Imagine this: a seamless, hassle-free way to fulfill your zakat obligations directly from your paycheck. In today's fast-paced world, where time is precious, wouldn't it be amazing to fulfill this important pillar of Islam with ease and efficiency? That's where the "Borang Potongan Gaji Zakat" comes into play – a system designed for convenience and impact.

Essentially, "Borang Potongan Gaji Zakat" translates to "Zakat Salary Deduction Form" in Malay. It's a voluntary system prevalent in Malaysia, allowing employees to automate their zakat payments. Instead of making manual payments each year, this form empowers you to authorize your employer to deduct a pre-determined amount of zakat directly from your salary. This amount is then channeled to the designated zakat collection agency.

But this system is more than just about convenience; it embodies a powerful blend of tradition and modernity. Zakat, one of the five pillars of Islam, is a spiritual obligation and a socioeconomic safety net. It ensures the equitable distribution of wealth, alleviating poverty and uplifting communities. By choosing the salary deduction method, individuals not only simplify their own religious practice but also contribute to a more just and compassionate society.

The concept of zakat itself has been around for centuries, deeply rooted in Islamic teachings. The modern implementation of the "Borang Potongan Gaji Zakat" reflects how societies adapt traditional practices to contemporary lifestyles. This system, while particularly popular in Malaysia, resonates with the broader global shift towards digitalization and streamlined processes.

However, like any system, it's essential to understand its nuances. One key aspect is the calculation of the zakat amount, which depends on factors like income, savings, and assets. It's crucial to ensure that deductions are accurate and aligned with Islamic guidelines. Thankfully, numerous resources and tools are available to guide individuals and employers through this process.

Advantages and Disadvantages of Borang Potongan Gaji Zakat

| Advantages | Disadvantages |

|---|---|

| Convenience and Automation | Potential for Inflexibility |

| Consistent Zakat Contributions | Need for Annual Review and Adjustments |

| Supports a Culture of Giving | Limited Control Over Zakat Distribution (Depending on Employer) |

While "Borang Potongan Gaji Zakat" offers a convenient way to manage zakat obligations, it's crucial to stay informed about its nuances, ensuring accurate calculations and a deep understanding of its impact.

Decoding the enigma why women rarely initiate romantic pursuit

Autumns embrace discovering this weeks local october festivals

Level up your love the ultimate guide to matching instagram bios for couples

MAJLIS PENYERAHAN BORANG POTONGAN ZAKAT PENDAPATAN EXCO KERAJAAN NEGERI - Khao Tick On

Borang Kebenaran Bayaran Balik Pinjaman Latihan Kemahiran Melalui - Khao Tick On

borang potongan gaji zakat - Khao Tick On

Borang zakat by SK Sultan Yussuf - Khao Tick On

borang potongan gaji zakat - Khao Tick On

Kempen Skim Potongan Zakat Bulanan - Khao Tick On

(Download PDF) borang potongan gaji - Khao Tick On

Borang Potongan Gaji Bayar Zakat Format Melaka - Khao Tick On

Borang A Zakat Selangor - Khao Tick On

borang potong gaji PTPTN - Khao Tick On

Skim Sakinah (Skim Potongan Zakat Bulanan) - Khao Tick On

BORANG POTONGAN ZAKAT MAJLIS AGAMA ISLAM JOHOR (MAIJ) FORMAT B - Khao Tick On

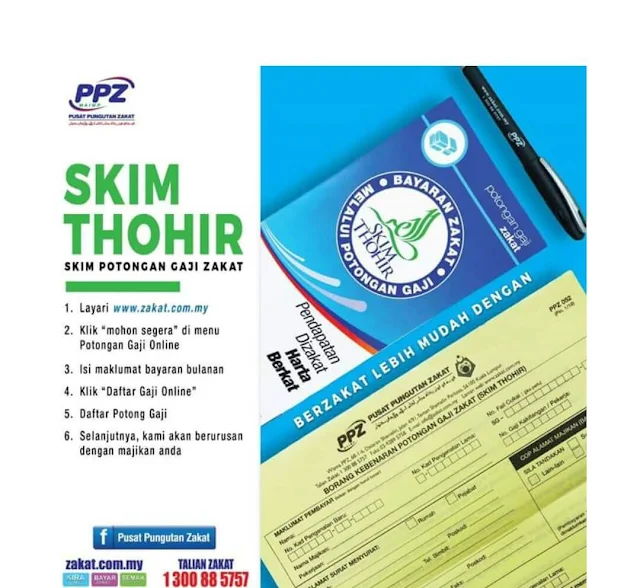

Kempen Skim Potongan Gaji Zakat (Skim Thohir) - Khao Tick On

Borang Potongan Gaji Online - Khao Tick On

.jpg)