Ever wondered how your paycheck magically appears in your account every month? Or maybe you're a business owner wrestling with the intricacies of payroll, especially when it comes to the 5-day workweek? It's like a complex dance between worked hours, overtime, benefits, and taxes – a dance we call salary calculation.

For many of us on a standard 5-day work schedule, understanding how our salary is determined can feel like navigating a labyrinth. Fear not, intrepid explorer of the professional world! We're here to demystify the process of calculating earnings based on a 5-day workweek.

Let's face it, the way we get paid is a pretty big deal. It's not just about the numbers; it's about fairness, transparency, and ensuring everyone gets what they've rightfully earned. And when we're talking about 5-day workweek salary calculations, things can get surprisingly intricate.

Whether you're a seasoned professional, a fresh graduate, or someone simply curious about the mechanics behind their paycheck, understanding the nuances of 5-day salary calculations is crucial. It empowers you to spot discrepancies, advocate for yourself, and ensure you're being compensated fairly for your hard work.

In this digital age, there's a plethora of tools and resources available to help navigate the world of payroll. But the key is understanding the fundamental principles behind 5-day workweek salary calculations, empowering you to make informed decisions about your earnings and your time.

Advantages and Disadvantages of a 5-Day Workweek Salary System

While a 5-day workweek is the norm in many places, it's essential to consider both its upsides and downsides in terms of salary calculation:

| Advantages | Disadvantages |

|---|---|

|

|

Frequently Asked Questions About 5-Day Workweek Salary Calculations

Let's tackle some common queries that pop up when grappling with this topic:

1. How is overtime calculated for a 5-day workweek?

Typically, overtime is calculated based on hours worked beyond the standard 40-hour workweek. However, specific rules vary depending on local labor laws.

2. What about public holidays in a 5-day workweek system?

Public holiday pay is usually governed by local regulations. Some countries mandate payment for public holidays, while others may offer time off in lieu.

3. How do sick days or leave affect my salary in a 5-day workweek setup?

This depends on company policies and local laws. Some employers offer paid sick leave, while others may deduct from your salary for days taken off.

Tips and Tricks

For employees, keep meticulous track of your working hours, especially overtime. For employers, leverage technology – payroll software can automate many aspects of salary calculation, reducing errors and saving time.

In conclusion, unraveling the enigma of a 5-day workweek salary calculation is about understanding the interplay of regulations, company policies, and individual work patterns. Whether you're an employee seeking clarity on your earnings or an employer striving for payroll accuracy, grasping these fundamentals empowers you to navigate this aspect of professional life with confidence. Remember, knowledge is power, especially when it comes to your hard-earned money!

Unlocking bliss the art of towed water recreation

Decoding fuel filter cross reference numbers your ultimate guide

Decoding the chevy silverado 53 engine mpg everything you need to know

Iuran Bpjs Ketenagakerjaan Perusahaan - Khao Tick On

perhitungan gaji 5 hari kerja - Khao Tick On

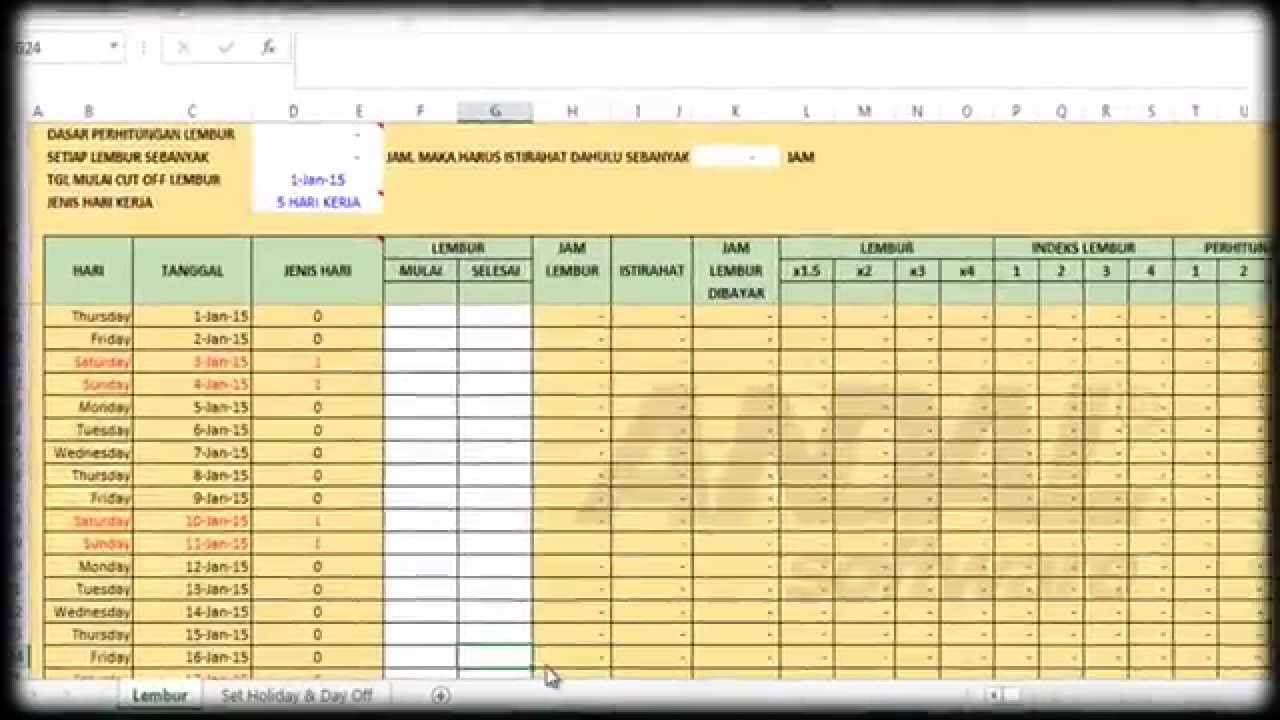

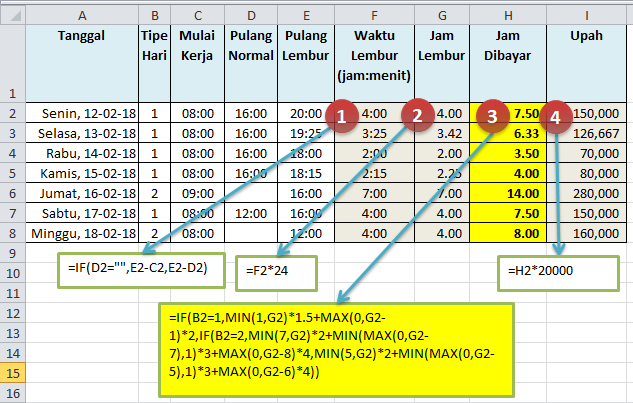

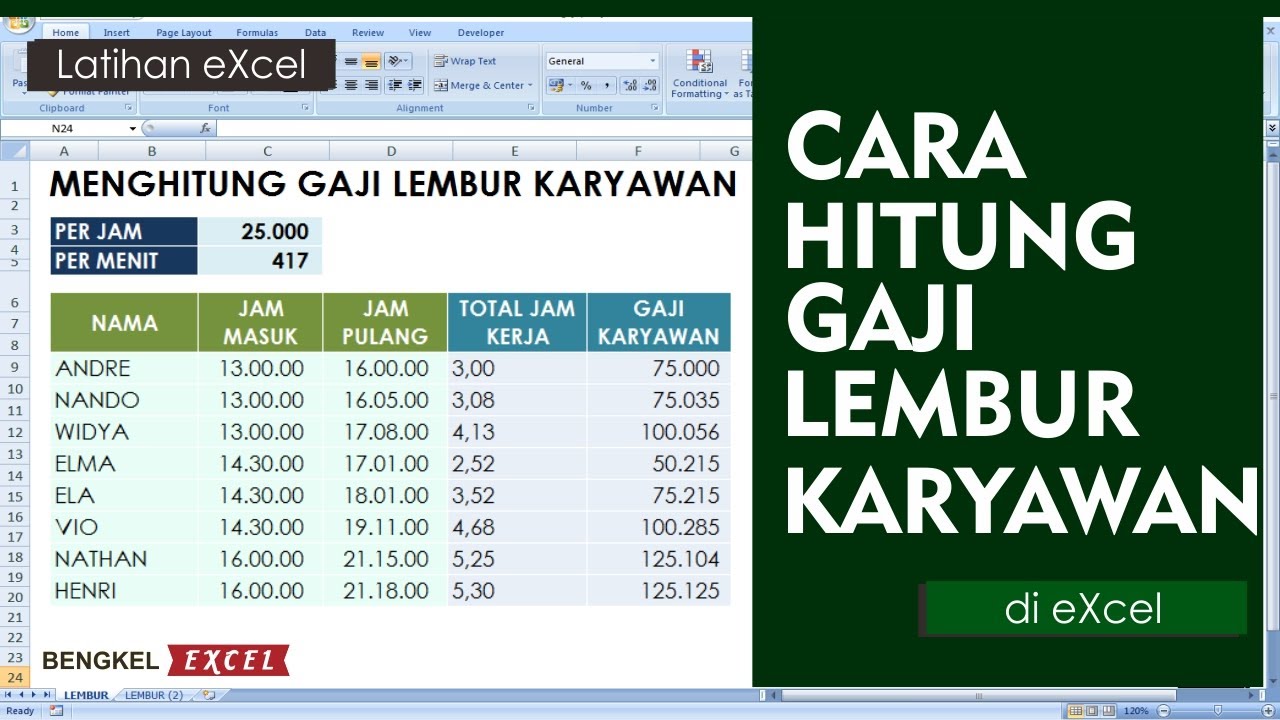

Cara Hitung Upah Lembur di Indonesia - Khao Tick On

perhitungan gaji 5 hari kerja - Khao Tick On

Contoh Absensi Karyawan Bulanan Excel - Khao Tick On

perhitungan gaji 5 hari kerja - Khao Tick On

perhitungan gaji 5 hari kerja - Khao Tick On

perhitungan gaji 5 hari kerja - Khao Tick On

perhitungan gaji 5 hari kerja - Khao Tick On

perhitungan gaji 5 hari kerja - Khao Tick On

perhitungan gaji 5 hari kerja - Khao Tick On

Cara Menghitung Jam Lembur Di Excel - Khao Tick On

cara mengira pcb bulanan Cara potong pcb yang ada garisnya - Khao Tick On

perhitungan gaji 5 hari kerja - Khao Tick On

Cara Menghitung Upah Lembur Karyawan Tetap dan Karyawan Harian - Khao Tick On