In a world moving towards digital convenience, managing your finances has never been easier. This rings especially true for members of the Employees Provident Fund (EPF) in Malaysia, who can now tap into the power of online platforms to manage their retirement savings. Among these advancements is the ability to make withdrawals from EPF Account 2 entirely online, simplifying a process that once required in-person applications and paperwork.

But what exactly does this online access mean for EPF members? Imagine needing funds for a significant life event – a down payment on your dream home, your child’s education fees, or even critical medical expenses. Traditionally, accessing these funds from your EPF Account 2 might have involved a trip to the EPF office, queuing, and filling out forms. The introduction of online withdrawals aims to streamline this journey, offering a faster and more efficient way to access your hard-earned savings.

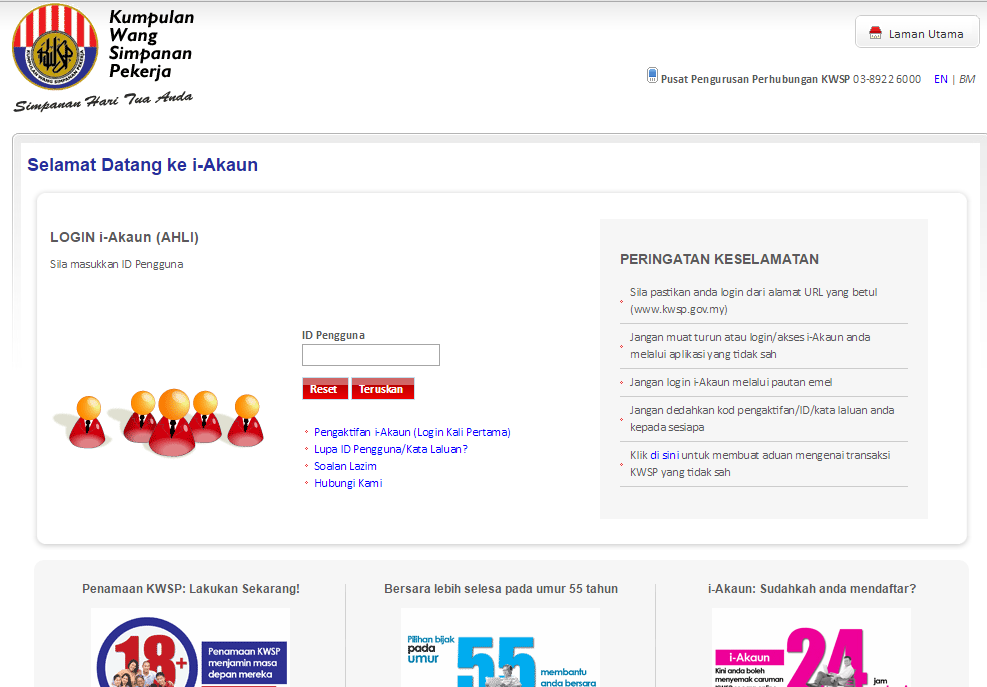

The ability to make these withdrawals online is not just about convenience; it signifies a shift towards greater financial control and accessibility for EPF members. With just a few clicks, you can initiate a withdrawal request from the comfort of your home, eliminating geographical barriers and lengthy procedures. However, this ease of access also underscores the importance of understanding the eligibility requirements, potential implications, and best practices associated with EPF Account 2 withdrawals.

This comprehensive guide aims to equip you with the knowledge and resources necessary to navigate the world of online EPF Account 2 withdrawals. We’ll delve into the specifics of the process, outlining the steps involved, and address common questions that may arise. Whether you’re considering an online withdrawal or simply want to be informed about your financial options, this guide will serve as a valuable resource in your journey towards making informed financial decisions.

As we explore the intricacies of EPF Account 2 online withdrawals, remember that knowledge is power. By understanding the nuances of this process, you can leverage this valuable tool to navigate various financial situations and work towards securing a brighter future.

Advantages and Disadvantages of EPF Account 2 Online Withdrawals

| Advantages | Disadvantages |

|---|---|

| Convenience and Time-Saving | Potential for Early Depletion of Retirement Savings |

| Faster Access to Funds | Risk of Overspending Due to Easy Access |

| Reduced Paperwork | Limited Withdrawal Amounts Based on Eligibility |

While this article provides a general overview of EPF Account 2 online withdrawals, it's crucial to consult official EPF resources and financial advisors for personalized guidance and to ensure you meet all requirements. Making informed financial decisions is key to securing your financial well-being.

Decoding the nfl draft your guide to the player selection process

Decoding the facebook font a deep dive into typography

Deciphering the font size enigma your business letters secret weapon

pengeluaran kwsp akaun 2 online - Khao Tick On

pengeluaran kwsp akaun 2 online - Khao Tick On

pengeluaran kwsp akaun 2 online - Khao Tick On

pengeluaran kwsp akaun 2 online - Khao Tick On

pengeluaran kwsp akaun 2 online - Khao Tick On

pengeluaran kwsp akaun 2 online - Khao Tick On

pengeluaran kwsp akaun 2 online - Khao Tick On

pengeluaran kwsp akaun 2 online - Khao Tick On

pengeluaran kwsp akaun 2 online - Khao Tick On

pengeluaran kwsp akaun 2 online - Khao Tick On

pengeluaran kwsp akaun 2 online - Khao Tick On

pengeluaran kwsp akaun 2 online - Khao Tick On

pengeluaran kwsp akaun 2 online - Khao Tick On

Ini cara mohon e - Khao Tick On

Cara Daftar dan Aktifkan i - Khao Tick On