Have you ever felt a sense of overwhelm when faced with the labyrinthine world of personal finance, particularly in a foreign land? It's a common experience, a feeling that leaves many yearning for a simpler, more intuitive approach to managing their money. Unraveling the mysteries of "cara dapatkan no cukai pendapatan," the process of obtaining a tax file number in Malaysia, is crucial for anyone seeking to establish financial harmony within the Malaysian landscape.

Imagine stepping into a bustling marketplace, a kaleidoscope of colors, scents, and sounds. While exhilarating, it can also be overwhelming, especially if you're unfamiliar with the local language and customs. Similarly, navigating the financial systems of a new country presents its own set of unique challenges. Understanding "cara dapatkan no cukai pendapatan," becomes your guide, your translator, in this new financial terrain.

Just as a well-chosen map can transform a daunting trek into an adventure, understanding the ins and outs of "cara dapatkan no cukai pendapatan" can empower you to move confidently within the Malaysian financial system. This knowledge is not just about fulfilling legal obligations, but about unlocking a sense of ease and clarity in your financial life.

Think of it as the cornerstone of your financial well-being in Malaysia. It's the key that unlocks access to a range of financial services, from opening a bank account to receiving salaries and filing taxes. Without this vital piece of the puzzle, you risk navigating a complex system without the proper tools, potentially leading to missed opportunities and unnecessary complications.

Just as a seasoned traveler seeks out local knowledge to enrich their journey, approaching "cara dapatkan no cukai pendapatan" with a spirit of curiosity and openness can transform a potentially daunting task into an empowering step toward financial clarity. It's about understanding the system, embracing the process, and ultimately, gaining a sense of mastery over your financial well-being in a new and exciting environment.

Advantages and Disadvantages of Understanding "Cara Dapatkan No Cukai Pendapatan"

| Advantages | Disadvantages |

|---|---|

| Access to essential financial services | Potential for paperwork and administrative processes |

| Legal compliance and peace of mind | Requirement to familiarize oneself with Malaysian tax laws |

| Potential for tax benefits and refunds |

While obtaining your tax file number is essential, the process might involve navigating bureaucratic procedures and understanding specific tax regulations. However, the benefits far outweigh the initial effort, paving the way for a smoother, more transparent financial journey in Malaysia.

As you embark on this journey of financial exploration, remember that knowledge is power. Equipping yourself with the right information and resources can make all the difference. Seek out reputable sources of information, connect with local experts, and approach the process with a positive mindset. By embracing the nuances of "cara dapatkan no cukai pendapatan," you're not simply fulfilling a requirement, but taking a proactive step toward financial well-being and peace of mind in your new Malaysian chapter.

Unlocking fluency the power of reading comprehension grade 5 hindi

Unveiling the dimensions of a bowling pin

Unlocking natures secrets understanding ecosystem components

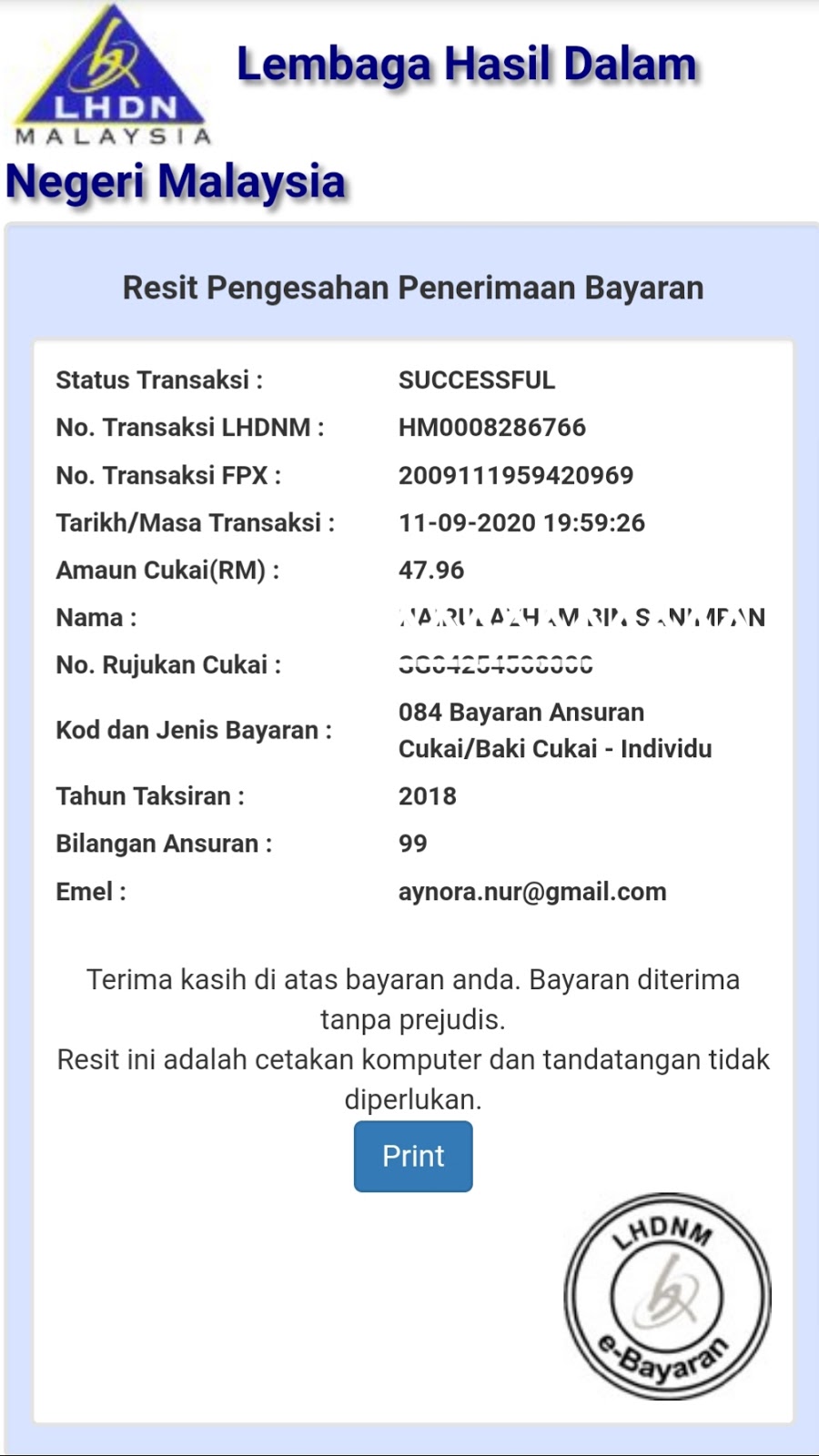

Cara Bayar Baki Cukai Pendapatan Secara Online Yang Mudah - Khao Tick On

Semak No Cukai Pendapatan Pekerja - Khao Tick On

CARA MENDAPATKAN NO CUKAI PENDAPATAN INDIVIDU DAN SYARIKAT SERTA DAFTAR - Khao Tick On

Bajet 2023: Potongan cukai pendapatan, diskaun PTPTN, pengecualian duti - Khao Tick On

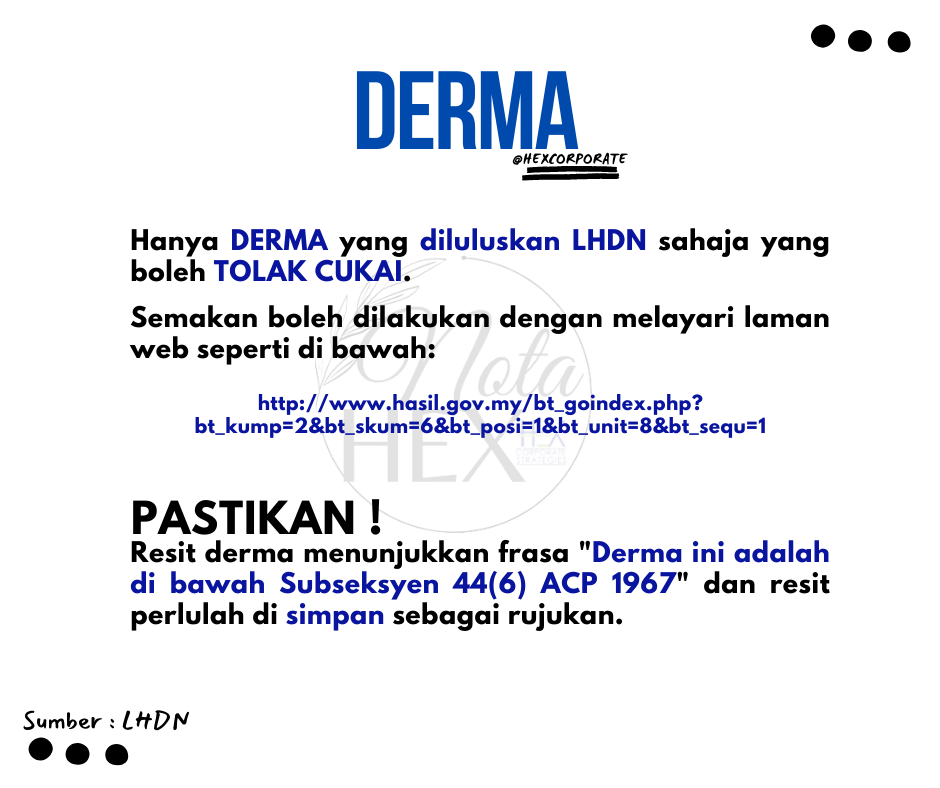

Derma / Hadiah: Syarat & Cara Dapatkan Insentif Potongan Cukai - Khao Tick On

Cara Semak No Cukai Pendapatan LHDN Number - Khao Tick On

cara dapatkan no cukai pendapatan - Khao Tick On

cara dapatkan no cukai pendapatan - Khao Tick On

Cara Daftar Cukai Pendapatan LHDN untuk e - Khao Tick On

SEMAK NO CUKAI PENDAPATAN : CARA DAPATKAN NOMBOR INCOME TAX INDIVIDU - Khao Tick On

Cara Daftar Cukai Pendapatan di Malaysia - Khao Tick On

cara dapatkan no cukai pendapatan - Khao Tick On

Semakan No Cukai Pendapatan Individu (TIN Hasil) - Khao Tick On

5 Cara Untuk Dapatkan Lebih Banyak Pelepasan Cukai Pendapatan Yang - Khao Tick On

SEMAK NO CUKAI PENDAPATAN : CARA DAPATKAN NOMBOR INCOME TAX INDIVIDU - Khao Tick On