Ever feel lost in a sea of numbers? Like your finances are a tangled mess you can't unravel? You're not alone. Many individuals and businesses struggle to keep their financial ducks in a row. But there's a powerful tool that can bring order to the chaos: accounting worksheets (ejemplos de hojas de trabajo en contabilidad in Spanish). These invaluable resources provide a structured way to organize financial data, paving the way for informed decision-making and a clearer financial picture.

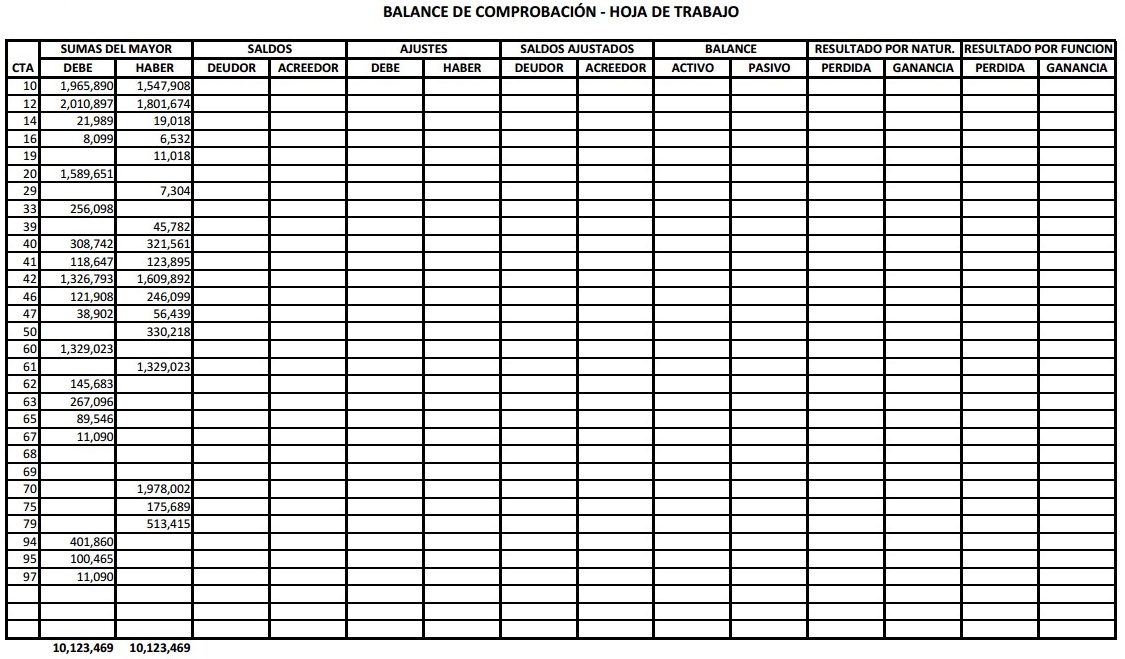

Accounting worksheets, or "hojas de trabajo" as they're known in Spanish, are essentially preliminary financial statements prepared before the formal financial statements. Think of them as a behind-the-scenes look at your finances. They allow you to test different scenarios, catch errors, and ensure accuracy before finalizing your books. Whether you're a small business owner, a freelancer, or just trying to manage your personal finances, understanding how to use these worksheets can be a game-changer.

The history of accounting worksheets is intertwined with the development of double-entry bookkeeping. As businesses became more complex, the need for a systematic way to organize and analyze financial information grew. Worksheets evolved as a tool to simplify the process of preparing financial statements. Their importance lies in their ability to facilitate accuracy and consistency in financial reporting, crucial for sound financial management.

One of the main issues surrounding accounting worksheets is the potential for errors if not used correctly. Inputting incorrect data or misapplying formulas can lead to inaccurate financial statements. Therefore, careful attention to detail and a thorough understanding of accounting principles are essential when working with these tools.

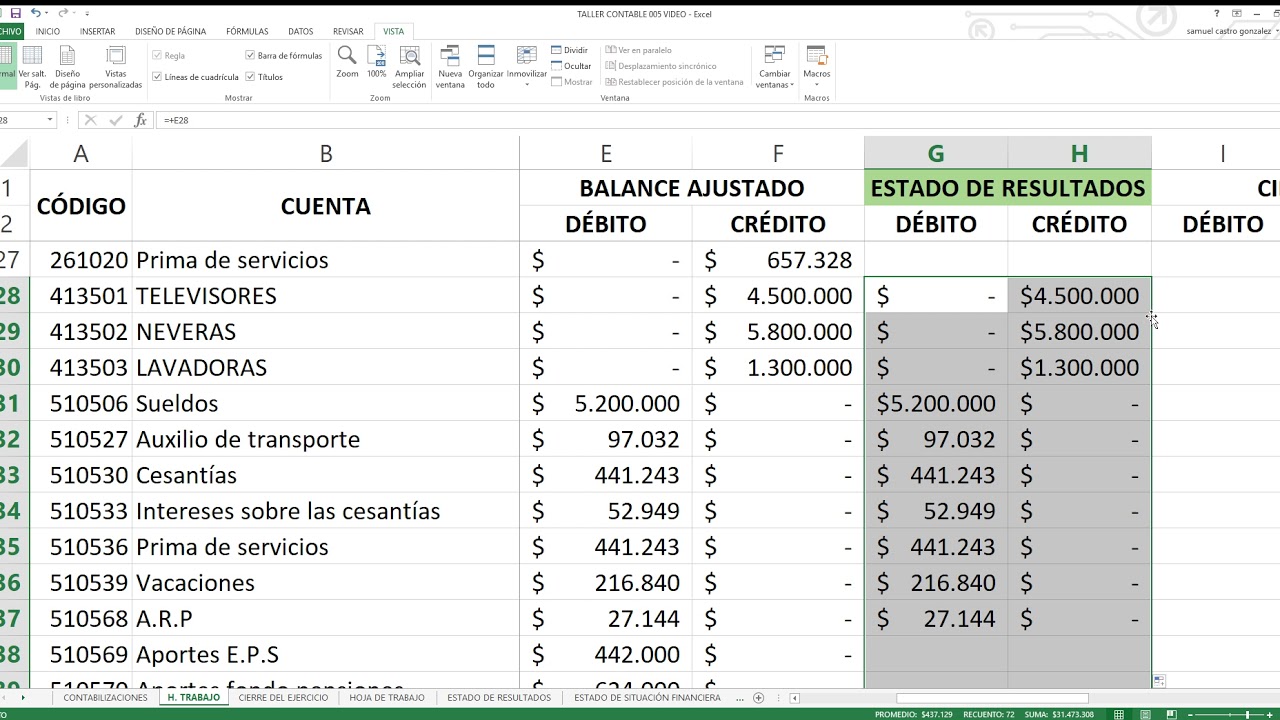

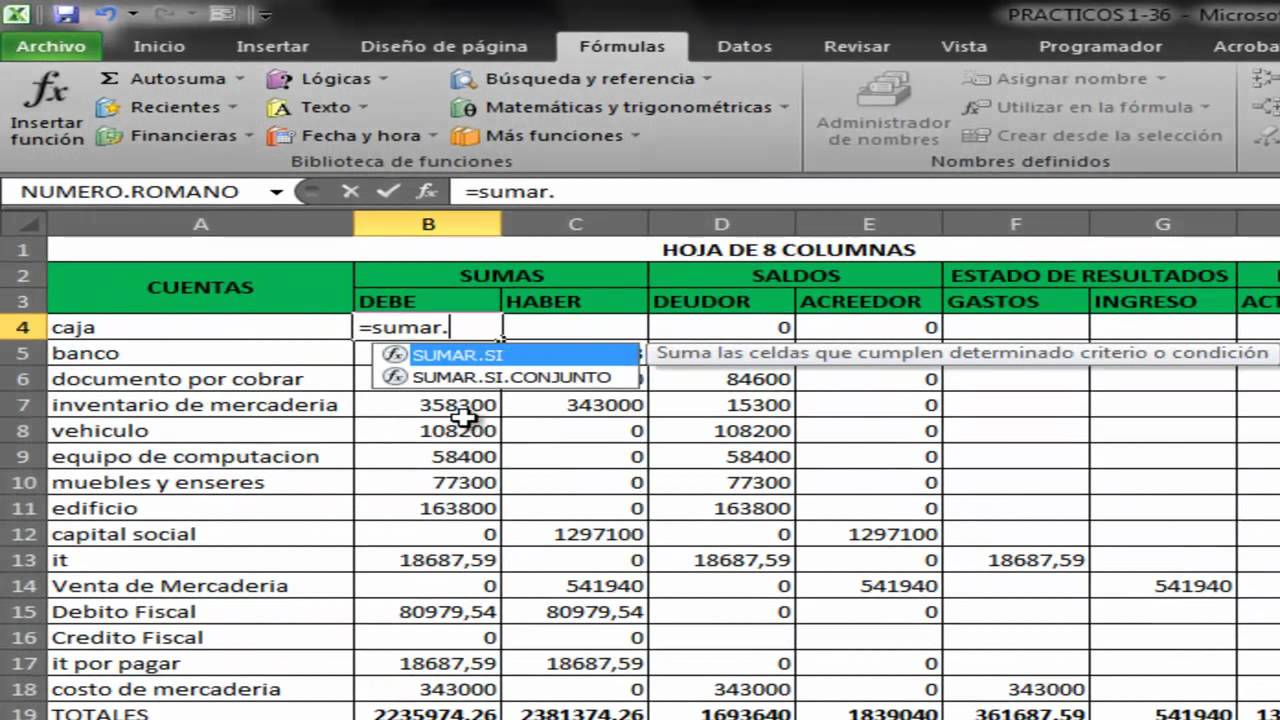

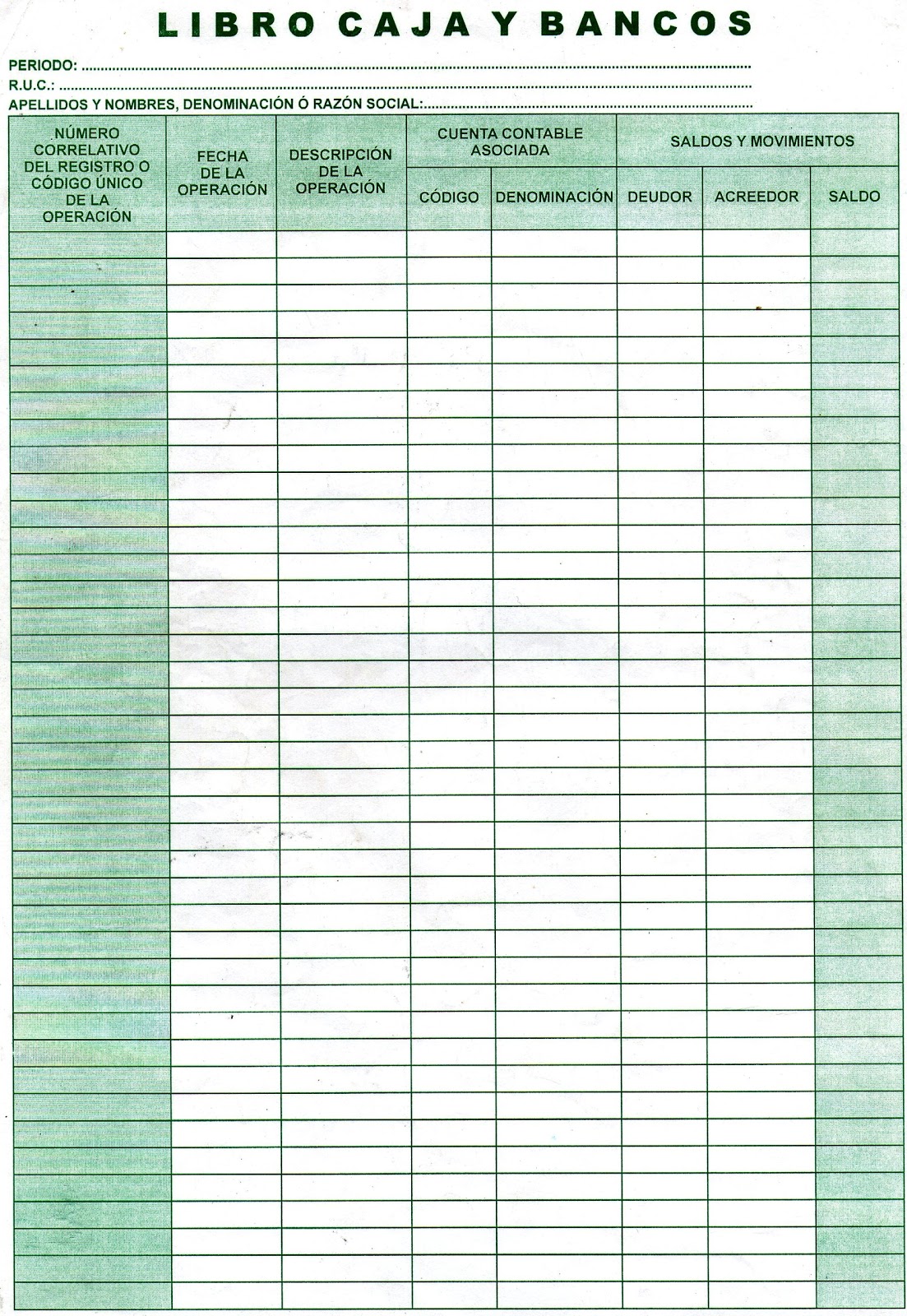

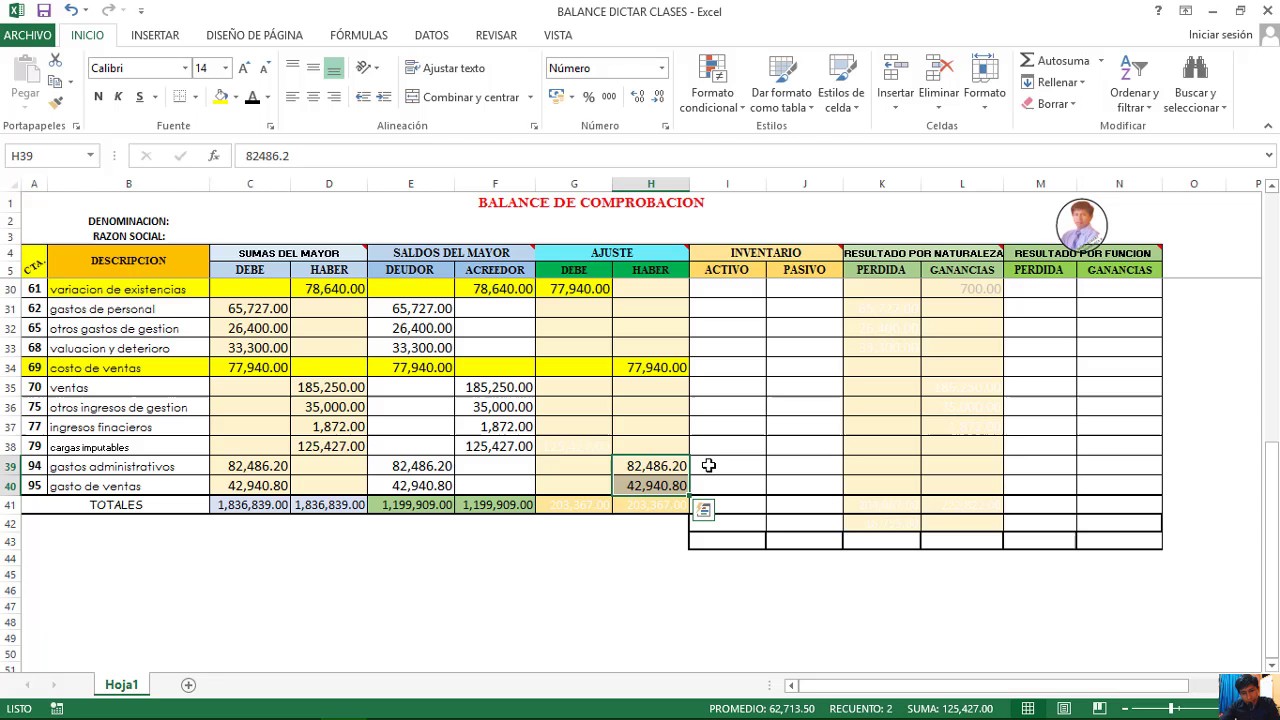

In simple terms, an accounting worksheet is a spreadsheet that lists all account balances. It typically includes columns for trial balance, adjustments, adjusted trial balance, income statement, and balance sheet. A simple example would be using a worksheet to prepare for year-end adjustments, such as recording depreciation or accrued expenses. This allows you to see the impact of these adjustments on your financial statements before finalizing them.

Utilizing accounting worksheets provides numerous benefits. Firstly, they enhance accuracy by allowing you to catch errors before they make it to the final financial statements. Secondly, they streamline the financial reporting process, saving you time and effort. Finally, they offer a deeper understanding of your financial position, enabling better decision-making.

Creating an action plan for using worksheets involves identifying your specific needs, choosing the appropriate template, inputting accurate data, and regularly reviewing and updating the worksheet.

Advantages and Disadvantages of Accounting Worksheets

| Advantages | Disadvantages |

|---|---|

| Improved Accuracy | Potential for Errors |

| Streamlined Reporting | Time-Consuming if Complex |

| Better Financial Understanding | Requires Accounting Knowledge |

Best practices for implementing accounting worksheets include: 1) Using a consistent template. 2) Ensuring data accuracy. 3) Regularly reviewing and updating the worksheet. 4) Utilizing formulas and functions to automate calculations. 5) Seeking professional guidance when needed.

Frequently Asked Questions:

1. What is an accounting worksheet? - A tool to organize financial data before preparing final statements.

2. Why are they important? - They improve accuracy and streamline reporting.

3. Who uses them? - Businesses, individuals, and accountants.

4. How do I create one? - Use a spreadsheet software or a template.

5. What are some common examples? - Worksheets for adjusting entries, budgeting, and financial analysis.

6. Where can I find templates? - Online resources and accounting software often provide templates.

7. What are some common mistakes to avoid? - Inputting incorrect data and misapplying formulas.

8. When should I use a worksheet? - Before preparing final financial statements.

Tips and tricks for using worksheets include utilizing formulas for calculations, creating separate worksheets for different periods or departments, and regularly backing up your data.

In conclusion, mastering the art of accounting worksheets (ejemplos de hojas de trabajo en contabilidad) is a crucial step towards achieving financial clarity and control. By understanding their importance, utilizing best practices, and exploring the various types of worksheets available, you can gain a deeper understanding of your financial position, make informed decisions, and ultimately achieve your financial goals. Whether you're running a business or managing your personal finances, incorporating these valuable tools into your routine will empower you to take control of your financial future. Don’t wait until tax season to get your finances in order. Start using accounting worksheets today and unlock the potential for a more organized and successful financial future.

Unlock your inner artist simple and beautiful pencil drawings

Express yourself on twitter a guide to heart emojis

Unveiling the majesty of johnnie walker blue label 750ml a comprehensive guide

Hojas De Contabilidad Para Imprimir - Khao Tick On

Plantilla Excel para Realizar Auditorías Descarga Gratis - Khao Tick On

Hoja De Trabajo Contabilidad - Khao Tick On

Hoja De Trabajo En Contabilidad - Khao Tick On

Hojas De Contabilidad De 8 Columnas Para Imprimir Mejor Top Hojas De - Khao Tick On

Hojas De Contabilidad Para Imprimir - Khao Tick On

Hoja De Registro Subasta Ejemplo - Khao Tick On

Cómo Elaborar una Hoja de Trabajo Contable - Khao Tick On

Hoja De Trabajo En Contabilidad - Khao Tick On

Hojas De Contabilidad Para Imprimir - Khao Tick On

Ejemplo De Una Hoja De Trabajo En Contabilidad - Khao Tick On

Hoja De Trabajo Contabilidad Ejemplo Images - Khao Tick On

Hoja de presentacion pdf - Khao Tick On

Hoja De Trabajo Contabilidad Ejercicios De Contabilidad Docsity - Khao Tick On

Cuentas T para contabilidad con hojas de cálculo - Khao Tick On

/CuentasT-597ba12a3df78cbb7a258566.png)