Ever wondered how money magically zips across borders? It's not magic, it's the SWIFT network, and your SECU SWIFT code is your key to unlocking it. Think of it as a secret handshake for banks around the world, ensuring your money gets where it needs to go safely and efficiently. But what exactly *is* this code, and why is it so important for NC State Employees Credit Union members?

The SWIFT code, or BIC (Bank Identifier Code), for NC State Employees Credit Union is the essential piece of information needed to send or receive international wire transfers. This unique identifier distinguishes SECU from every other financial institution globally. Without it, your international transaction could get lost in the digital ether, delayed, or even returned. This alphanumeric code acts like a global positioning system for your money, guiding it accurately to its destination.

Historically, international money transfers were a complex and time-consuming process. The SWIFT network, established in 1973, revolutionized this by creating a standardized system for secure communication between banks. The introduction of SWIFT codes provided a unique identifier for each participating institution, greatly simplifying and accelerating cross-border transactions. For SECU members, access to the SWIFT network means easy participation in the global economy.

Understanding the importance of your SECU SWIFT code is crucial, especially if you're planning international transactions. Whether you're sending money to family overseas, paying for an international purchase, or receiving funds from a foreign source, this code ensures the smooth and secure transfer of your funds. Without it, you're essentially navigating the global financial landscape without a map.

One of the main issues related to using a SWIFT code is ensuring its accuracy. Even a single incorrect digit can lead to delays, returned funds, or even the loss of your money. It's crucial to double-check the code with SECU directly or through their official website before initiating any international transfer. This seemingly small detail can make all the difference in a successful transaction.

While specific benefits related to having a SWIFT code are inherent to having access to the SWIFT network itself, the ability to participate in global finance is a powerful advantage for SECU members. It facilitates seamless international trade, personal remittances, and investment opportunities. This access connects SECU members to a wider world of financial possibilities.

To use your SECU SWIFT code, obtain it from SECU directly or through their official online channels. Provide the recipient's bank with your SECU SWIFT code along with all other required information for the transfer. Always verify the accuracy of the provided information to avoid delays or errors.

Frequently Asked Questions:

1. What is a SWIFT code? A SWIFT code identifies a specific bank for international transactions.

2. How do I find my SECU SWIFT code? Contact SECU or visit their official website.

3. Is a SWIFT code the same as a BIC? Yes, they are interchangeable terms.

4. Why is my SWIFT code important? It ensures your international transfers reach the correct destination.

5. What happens if I use the wrong SWIFT code? Your transfer could be delayed, returned, or lost.

6. Can I use a SWIFT code for domestic transfers? No, SWIFT codes are for international transactions.

7. Where can I find more information about SWIFT codes? Consult the official SWIFT website.

8. Does SECU provide support for international transfers? Contact SECU for specific information about their international transfer services.

Tips and Tricks: Always double-check the SWIFT code before submitting your transfer. Keep a record of your SWIFT code and other relevant transaction details for future reference. If you have any doubts or questions, contact SECU directly for assistance.

In conclusion, the SECU SWIFT code is a vital tool for members engaging in international financial transactions. It ensures the efficient and secure transfer of funds across borders, connecting SECU members to the global financial network. Understanding the importance of this code, its proper use, and the potential issues associated with inaccuracies is crucial for successful international transfers. By following best practices and verifying information, SECU members can navigate the complexities of international finance with confidence. Take the time to understand your SECU SWIFT code, and unlock the potential of seamless global transactions. Contact SECU today to learn more about international banking services and how they can help you manage your finances globally. Empower yourself with the knowledge to navigate the world of international finance efficiently and securely.

Unlocking potential a guide to contenido de tercer grado de primaria third grade curriculum

Ocker monuments and headstones

Whatcom community college your gateway to success

nc state employees credit union swift code - Khao Tick On

State Employees Credit Union - Khao Tick On

nc state employees credit union swift code - Khao Tick On

nc state employees credit union swift code - Khao Tick On

nc state employees credit union swift code - Khao Tick On

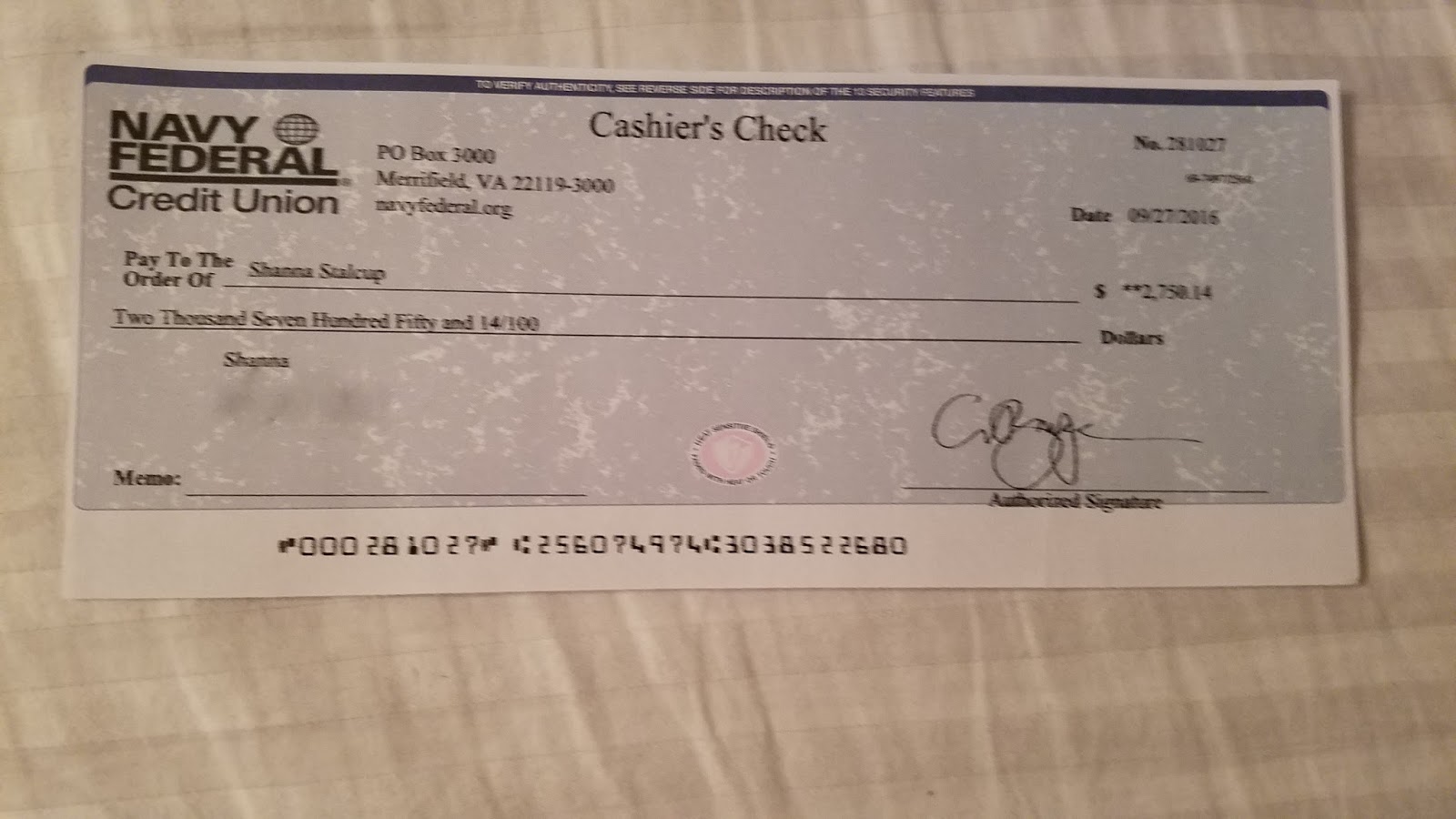

Navy Federal Credit Union SWIFTBIC Code is NFCUUS33 - Khao Tick On

State Employees Credit Union Routing Number - Khao Tick On

Navy Federal Promo Code Checking 2024 - Khao Tick On

Brise Perth Rahmen nc secu routing number Fort Vati Diskretion - Khao Tick On

Navy Federal Credit Union Swift Code - Khao Tick On

nc state employees credit union swift code - Khao Tick On

State Employees Credit Union logo Vector Logo of State Employees - Khao Tick On

nc state employees credit union swift code - Khao Tick On