Imagine a bustling community, a collective of passionate individuals united by a shared purpose. Now, picture that community thriving, its activities fueled by a wellspring of financial transparency and accountability. This is the power of meticulously maintained association financial statements, a topic often shrouded in mystery but crucial for any organization's well-being.

At their core, association financial statements serve as a financial compass, guiding stakeholders through an organization's economic journey. They offer a clear snapshot of an association's financial health, encompassing its income, expenses, assets, and liabilities. These statements are not merely a collection of numbers but rather a narrative that speaks volumes about an organization's story – its struggles, its triumphs, and its path towards a sustainable future.

The historical roots of financial reporting for associations can be traced back to the very foundations of organized groups. As communities came together for collective action, the need for transparency in managing shared resources became paramount. This led to the development of rudimentary accounting practices, gradually evolving into the sophisticated financial reporting systems we see today. The importance of such systems cannot be overstated. They serve as a bedrock of trust, assuring members, donors, and the public that an association operates with integrity and responsibility.

However, the realm of association financial statements is not without its challenges. Intricacies in accounting standards, the nuances of non-profit financial management, and the ever-present risk of human error can create hurdles in ensuring accurate and reliable reporting. This is where a clear understanding of the process becomes crucial, empowering associations to navigate these complexities with confidence.

Let's delve into the world of these statements, demystifying their components and shedding light on the benefits they offer. We'll explore practical tips for maintaining these crucial documents, ensuring your association's financial story is one of transparency, accountability, and ultimately, success.

Advantages and Disadvantages of Well-Maintained Association Financial Statements

| Advantages | Disadvantages |

|---|---|

| Enhanced Transparency and Trust | Time and Resource Intensive |

| Informed Decision-Making | Potential for Errors if not handled properly |

| Attracting Funding and Support | May require specialized knowledge for complex situations |

| Improved Accountability and Governance | |

| Enhanced Planning and Budgeting |

In conclusion, association financial statements are not merely a bureaucratic requirement, but a vibrant tapestry woven with the threads of an organization's financial journey. They are a testament to transparency, a beacon of accountability, and a roadmap towards a thriving and sustainable future. By embracing the principles of sound financial management and investing in the tools and knowledge necessary to navigate this landscape, associations can unlock a world of possibilities and ensure their stories are written in the ink of financial integrity and success.

Saint john nb to tampa florida sun sand and snowbirds

Amplify your life unleashing the denon heos amp

Understanding hand gestures the potential implications of a downward pointing middle finger

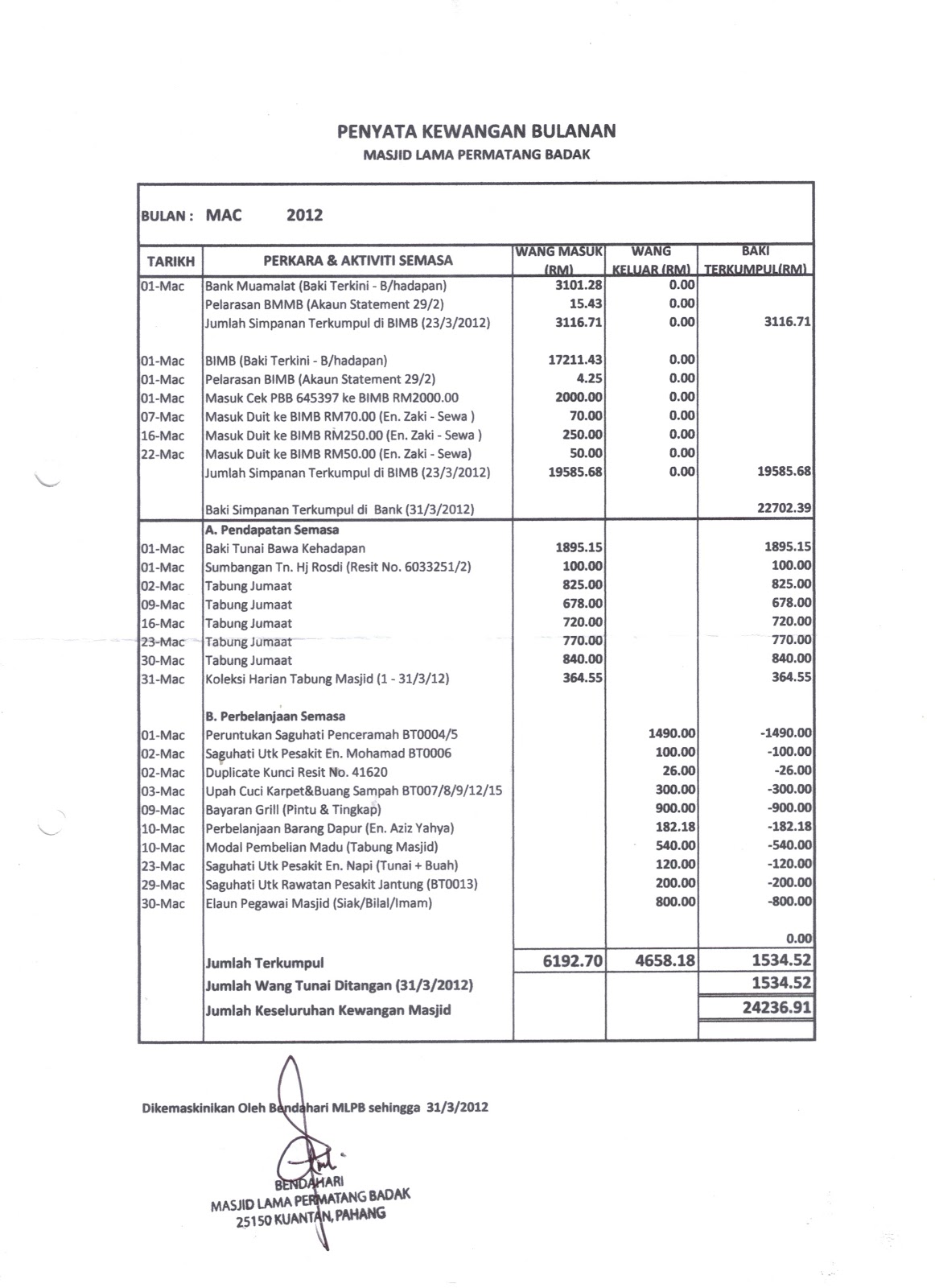

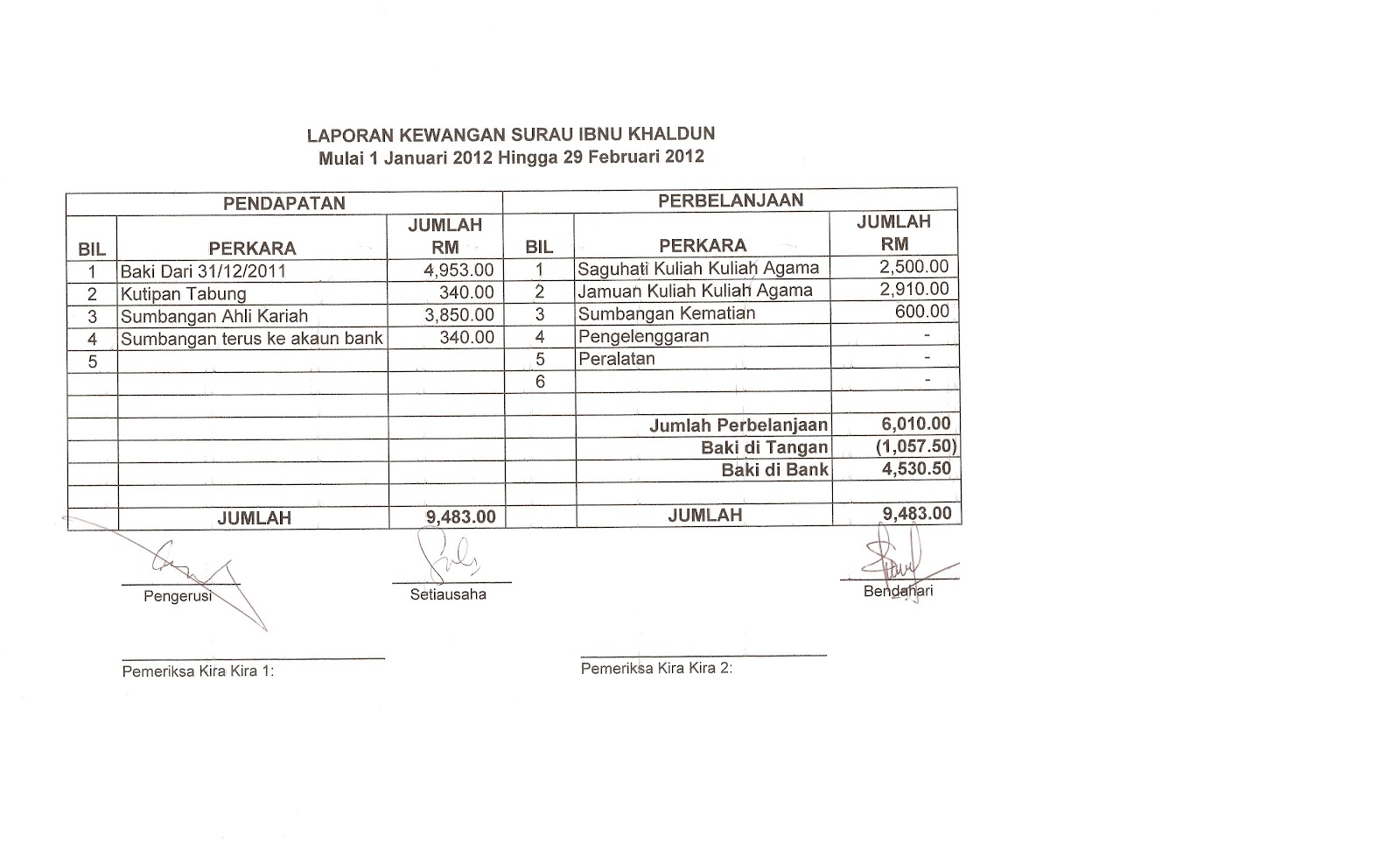

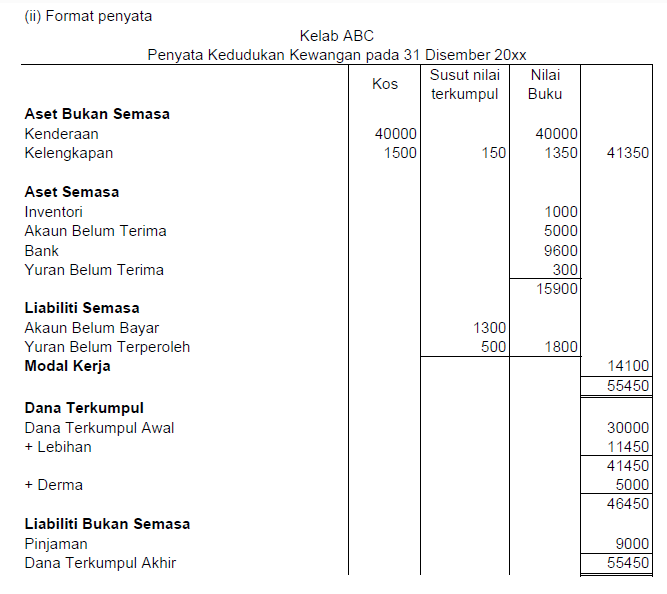

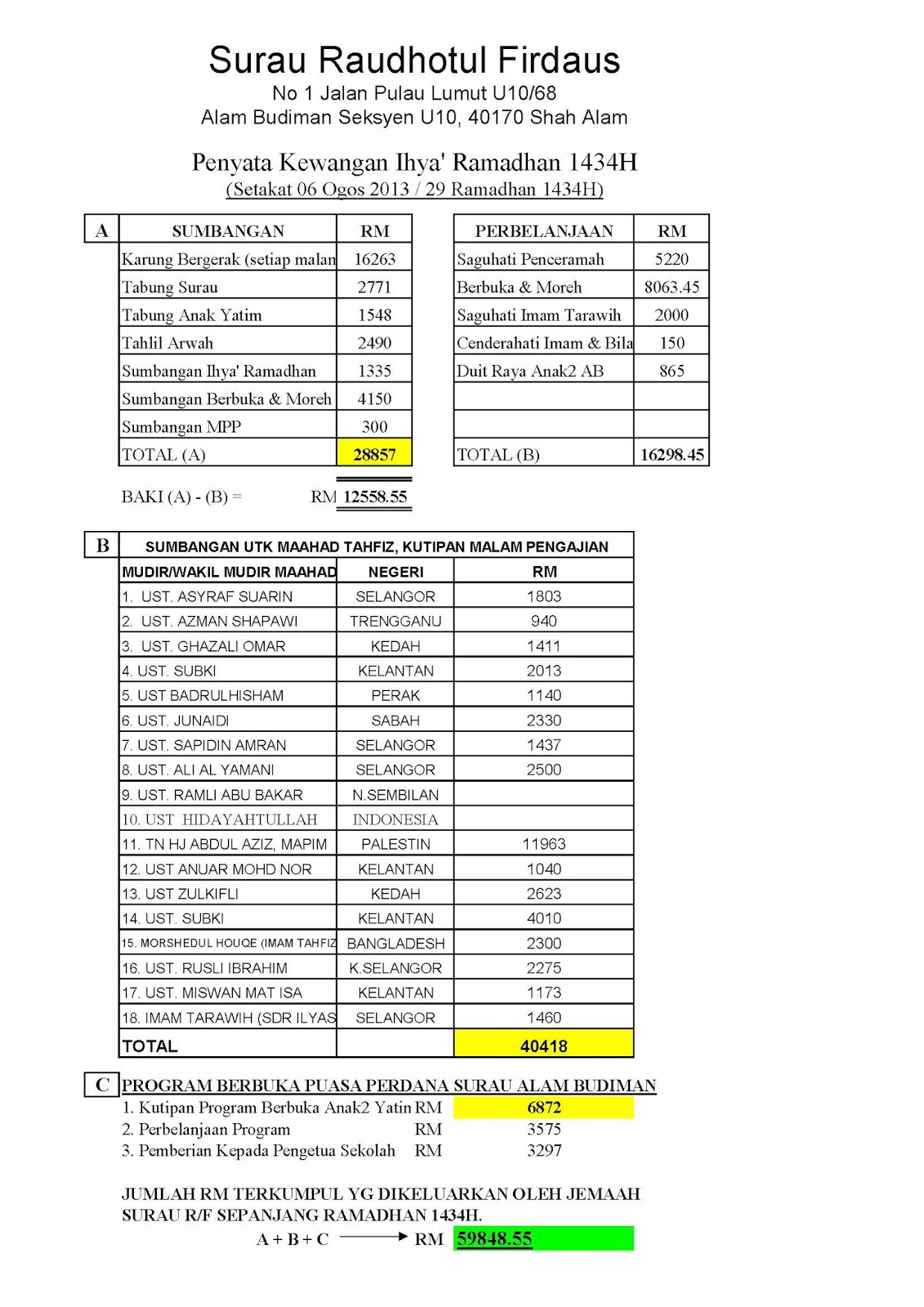

contoh penyata kewangan persatuan - Khao Tick On

contoh penyata kewangan persatuan - Khao Tick On

contoh penyata kewangan persatuan - Khao Tick On

contoh penyata kewangan persatuan - Khao Tick On

contoh penyata kewangan persatuan - Khao Tick On

contoh penyata kewangan persatuan - Khao Tick On

contoh penyata kewangan persatuan - Khao Tick On

contoh penyata kewangan persatuan - Khao Tick On

contoh penyata kewangan persatuan - Khao Tick On

contoh penyata kewangan persatuan - Khao Tick On

contoh penyata kewangan persatuan - Khao Tick On

contoh penyata kewangan persatuan - Khao Tick On

contoh penyata kewangan persatuan - Khao Tick On