Imagine this: you're strolling through a charming neighborhood, sunlight dappling through the leaves, when you spot it – the perfect house. It's practically begging you to call it home. But then reality sets in. Can you actually afford it? How do you even know if you qualify for a mortgage? The good news is, navigating the path to homeownership might seem daunting, but it doesn't have to be. Understanding your mortgage eligibility is the crucial first step, and it's simpler than you might think.

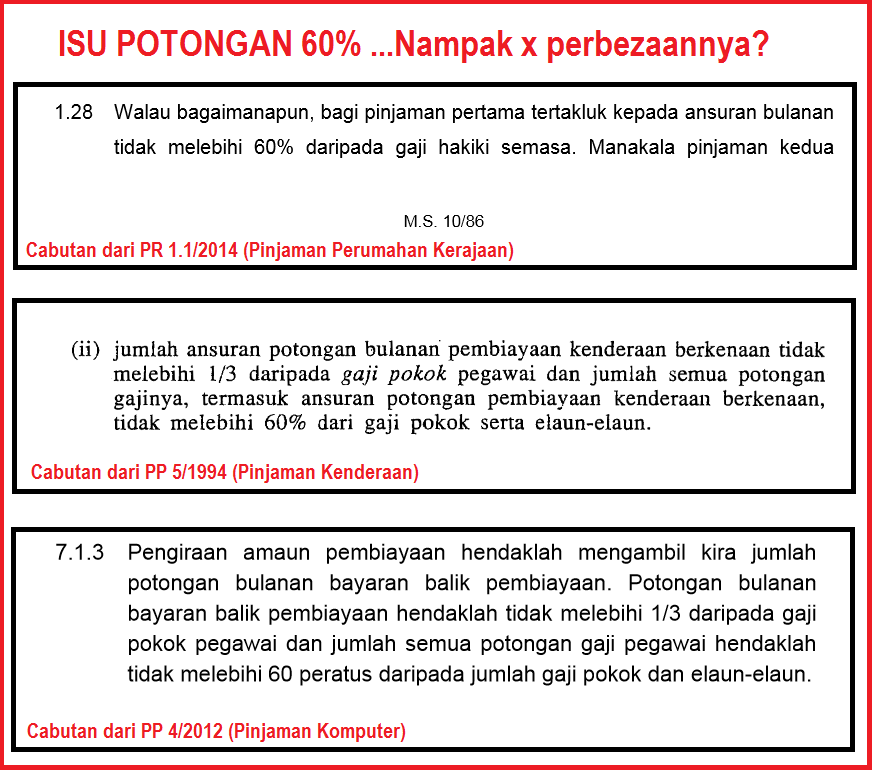

At its core, determining your mortgage eligibility is like solving a financial puzzle. Lenders consider various factors to assess your ability to repay a loan, and understanding these factors is key to unlocking your homeownership dreams. This is where the concept of "cara kira kelayakan loan rumah" comes into play – a Malay phrase that translates to "how to calculate home loan eligibility." Essentially, it's about evaluating your financial health to determine how much you can borrow responsibly.

While the exact origins of mortgage eligibility calculations might remain shrouded in the mists of time, their importance is undeniable. In a world of ever-evolving financial landscapes, these calculations serve as a cornerstone of responsible lending and borrowing. They protect both lenders from risky investments and borrowers from taking on more debt than they can handle.

However, the journey towards mortgage approval isn't without its bumps. A common issue many aspiring homeowners face is a lack of awareness about the factors influencing their eligibility. This can lead to disappointment, frustration, or even worse, taking on a mortgage they struggle to afford. That's why demystifying the process of calculating mortgage eligibility is crucial. It empowers individuals to take control of their financial futures and make informed decisions on their path to homeownership.

Imagine a young couple, let's call them Sarah and John, eager to buy their first home. They're drawn to a cozy townhouse, but without understanding their mortgage eligibility, they're unsure if it's within reach. This uncertainty can be paralyzing, preventing them from even taking the first step. Now, imagine if Sarah and John had the tools and knowledge to calculate their eligibility beforehand. Armed with this information, they could confidently approach lenders, negotiate better terms, and potentially secure their dream home.

Advantages and Disadvantages of Understanding Mortgage Eligibility

| Advantages | Disadvantages |

|---|---|

| Empowers informed financial decisions. | Requires understanding financial concepts. |

| Helps set realistic budget expectations. | Calculations can be complex for some individuals. |

| Facilitates smoother loan application process. | Doesn't guarantee loan approval, as other factors are considered. |

While there are many aspects to consider regarding mortgage eligibility, it's essential to remember that knowledge is power. By arming yourself with the right information, you're taking a significant step towards achieving your homeownership dreams responsibly and confidently.

Shower power unleashing the awesome potential of tiled walk in shower pics

Finding your place exploring church in roswell nm

John hoogenakker spectrum commercial

cara kira kelayakan loan rumah - Khao Tick On

cara kira kelayakan loan rumah - Khao Tick On

cara kira kelayakan loan rumah - Khao Tick On

cara kira kelayakan loan rumah - Khao Tick On

cara kira kelayakan loan rumah - Khao Tick On

cara kira kelayakan loan rumah - Khao Tick On

cara kira kelayakan loan rumah - Khao Tick On

cara kira kelayakan loan rumah - Khao Tick On

cara kira kelayakan loan rumah - Khao Tick On

cara kira kelayakan loan rumah - Khao Tick On

cara kira kelayakan loan rumah - Khao Tick On

cara kira kelayakan loan rumah - Khao Tick On

cara kira kelayakan loan rumah - Khao Tick On