Imagine having a clear, concise snapshot of your finances every single month. You'd be able to track your income, expenses, and overall financial health with ease. That's precisely what a monthly financial statement, similar to a "contoh penyata kewangan bulanan" provides. In this comprehensive guide, we'll delve into the world of monthly financial statements, exploring their importance, benefits, and how they can empower you to make informed financial decisions.

Managing your money effectively is crucial for achieving your financial goals, whether it's buying a dream home, investing wisely, or simply gaining control of your spending. A "contoh penyata kewangan bulanan," which translates to a monthly financial statement, acts as a financial roadmap, guiding you towards financial stability and success.

In the past, financial statements were often associated with businesses and corporations. However, in today's fast-paced world, individuals are increasingly recognizing the value of maintaining personal monthly financial statements. These statements provide a structured approach to monitoring your financial progress and making necessary adjustments along the way.

But what exactly is a monthly financial statement, and why is it so important? In essence, it's a document that summarizes your income, expenses, assets, and liabilities for a specific month. By regularly reviewing this statement, you gain valuable insights into your spending patterns, identify areas where you can save, and track your progress towards your financial goals.

Without a clear understanding of your income and expenses, it's easy to overspend, accumulate debt, and lose sight of your financial aspirations. A monthly financial statement empowers you to take control of your finances by providing a comprehensive overview of your financial situation.

Advantages and Disadvantages of Monthly Financial Statements

| Advantages | Disadvantages |

|---|---|

| Enhanced financial awareness | Time commitment required |

| Improved budgeting and saving | Potential for errors if not maintained accurately |

| Early detection of financial issues | May not be suitable for everyone's financial situation |

While the concept of monthly financial statements is not new, its importance has grown significantly in the digital age. Online banking, budgeting apps, and financial management tools have made it easier than ever to track your finances and generate these statements effortlessly.

However, even with these technological advancements, many individuals still struggle with the intricacies of managing their finances effectively. This is where a deep dive into the world of "contoh penyata kewangan bulanan" becomes invaluable. By understanding its principles and applying them consistently, you can pave the way for a more secure and prosperous financial future.

In conclusion, embracing the power of monthly financial statements can be a game-changer for your financial well-being. By providing clarity, control, and actionable insights, these statements empower you to make informed decisions, achieve your financial goals, and build a brighter financial future. Start tracking your finances today and embark on your journey towards financial success.

The art of jet ski cleaning preserving your aquatic steed

Elevate moms birthday cake with png toppers

Your health journey starts here baystate wing hospital palmer ma primary care

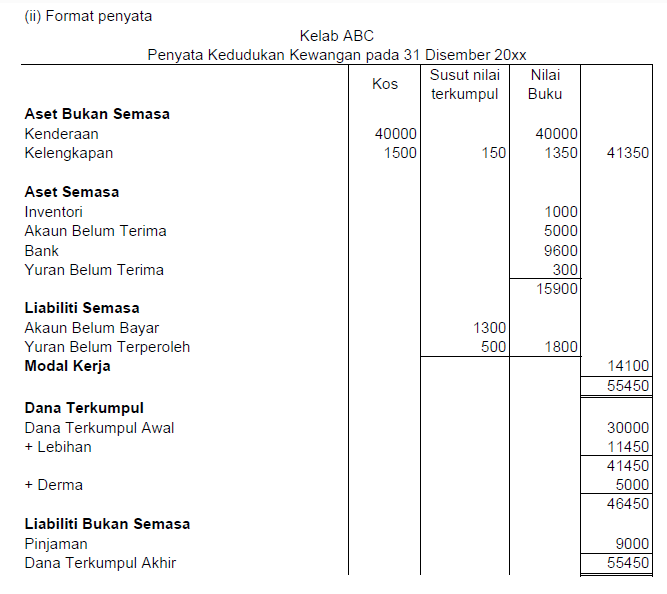

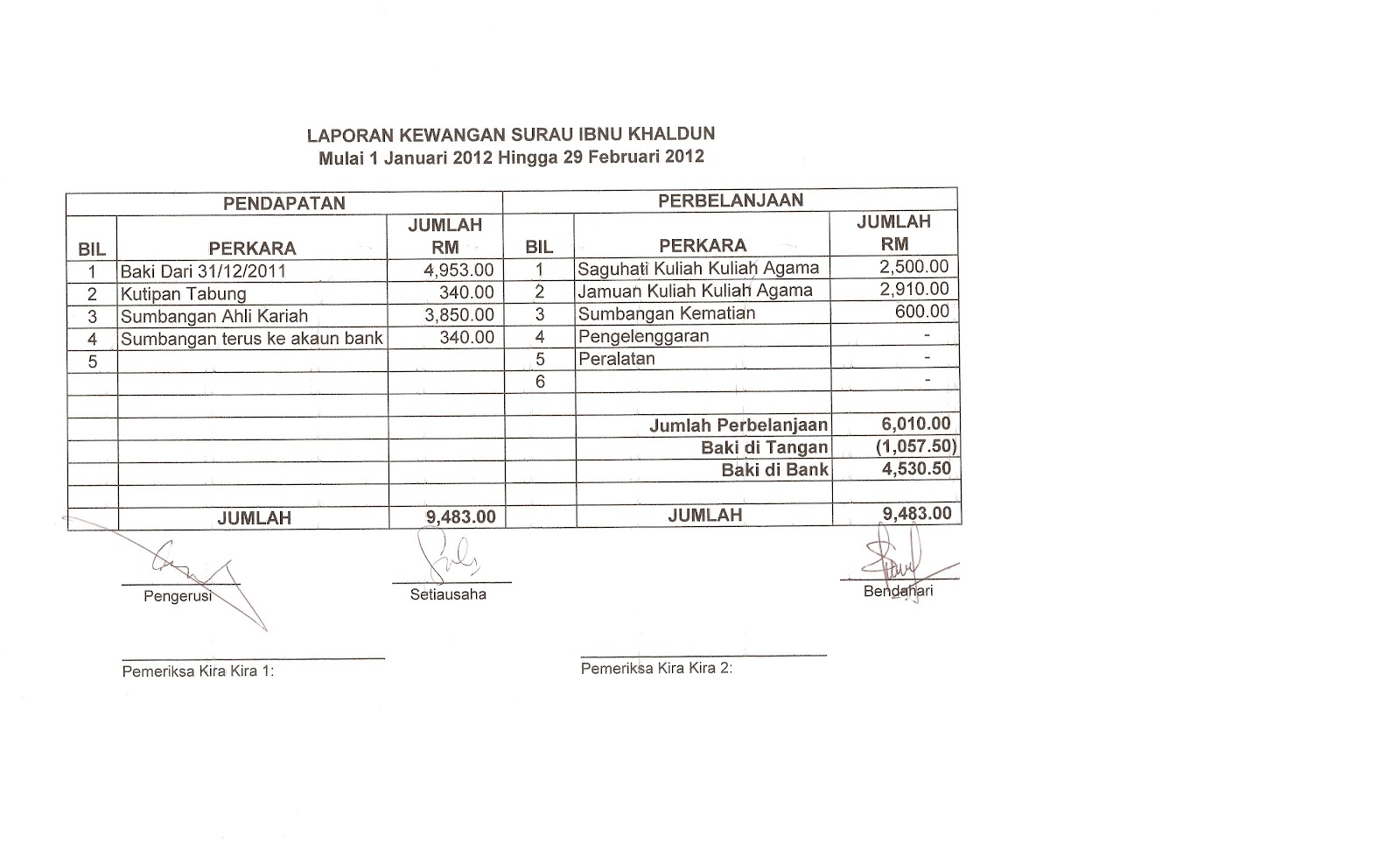

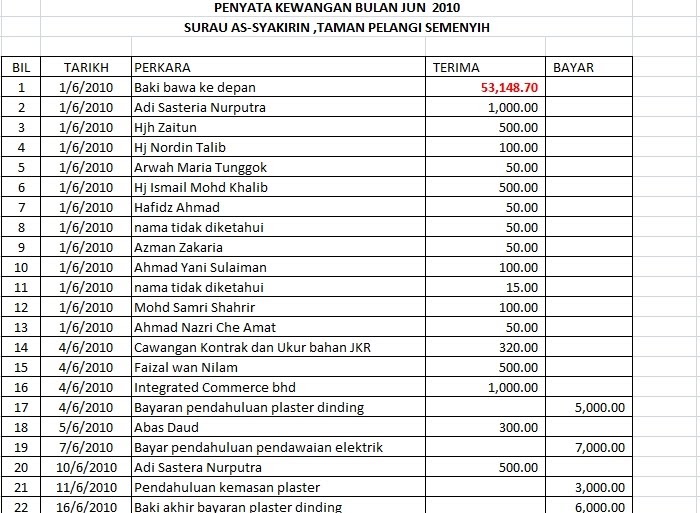

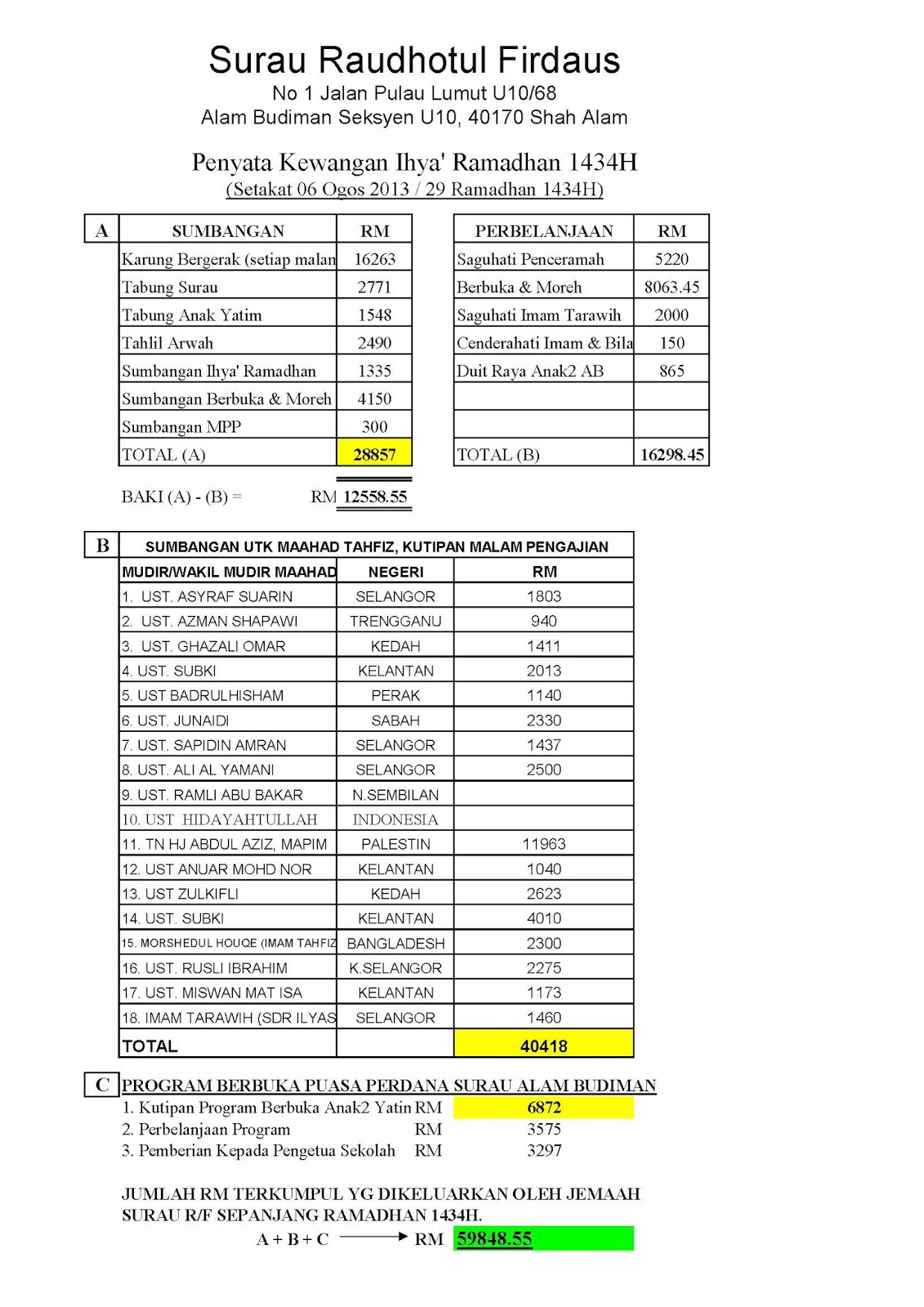

contoh penyata kewangan bulanan - Khao Tick On

contoh penyata kewangan bulanan - Khao Tick On

contoh penyata kewangan bulanan - Khao Tick On

contoh penyata kewangan bulanan - Khao Tick On

contoh penyata kewangan bulanan - Khao Tick On

contoh penyata kewangan bulanan - Khao Tick On

contoh penyata kewangan bulanan - Khao Tick On

contoh penyata kewangan bulanan - Khao Tick On

contoh penyata kewangan bulanan - Khao Tick On

contoh penyata kewangan bulanan - Khao Tick On

contoh penyata kewangan bulanan - Khao Tick On

contoh penyata kewangan bulanan - Khao Tick On