Imagine a world where you could easily access government services, participate fully in the financial system, and even build a brighter future. Sounds good, right? Well, in many countries, this world is unlocked with a simple key: your tax identification number (TIN). It's your ticket to a smoother, more financially empowered life.

Now, if you're scratching your head wondering, "What in the world is a TIN?", you're not alone! It's simply a unique number assigned to individuals or businesses for tax purposes. Think of it like your financial fingerprint, helping the government track your income and ensure you're paying your fair share.

But here's the kicker: obtaining and using your TIN isn't just about fulfilling your civic duty. It's about unlocking a whole bunch of benefits that can supercharge your financial journey.

Skeptical? Let's dive in! In many countries, without a TIN, things like opening a bank account, applying for loans, or even getting a formal job can be a real uphill battle. It's like trying to run a marathon with your shoelaces tied together. Your TIN cuts through the red tape, making these essential financial activities a breeze.

Ready to unlock your financial potential? Great! The process for obtaining a TIN varies depending on your country, but it's usually straightforward. A simple online search for "[your country] tax identification number application" should point you in the right direction. You'll likely need some basic documents like proof of identity and address.

Now, let's talk about those sweet, sweet benefits. With your TIN in hand, you're not just fulfilling your tax obligations, you're opening doors to a more secure and prosperous future. Here are a few examples:

Advantages and Disadvantages of Having a Tax Identification Number

| Advantages | Disadvantages |

|---|---|

| Access to Formal Financial Services (Bank Accounts, Loans, etc.) | Potential for Identity Theft if TIN is Not Securely Stored |

| Easier Employment Opportunities | Requirement to File Tax Returns, Even With Low or No Income |

| Eligibility for Government Programs and Benefits |

Having a TIN is crucial for interacting with the tax system and accessing a range of financial and social benefits. While there might be some administrative requirements and potential risks associated with having a TIN, the advantages significantly outweigh the disadvantages.

Remember, understanding your country's specific tax laws and seeking professional advice if needed is always recommended to ensure you're meeting all your obligations and maximizing the benefits of having a TIN.

Unlocking language a journey through early literacy with the letter n

Decoding the lithium battery voltage dip why your power sags

Left hand thumb pain dolor dedo pulgar mano izquierda causes and treatment

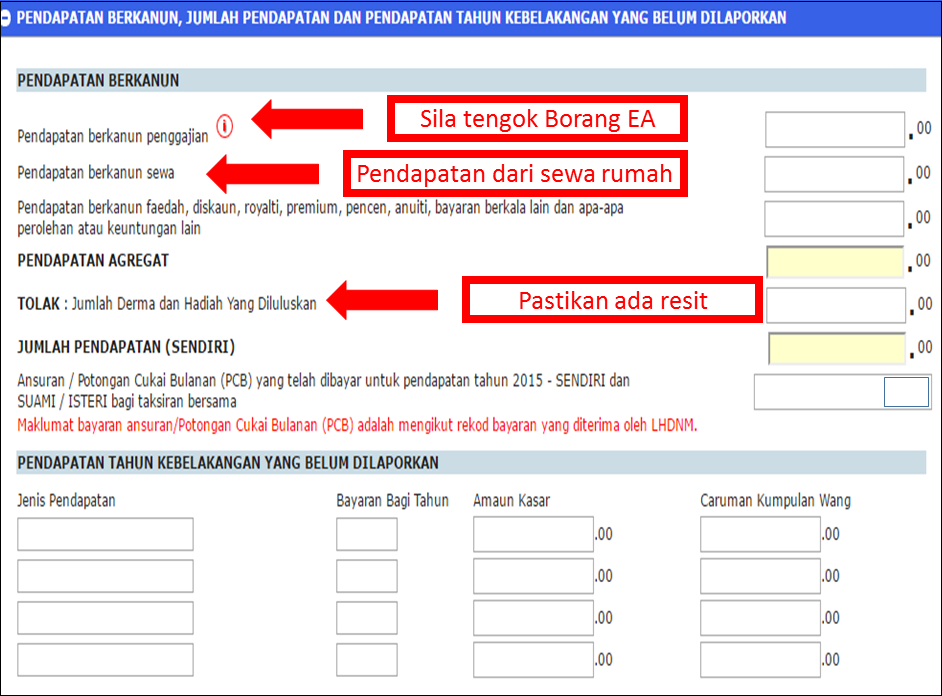

Cara Isi Borang Ea Form - Khao Tick On

contoh no pengenalan cukai - Khao Tick On

contoh no pengenalan cukai - Khao Tick On

contoh no pengenalan cukai - Khao Tick On

contoh no pengenalan cukai - Khao Tick On

contoh no pengenalan cukai - Khao Tick On

contoh no pengenalan cukai - Khao Tick On

contoh no pengenalan cukai - Khao Tick On

contoh no pengenalan cukai - Khao Tick On

contoh no pengenalan cukai - Khao Tick On

contoh no pengenalan cukai - Khao Tick On

contoh no pengenalan cukai - Khao Tick On

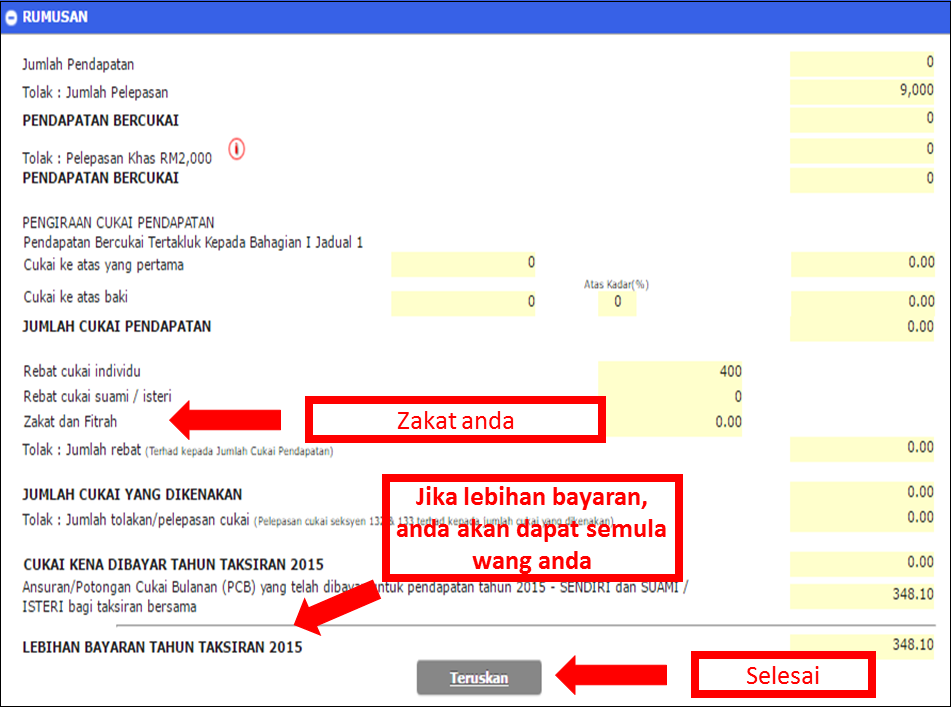

How to Pay Income Tax (LHDN) Online? - Khao Tick On

contoh no pengenalan cukai - Khao Tick On

contoh no pengenalan cukai - Khao Tick On