In the labyrinthine world of finance, a seemingly simple slip of paper – a cheque – holds the power to transfer significant sums. Yet, between the moment it changes hands and the funds become available lies a crucial step: cheque clearance. This process, often taken for granted, can be a source of both anticipation and anxiety. Understanding its nuances empowers us to navigate the financial landscape with greater confidence.

Imagine a scenario where a vital payment, perhaps for a crucial business transaction or a long-awaited purchase, hinges on the timely clearance of a cheque. Suddenly, the seemingly straightforward act of depositing a cheque becomes a pivotal event. This underscores the essential role of a well-crafted cheque clearance request letter in ensuring the smooth and efficient transfer of funds. This document acts as a bridge between the payer and the payee, facilitating communication and transparency.

The history of cheque clearance is intertwined with the evolution of banking itself. From the early days of handwritten notes and complex clearing houses to today's digital systems, the process has undergone a significant transformation. Yet, the core principle remains the same: verifying the legitimacy and availability of funds before they are credited to the recipient's account. This verification process is a critical safeguard against fraud and ensures the integrity of financial transactions.

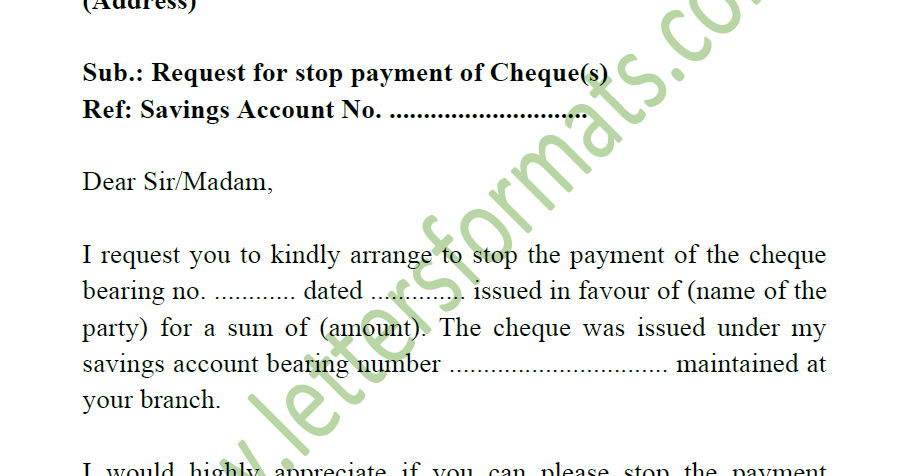

A formal request for cheque clearance can be invaluable in situations where time is of the essence. By proactively communicating with the bank, individuals and businesses can gain clarity on the status of their cheque and potentially expedite the process. A well-written letter serves as a record of the request and can be instrumental in resolving any discrepancies or delays that may arise.

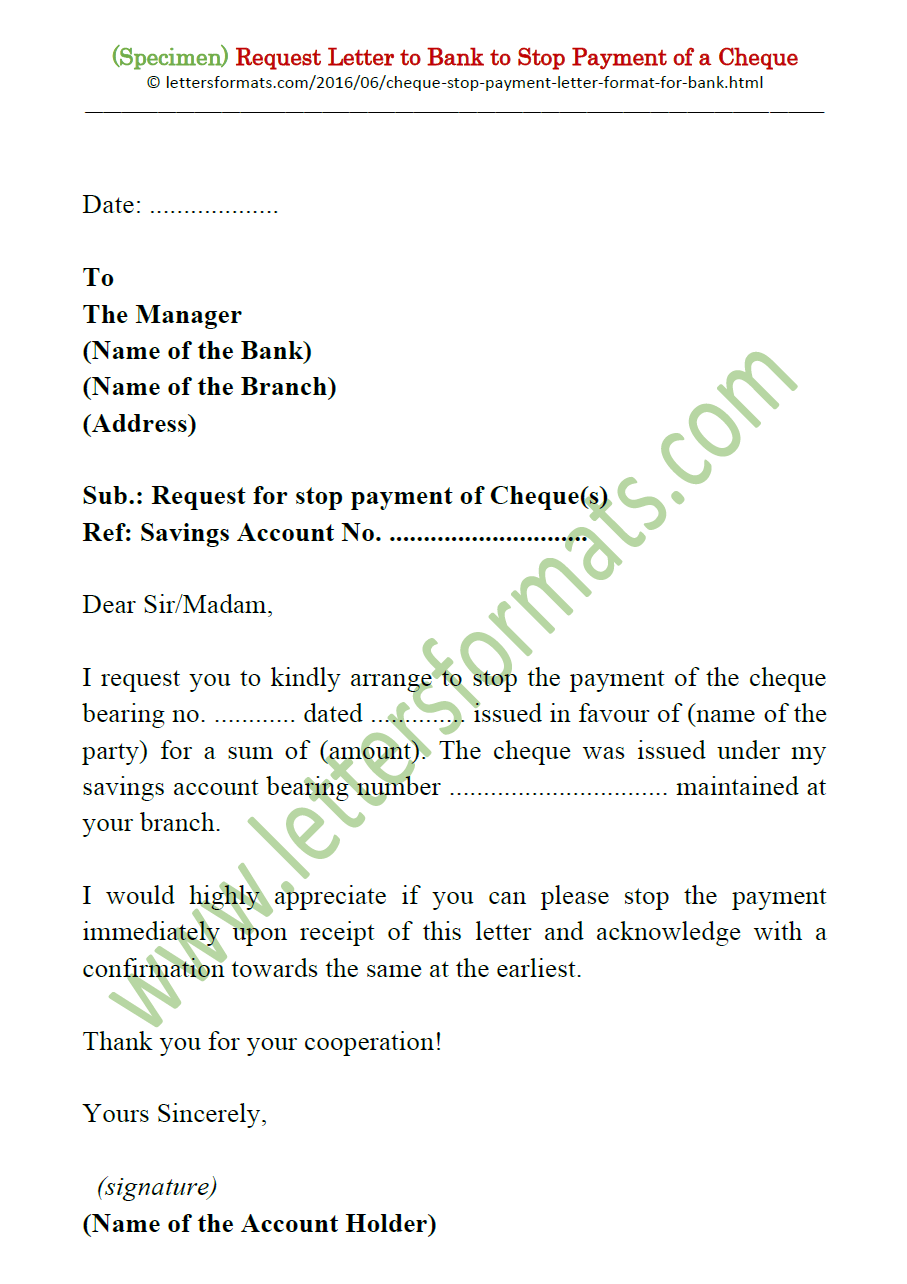

The importance of a clear and concise request letter cannot be overstated. It provides the bank with all the necessary information, including the cheque number, date, amount, and the account holder's details. This minimizes the risk of errors and delays, allowing for a more efficient processing of the cheque. A well-structured letter also demonstrates professionalism and reinforces the seriousness of the request.

A simple example of a cheque clearance request might involve a small business owner seeking confirmation of a payment received from a client. By submitting a formal request to the bank, the business owner can ensure that the funds are available to cover upcoming expenses and maintain a healthy cash flow.

One benefit of writing a cheque clearance request is the potential for expedited processing. Another benefit lies in the increased transparency and communication between the account holder and the bank. Finally, a formal request creates a documented record of the transaction, which can be invaluable in case of disputes or discrepancies. These benefits contribute to a more efficient and secure financial management process.

Advantages and Disadvantages of Requesting Cheque Clearance

| Advantages | Disadvantages |

|---|---|

| Faster Processing | Time Investment (writing the letter) |

| Improved Transparency | Not always guaranteed to speed up the process |

| Documented Record | May be unnecessary in some cases (digital checks) |

Best practices for writing a cheque clearance request include being polite and professional, providing all necessary information, clearly stating the request, keeping a copy of the letter, and following up if necessary. These practices ensure that the request is handled efficiently and effectively.

Frequently asked questions regarding cheque clearance requests often include inquiries about the typical processing time, required documentation, and procedures for handling delayed clearances. Understanding these common queries can empower individuals to navigate the process with confidence.

In conclusion, the seemingly mundane act of requesting cheque clearance holds significant importance in the realm of personal and business finance. A well-crafted request letter empowers individuals and organizations to take control of their funds, ensuring timely access to vital resources. By understanding the nuances of the process, from its historical context to best practices, we can navigate the financial landscape with greater confidence and efficiency. Take the time to understand your rights and responsibilities, and empower yourself to manage your finances effectively. The power to unlock your funds lies within your grasp.

Navigating the medicare maze aarp part d supplemental plan explained

Gangsta cartoon art wallpaper a bold choice for your screen

The poetry of preservation restoring your rav4s white canvas

Sample Letter to Bank Manager for Non Clearance of Cheque - Khao Tick On

Bank Letter for Cheque Payment and Submission - Khao Tick On

Real Info About Cheque Book Request Letter Format In Word Customer - Khao Tick On

Looking Good Info About Stop Payment Of Cheque Letter Format A Good - Khao Tick On

Request Letter For Clearance of Our Outstanding Balance - Khao Tick On

Clearance Letter Bank 10 Clearance Letter Bank That Had Gone Way Too - Khao Tick On

Letter of Acknowledgement For Cheque Received - Khao Tick On

Request Letter For Tax Clearance Certificate Sample Letter Requesting - Khao Tick On

5 Best Cheque Book Request Letter Samples - Khao Tick On

request letter to bank for cheque clearance - Khao Tick On

Cool Info About Cheque Stop Payment Request Letter Format Top Rated - Khao Tick On

Sample Letter to Bank Manager for Non Clearance of Cheque - Khao Tick On

Authority Letter to Collect a Cheque Book from the Bank - Khao Tick On

Cheque missing letter format to customer Fill out sign online - Khao Tick On

Image result for cheque confirmation letter to a bank - Khao Tick On

/a06ec230-a1dc-4a4a-bdaf-7bc7f4e6b1d9_1.png)