Zakat Simpanan - Khao Tick On

kira zakat pendapatan selangor - Khao Tick On

Cara Kira Zakat Emas & Kadar Uruf Emas Setiap Negeri 2024 - Khao Tick On

kira zakat pendapatan selangor - Khao Tick On

Panduan Lengkap Zakat Pendapatan di Malaysia 2024 - Khao Tick On