Starting a business or expanding an existing one often requires a significant financial investment. Whether it's purchasing new equipment, securing inventory, or simply covering operational costs, access to capital can make or break a venture. This is where business loans come in. In many parts of the world, particularly in Indonesia, the process begins with a formal loan application, known as a "contoh surat permohonan pinjaman modal."

Imagine this: you have a brilliant business idea, a solid plan, and the passion to make it a reality. The only missing piece is the funding. A well-crafted loan application can be your key to unlocking that critical financial support. It's your chance to clearly communicate your vision, showcase your business acumen, and convince lenders that your venture is worth investing in.

But navigating the world of business loans, especially in a different language and cultural context, can feel daunting. The terminology might seem unfamiliar, and the requirements might feel overwhelming. What exactly is a "contoh surat permohonan pinjaman modal," and how can you ensure yours stands out from the crowd?

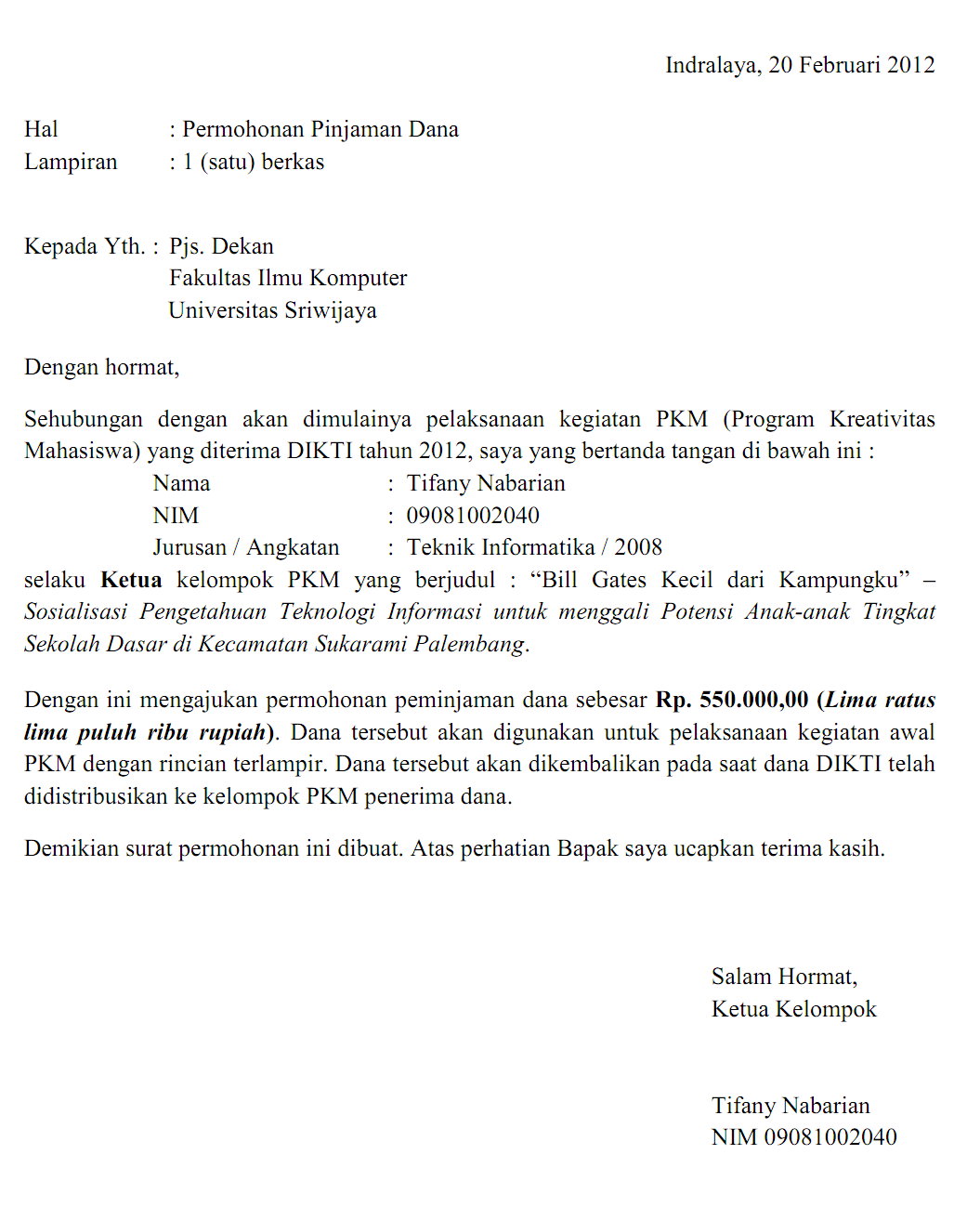

In essence, "contoh surat permohonan pinjaman modal" translates to "sample letter of application for capital loans." It's the foundation of your loan request in Indonesia. Think of it as your business's formal introduction to potential lenders. This document goes beyond simply stating how much money you need; it tells the story of your business, outlines your financial projections, and demonstrates your commitment to repayment.

In this article, we'll demystify the process of crafting a compelling contoh surat permohonan pinjaman modal. We'll explore the key elements it should include, provide practical tips for making your application shine, and equip you with the knowledge and confidence to approach potential lenders. By mastering this crucial step, you'll be well on your way to securing the funding you need to turn your entrepreneurial dreams into a thriving reality.

Advantages and Disadvantages of Traditional Business Loan Applications

While we won't delve deeply into specific websites, books, or apps, it's worth noting that there are numerous resources available to help you navigate the Indonesian business landscape and find templates for loan applications (contoh surat permohonan pinjaman modal). Online business forums, financial advice websites, and even government portals can offer valuable information.

As you embark on your journey to secure funding, remember that a well-prepared and thoughtfully written loan application is an investment in your business's future. By presenting a clear, concise, and compelling case, you'll significantly increase your chances of securing the financial support needed to make your entrepreneurial aspirations a resounding success.

Remembering loved ones a guide to salerno funeral home obituaries in roselle

Epic fantasy guy names and their meanings a world of inspiration

Navigating faith education a look at blessed trinity hs roswell ga

Detail Contoh Surat Permohonan Pinjaman Uang Ke Kantor Koleksi Nomer 11 - Khao Tick On

10++ Contoh Surat Peminjaman Alat - Khao Tick On

Contoh Surat Permohonan Pembiayaan Pada Bank - Khao Tick On

Contoh Surat Perjanjian Pinjaman Karyawan - Khao Tick On

Contoh Surat Perjanjian Pinjaman Uang Untuk Modal Usaha - Khao Tick On

Contoh Surat Permohonan Kesediaan Membuka Acara - Khao Tick On

Contoh Surat Permohonan Pembiayaan Pada Bank - Khao Tick On

Contoh Surat Permohonan Pinjaman Modal Usaha Perorangan - Khao Tick On

Contoh Surat Permohonan Pembukaan Perorangan Kmp - Khao Tick On

Contoh Surat Permohonan Penambahan Modal Usaha - Khao Tick On

Contoh Surat Perjanjian Pinjaman Modal - Khao Tick On

Surat Permohonan Pinjaman Uang Ke Perusahaan - Khao Tick On

Contoh Surat Permohonan Modal Usaha Sekolah - Khao Tick On

Contoh Surat Perjanjian Pinjaman Modal - Khao Tick On

Contoh Surat Permohonan Modal Usaha Di Sekolah - Khao Tick On