Planning for a secure financial future in Malaysia often involves strategic management of your Employees Provident Fund (KWSP) savings. While Account 1 forms the foundation of your retirement fund, Account 2 offers flexibility for specific life goals. However, there's another avenue to consider – Account 3. This account presents unique advantages, especially for those seeking to grow their wealth through investments or cover specific medical expenses. But how exactly do you go about transferring funds from your KWSP to Account 3?

In this comprehensive guide, we'll delve into the intricacies of transferring your KWSP savings to Account 3. We'll explore the eligibility criteria, step-by-step procedures, and potential benefits. Whether you're looking to invest in your future, prepare for healthcare needs, or simply understand this aspect of KWSP management better, this guide has you covered.

Before we dive into the "how-to," it's crucial to grasp the "why." Why would you consider transferring funds to Account 3? The answer lies in the potential benefits it offers. Firstly, Account 3 allows you to invest a portion of your KWSP savings in approved unit trust funds or through the Members Investment Scheme (MIS). This can potentially yield higher returns compared to leaving your funds solely in Account 1.

Secondly, Account 3 serves as a valuable resource for specific medical expenses, including critical illnesses, surgeries, and fertility treatments for yourself, your spouse, or your child. By utilizing these funds strategically, you can alleviate the financial burden of healthcare costs.

Lastly, transferring funds to Account 3 does not affect your basic retirement savings in Account 1. You're essentially optimizing a portion of your KWSP funds for potential growth or specific needs while ensuring your retirement nest egg remains intact.

Advantages and Disadvantages of Transferring KWSP to Account 3

| Advantages | Disadvantages |

|---|---|

| Potential for higher investment returns. | Investment risks associated with chosen funds. |

| Financial assistance for specific medical expenses. | Limited withdrawal options compared to Account 2. |

| Does not affect basic retirement savings in Account 1. | Potential tax implications on investment gains. |

Navigating the process of transferring your KWSP savings to Account 3 doesn't have to be complex. By understanding the eligibility criteria, benefits, and procedures involved, you can make informed decisions to enhance your financial well-being.

Remember, managing your KWSP savings effectively is an ongoing journey. Regularly reviewing your financial goals and exploring different avenues within the KWSP ecosystem, like Account 3, can pave the way for a more secure and prosperous future.

Deconstructing rolling stones 500 greatest songs a sonic deep dive

Taming the uppercase mastering text transformation

Dreaming of wide open spaces house ideas for building a spacious farmhouse

Cara mudah pindah baki KWSP akaun 2 ke akaun fleksible buat ramai nak tahu - Khao Tick On

Ini cara mohon e - Khao Tick On

Akaun 3 KWSP Akan Diperkenalkan - Khao Tick On

macam mana nak transfer kwsp ke akaun 3 - Khao Tick On

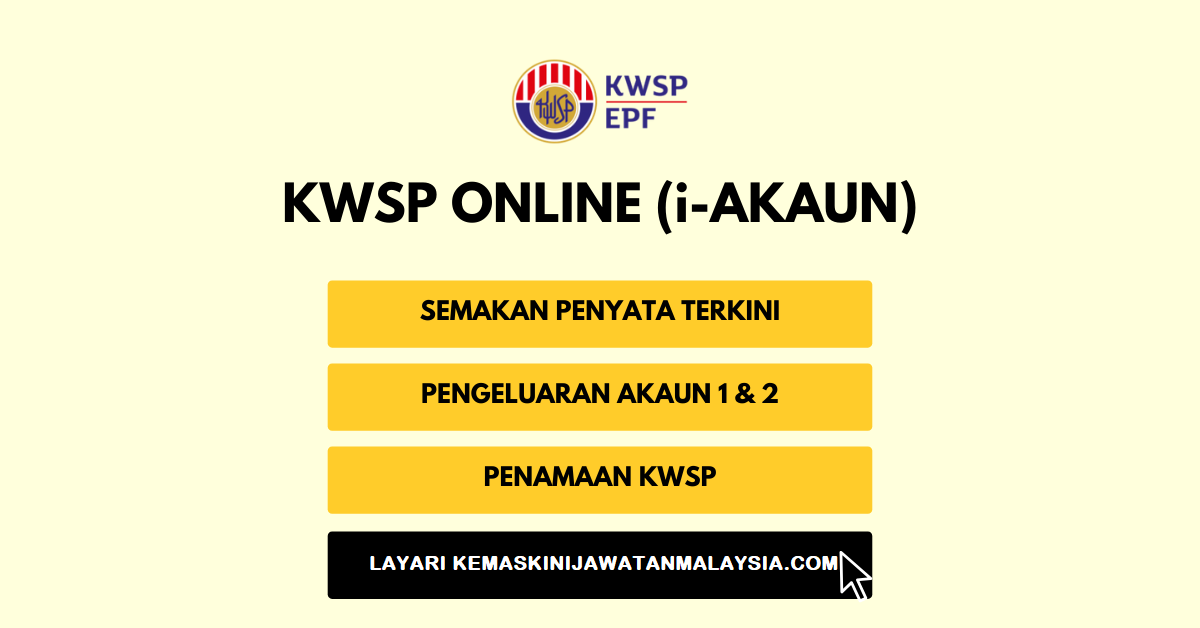

Semakan Penyata KWSP Online (i - Khao Tick On

Macam Mana Nak Check i - Khao Tick On

macam mana nak transfer kwsp ke akaun 3 - Khao Tick On

Akaun Fleksibel (Akaun 3): Account Restructuring - Khao Tick On

Pengeluaran KWSP Melalui Akaun 3 - Khao Tick On

How to Check EPF Number with IC Online? Here 5 Ways! - Khao Tick On

Terkini: Pengeluaran Melalui Akaun 3 KWSP DiBenarkan! - Khao Tick On

Syarat dan Cara Pengeluaran KWSP Akaun 1 i - Khao Tick On

macam mana nak transfer kwsp ke akaun 3 - Khao Tick On

Ini Sebenarnya Fungsi Akaun 1 Dan Akaun 2 KWSP Yang Ramai Keliru - Khao Tick On

Status Pengeluaran KWSP Akaun 3 : Tarikh & Jumlah Bayaran - Khao Tick On