Imagine this: you're cruising towards financial independence, your hard-earned money working for you, not the other way around. But wait, there's a sneaky tax bill lurking in the shadows, threatening to derail your well-laid plans. Don't let it! Today, we're tackling a topic that's often met with groans and confusion but is absolutely crucial for anyone serious about building wealth: employee income tax calculations.

Let's be real, taxes are an inevitable part of life, like that annoying neighbor who always seems to catch you at the worst possible moment. But unlike your neighbor, understanding income tax calculations can actually put more money back in your pocket. We're talking about avoiding overpaying, maximizing deductions, and keeping more of your hard-earned cash.

Think of it like this: your paycheck is a delicious pie, and the government wants a slice. Fair enough, they provide essential services. But wouldn't you rather control the size of that slice instead of letting them take a huge chunk? That's where mastering employee income tax calculations comes in.

Whether you're a seasoned pro or just starting out on your financial journey, understanding the ins and outs of how your income tax is calculated is essential. It's the key to making informed decisions about your finances, from negotiating a salary to planning for retirement.

So buckle up, grab your favorite beverage, and get ready to demystify the world of employee income tax calculations. We'll explore the hows, the whys, and the what-the-heck-do-I-do-with-this-information so you can navigate tax season like a pro and keep more of your hard-earned money where it belongs – in your pocket!

Advantages and Disadvantages of Understanding Employee Income Tax Calculation

Let's face it, delving into the world of income tax calculations isn't always a walk in the park. There are forms, jargon, and let's be honest, it can feel about as exciting as watching paint dry. But before you click away, let's break down the pros and cons of understanding this essential financial skill:

| Advantages | Disadvantages |

|---|---|

|

|

Even though there are challenges, the benefits of understanding employee income tax calculations far outweigh the drawbacks. It's an investment in your financial well-being, empowering you to make informed decisions and keep more of your hard-earned money.

So, are you ready to take control of your finances and conquer the world of employee income tax calculations?

Harnessing the missouri wind your guide to wind speed maps

Navigating international trade the wells fargo letter of credit department

Unlocking fc24 career mode building a dream team on a budget

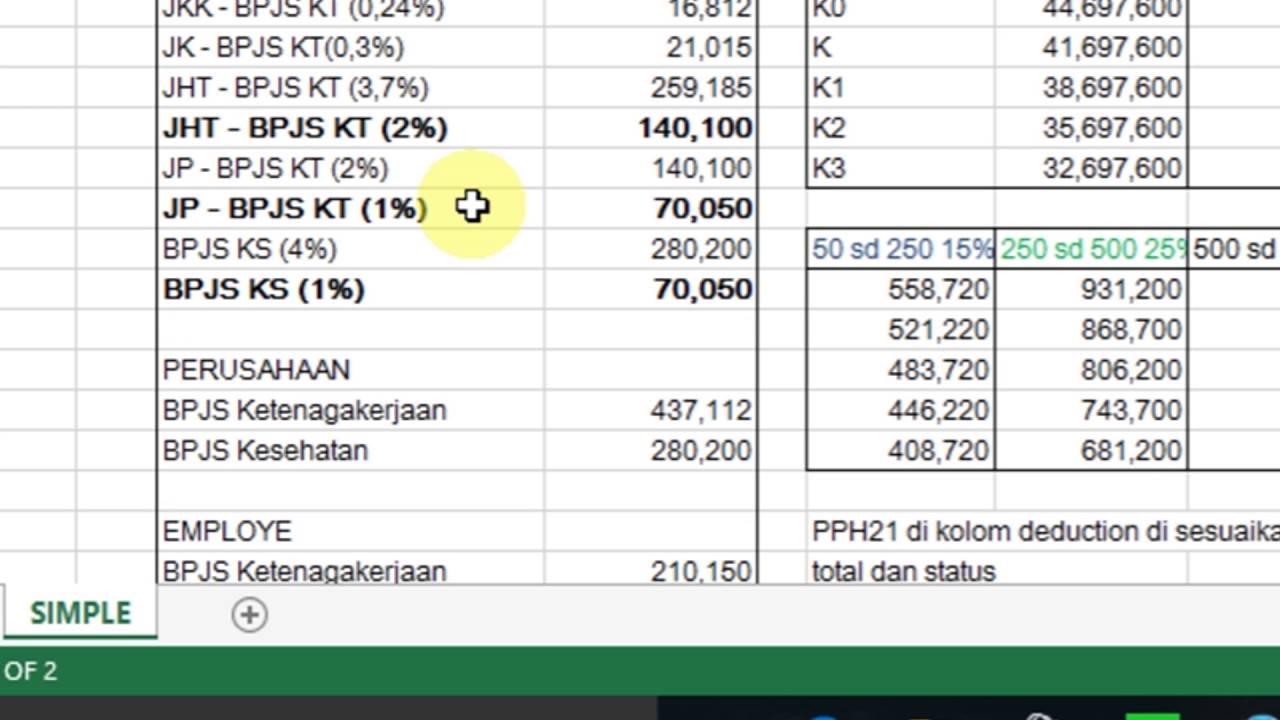

perhitungan pajak gaji karyawan - Khao Tick On

perhitungan pajak gaji karyawan - Khao Tick On

perhitungan pajak gaji karyawan - Khao Tick On

perhitungan pajak gaji karyawan - Khao Tick On

perhitungan pajak gaji karyawan - Khao Tick On

perhitungan pajak gaji karyawan - Khao Tick On

perhitungan pajak gaji karyawan - Khao Tick On

perhitungan pajak gaji karyawan - Khao Tick On

Implementasi Tarif Efektif Rata - Khao Tick On

perhitungan pajak gaji karyawan - Khao Tick On

perhitungan pajak gaji karyawan - Khao Tick On

Implementasi Tarif Efektif Rata - Khao Tick On

perhitungan pajak gaji karyawan - Khao Tick On

perhitungan pajak gaji karyawan - Khao Tick On

perhitungan pajak gaji karyawan - Khao Tick On