Ever wonder how much your money is truly growing? We're diving deep into the world of interest income calculation, empowering you to take control of your financial future.

Understanding how to calculate your interest income isn't just about numbers; it's about gaining clarity and making informed choices. It's the key to unlocking the true potential of your savings and investments.

Whether you're a seasoned investor or just starting your financial journey, calculating interest earnings is a fundamental skill. It's the foundation upon which smart financial decisions are built.

From simple savings accounts to complex investment vehicles, the principles of interest calculation remain consistent. Let's demystify the process and equip you with the knowledge you need to succeed.

Imagine having the power to predict your investment growth with accuracy. By mastering interest income calculation, you can transform that vision into reality.

The concept of interest has been around for centuries, tracing back to ancient civilizations where lending and borrowing were commonplace. Interest served as compensation for the risk and opportunity cost associated with lending money.

Calculating interest income is crucial for several reasons. It allows you to track the growth of your investments, compare different investment options, and project your future financial position. It also empowers you to make informed decisions about saving, spending, and investing.

One of the main issues related to interest income calculation is understanding the different types of interest. Simple interest is calculated only on the principal amount, while compound interest is calculated on the principal plus accumulated interest. This distinction can significantly impact your overall returns.

Let's illustrate with a simple example: you deposit $1,000 into a savings account with a 5% annual interest rate. With simple interest, you'd earn $50 each year. With compound interest, your earnings would increase each year as the interest is calculated on the growing balance.

Benefits of mastering interest calculation include: making informed investment choices, tracking your financial progress effectively, and negotiating better terms on loans and investments.

An action plan for effective interest calculation involves identifying your investment goals, understanding the different interest calculation methods, and using online calculators or spreadsheets to simplify the process. Regularly reviewing and adjusting your investment strategy based on your calculated interest income is crucial.

Advantages and Disadvantages of Different Interest Calculation Methods

| Method | Advantages | Disadvantages |

|---|---|---|

| Simple Interest | Easy to calculate and understand. | Lower returns compared to compound interest over long periods. |

| Compound Interest | Higher returns over time due to the "snowball effect." | Can be more complex to calculate manually. |

Best practices for calculating interest income: Understand the difference between simple and compound interest, utilize online calculators or spreadsheet software, consider the effects of inflation, factor in any fees or taxes, and regularly review and adjust your calculations.

FAQ:

1. What is interest income? - Income earned from lending money or investing in interest-bearing instruments.

2. How is simple interest calculated? - Principal * Rate * Time

3. How is compound interest calculated? - P (1 + r/n)^(nt) where P = principal, r = annual interest rate, n = number of times interest is compounded per year, and t = number of years.

4. What factors affect interest rates? - Inflation, economic growth, and central bank policies.

5. How can I maximize my interest income? - Choose investments with higher interest rates, consider compounding frequency, and reinvest your earnings.

6. What are some common interest-bearing investments? - Savings accounts, certificates of deposit (CDs), and bonds.

7. What is the impact of inflation on interest income? - Inflation erodes the purchasing power of interest earnings.

8. Where can I find reliable interest rate information? - Bank websites, financial news sources, and government websites.

Tips and tricks for calculating interest: Use online interest calculators for quick and accurate results, familiarize yourself with different interest rate formulas, and understand the impact of compounding frequency on your returns.

In conclusion, understanding how to calculate interest income is a fundamental financial skill. It empowers you to make informed decisions about your savings and investments, track your financial progress, and achieve your financial goals. By mastering the principles of interest calculation, you gain control over your financial destiny and pave the way for a more secure and prosperous future. Start calculating your interest income today and unlock the full potential of your money. Don't leave your financial future to chance – take charge and watch your investments grow.

Unleash your inner ninja the allure of wallpaper mata sharingan hd

Elevate your canva ppts a guide to typography that transcends

Unearthing the mystery your guide to el pulpo junk yard

Contoh Soal Keseimbangan Lingkungan Dan Jawabannya Dunia Sekolah Id - Khao Tick On

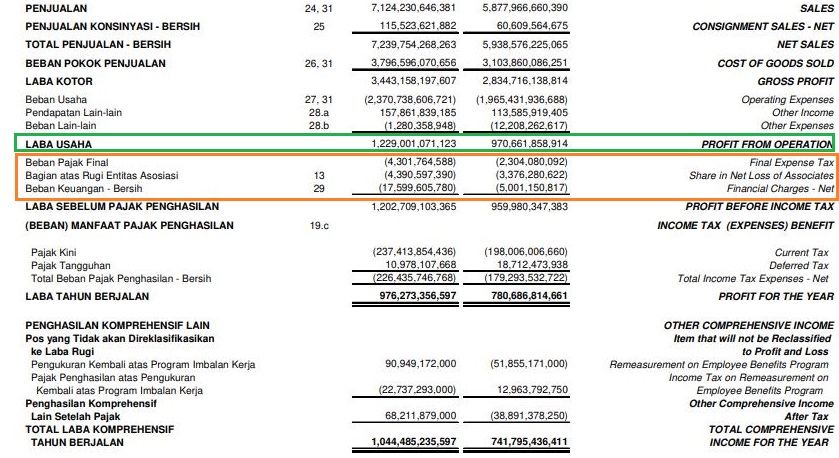

Rumus Laba Bersih Cara Menghitung Pendapatan Setelah Biaya - Khao Tick On

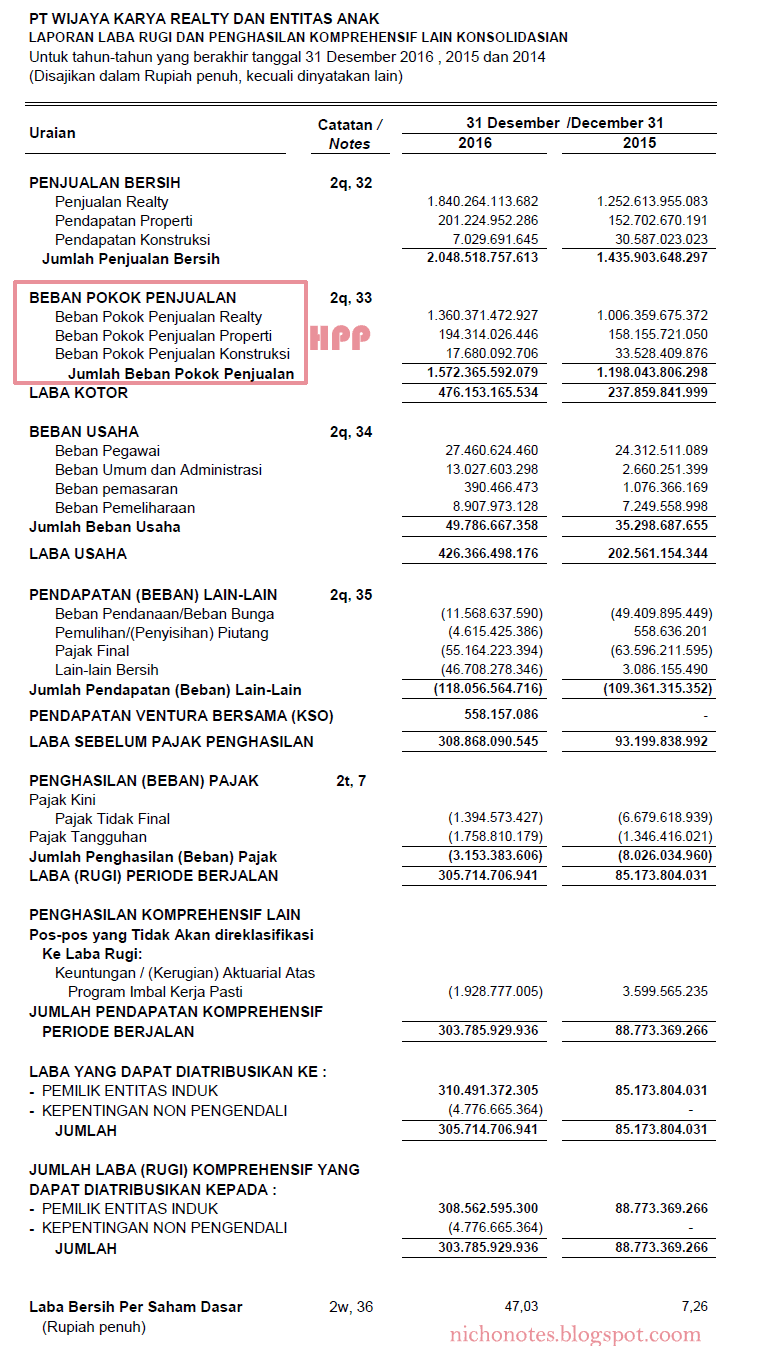

Laporan Keuangan Laba Rugi Perusahaan Dagang - Khao Tick On

Pengertian Lengkap Pendapatan Bunga dan Cara Menjurnalnya - Khao Tick On

Eat Dalam Laporan Keuangan - Khao Tick On

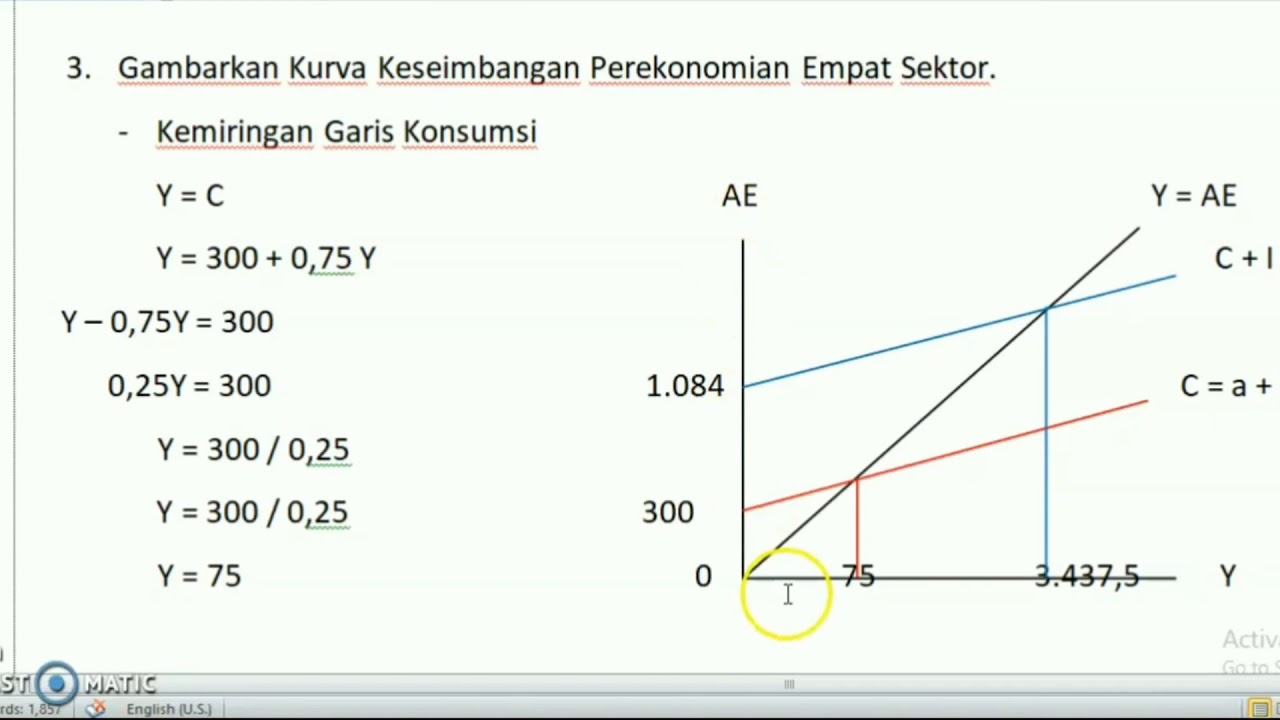

Cara Mudah Menghitung Pendekatan Pendapatan Dalam Pendapatan Nasional - Khao Tick On

Menghitung Pendapatan Nasional Dengan Metode Produksi - Khao Tick On

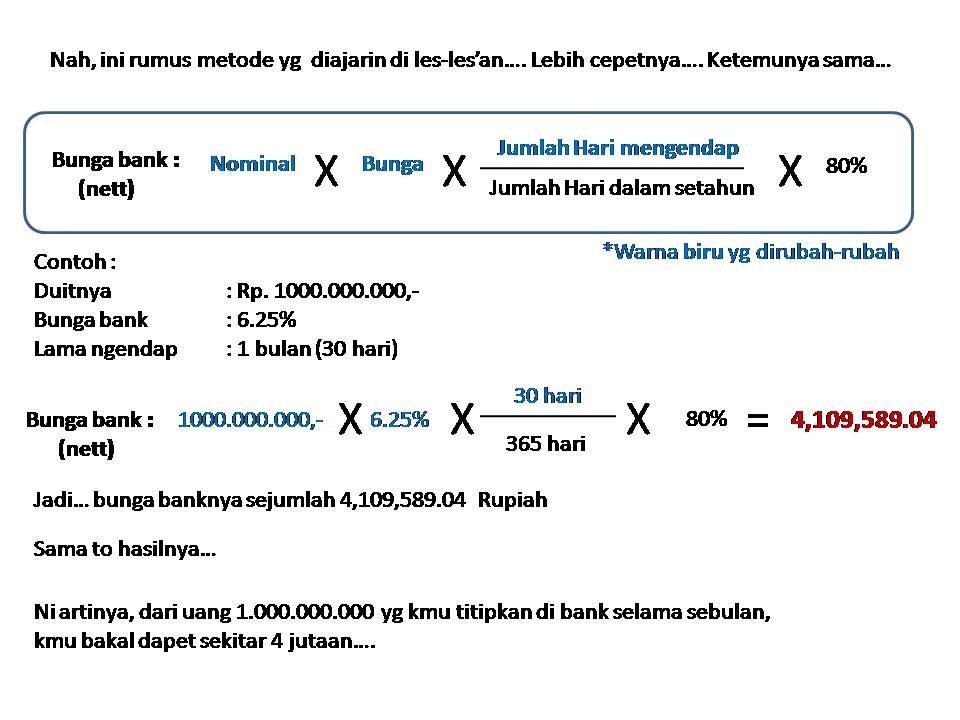

Cara Menghitung Bunga Bank - Khao Tick On

cara menghitung pendapatan bunga - Khao Tick On

Rumus Net Interest Margin NIM Bank - Khao Tick On

Cara Menghitung Bunga Majemuk Tahunan Terbaru - Khao Tick On

Cara Mencari Beban Bunga pada Laporan Keuangan - Khao Tick On

Penjelasan dan Contoh Lengkap Piutang Pendapatan - Khao Tick On

Pengertian dan Cara Mencari Beban Bunga di Laporan Keuangan - Khao Tick On

Rumus Laba Bersih Cara Menghitung Pendapatan Setelah Biaya - Khao Tick On